Sinopec parent plans $17.7b stake buyback

Updated: 2013-11-06 10:53

(Agencies)

|

||||||||

Shanghai - China Petrochemical Group, parent of Shanghai and Hong Kong listed oil giant Sinopec Corp, plans to spend an estimated maximum $17.7 billion to buy back a 2 percent stake in the Shanghai-listed entity over the next year, in an apparent move to support the mainland's sagging stock market.

The State-owned parent started the purchase on Tuesday, buying 6.06 million shares, or 0.005 percent of the listed arm, Sinopec said in a filing to the Shanghai Stock Exchange dated November 6.

A 2 percent stake amounts to 2.33 billion shares, based on Sinopec's total capital base of 116.6 billion share.

Sinopec's Shanghai-listed, yuan-denominated A shares closed at 4.62 yuan per share on Tuesday. Based on these calculations, the parent could spend as much as 107.7 billion yuan ($17.7 billion).

US, Russia fail to agree Syria peace talks date

US, Russia fail to agree Syria peace talks date

India launches exploratory spacecraft to red planet

India launches exploratory spacecraft to red planet

Taking risks in a firestorm

Taking risks in a firestorm

Biden to emphasize Asia pivot on tour

Biden to emphasize Asia pivot on tour

China vows to cooperate in global fight against ivory smuggling

China vows to cooperate in global fight against ivory smuggling

US mall on lockdown after shots heard

US mall on lockdown after shots heard

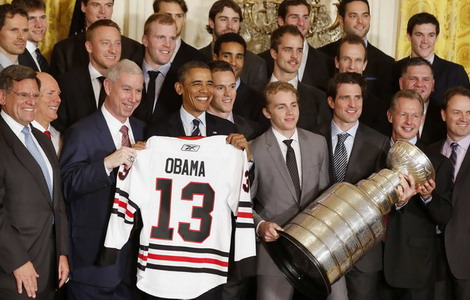

Blackhawks honored at White House

Blackhawks honored at White House

Kerry denies tensions between US, Saudi Arabia

Kerry denies tensions between US, Saudi Arabia

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Brazilian govt to use anti-spying email system

China seeks collaborative efforts on nuclear safety

Alipay partners with UATP

Britain, Spain agree on declaration on Gibraltar

Brazil welcomes China's oil investments

US media under attack for 'double standards' on terror

Govt to focus on better service

Cyber minister proposes security fix

US Weekly

|

|