All that glisters is no longer gold in the city of Zhaoyuan

Updated: 2013-10-21 07:06

By Zhong Nan and Zhao Ruixue (China Daily)

|

||||||||

|

A worker carves a gold ornament in Zhaoyuan. As the gold capital in China, Zhaoyuan now realizes that it should plan the resource carefully and diversify gold-related industries. Zhang Yanhui / Xinhua |

Mining hub seeks other ways to turn an honest penny as reserves of precious metal start to decline

China's gold capital, Zhaoyuan, used to be the very model of optimism. As the country basked in economic success and the city in Shandong province faced the possibility of stiffer economic competition from its neighbors, there was always a loud chorus of reassurance: "Our gold-filled mines will always keep us ahead."

But the shaky premises on which that hope was built have begun to dawn in Zhaoyuan as the price of gold has fallen this year and as it has become clearer that the city's gold mines are not bottomless.

Now the government and gold mining companies are diversifying their business models to ensure that economic fortune continues to shine on Zhaoyuan.

The city has 68 gold mines with explored reserves of about 520 tons and produced 33 tons of gold last year, accounting for one-seventh of the country's total annual gold output. Thanks mainly to gold, Zhaoyuan has been ranked as one of China's 100 fastest growing county-level cities for 38 years.

"There is great scope for gold to support the country's growth," says Zhao Bingxu, director of Zhaoyuan's gold industry management bureau. "However, it's possible that Zhaoyuan's gold reserves will dry up in the next 10 to 15 years if all mining companies continue to carry on large-scale exploitation."

To help the city confront the challenges posed by exhausted mines, mining companies have started recycling abandoned low-grade ore or digging more deeply to eke out more from mines whose years are numbered.

Zhao says most gold mines in Zhaoyuan used to extract ore that contained about 4 grams of gold a ton, but with heightened demand that has been reduced to 2 grams a ton. That exhaustive production is said to have been detrimental to both mines and the environment.

"The city clearly needs more measures to put its economic growth on a healthy footing because revenue from gold mining is highly likely to fall amid unstable international gold prices and economic uncertainties in the West," Zhao says.

"It costs about 105 yuan ($17) to produce one gram of gold," says Lu Dongshang, president of Shandong Zhaojin Group Co Ltd, China's largest gold producer and one of the world's 20 largest.

"But costs have already risen about 8 percent this year because of rising mining equipment, power and labor costs."

Whereas the State-owned China National Gold Group Corp is keen on buying gold mines overseas such as Goldcorp Inc of Canada or Newcrest Mining Ltd of Australia, even though the price of gold approached a low point of $1,200 an ounce this year. Zhaojin Group has started to prospect and develop gold, silver and copper mines in other Chinese provinces to ensure its production capacity.

"That avoids financial risks, complex entry conditions and labor rules in unfamiliar gold production countries such as Australia, Brazil, Ghana and Mongolia," Lu says.

By the end of last year, the company had set up more than 26 branches to offer a comprehensive range of services such as technical, management and cost-saving solutions across China, including six wholly owned and joint venture gold mines under state supervision in Gansu, Qinghai and Shaanxi provinces, and in Inner Mongolia and Xinjiang Uygur autonomous regions.

The company says that last year it found new gold reserves of 223 tons and produced 3.5 tons.

Gold has been in hot demand in China since mid-April, when Chinese people, many of them middle-aged housewives, started a run on jewelry store supplies, buying large quantities as prices slumped, triggered mainly by Cyprus, in the throes of a debt crisis, selling its gold reserves.

Lu says the falling price has put extra pressure on Zhaoyuan's miners because profits on gold bars, Zhaoyuan's staple product, are linked to international prices.

Gold futures on the Comex division of the New York Mercantile Exchange dived to $1,200 an ounce, approaching a three-year low, before the third quarter of this year and, earlier this month, it was at $1,300 an ounce on the back of worries of a debt default in the US. In January the Comex price had been between $1,630 and $1,680 an ounce.

Lu says: "Since the beginning of the second half, we have been busy responding to this drawback by diversifying the business focus to further develop better value-added products, because producing more gold products such as gold commemorative coins, necklaces, rings, bracelets, ornaments and artworks can help add to the group's revenue."

Chinese people have always been fond of jewelry, particularly gold and diamonds, seeing them as a safe investment.

"Once the jewelry market starts booming, it is easy for it to become a consumption trend," says Zhang Yongtao, vice-chairman of the China Gold Association in Beijing.

Zhaojin Group had revenue of 40.3 billion yuan last year, half of it from the company's gold and related businesses. Lu says the company plans to build a jewelry park in Zhaoyuan next year, including a production plant, a regional distribution center and other support facilities. The park is expected to be open by 2016.

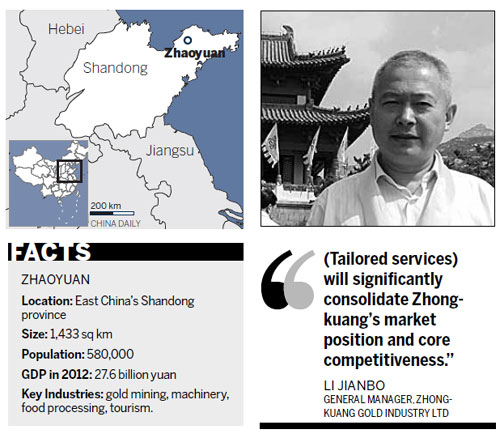

Li Jianbo, general manager of Zhongkuang Gold Industry Ltd, another large gold mining business in Zhaoyuan, says gold companies in the city should focus on tailored products and services for banks, other companies and wealthy individuals to boost sales, because gold bars are unlikely to draw higher returns amid slow global economic recovery.

China Construction Bank and Industrial and Commercial Bank of China are two of Zhongkuang's biggest customers, but Li believes the company needs to snap up business with other big companies, jewelry retailers and rich individuals before its rivals do so.

Zhongkuang bought cutting edge color printers from Canada in May, each costing more than $100,000, that allow it to emboss gold in line with customers' wishes. The company will produce five tons of gold this year, Li says.

Services tailored to customer requirements "will significantly consolidate Zhongkuang's market position and core competitiveness", he says.

Such services accounted for 15 percent of Zhongkuang's sales in the first half of this year, the company says. It aims to double that next year. It has set up a 30-person sales team to seek wealthier customers in China's first- and second-tier cities.

Local government has also been looking to diversify Zhaoyuan's economic growth and reduce its dependence on gold, which accounted for 2.2 billion yuan, or 71 percent, of the city's fiscal revenue last year. The government plans to raise the percentage of revenue from other sectors such as gold-related tourism, real estate, food processing and organic agriculture to more than 50 percent of revenue over the next three years.

The city says it is using the money generated from the gold industry to support other non-gold related sectors. Over the past two years, Shandong provincial and Zhaoyuan governments have invested 11.5 billion yuan in more than 70 industrial transformation projects. Another 21 projects were launched with investment of 1.3 billion yuan in the first half of this year.

One mine that exhausted its reserves and closed in 2007 has been turned into a tourist attraction that features a trip to an underground site 500 meters long and 50 meters deep. A gold museum, a replica of an old town, hotels and a park have also been built.

Tan Keliang, Zhaoyuan's vice-mayor, says that after years of development, Zhaoyuan has a complete gold industrial chain from prospecting, mining, smelting and refining to making mine machinery, mine designing and engineering, as well as producing gold, silver and gemstones.

"The government will help the city's businesses find new markets at home and abroad," Tan says.

Contact the writers at zhongnan@chinadaily.com.cn.

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China has to brace for next dollar drama

Life of Pi artwork on display

No criminal charges in Asiana crash death: DA

US deal key to nabbing fugitives

Seattle high-tech summit talks 'green'

JPMorgan reaches $13b deal

China is reaching its tipping point

Beijing works to spur global development

US Weekly

|

|