China's automakers shun Detroit show

Updated: 2014-01-15 00:38

By LI FANGFANG in Detroit and MICHAEL BARRIS in New York (China Daily)

|

||||||||

Meeting safety and emissions standards in the US a key factor for manufacturers

Chinese car companies are shunning North America's largest auto show for the first time in eight years despite their repeated pledges to explore overseas markets.

As the North American International Auto Show — a magnet for automakers with global ambitions — opened in Detroit for the media on Monday, those from China were not among the exhibitors.

Geely Automobile Holdings made its debut at the show, now in its 107th year, in 2006.

China has made going global in the automotive industry a priority. The goal, articulated in the 12th Five-Year Plan (2011-15), builds on the country's 2009 achievement of overtaking the US as the world's largest automotive market by sales.

Although China has made inroads as a parts supplier through acquisitions of foreign suppliers and through joint ventures with international parts makers, it is seen as being at least five to 10 years away from selling cars that would meet the North American market's safety and emissions requirements.

To date, the only Chinese-made vehicles exported to North America are small trucks and off-road vans such as the Wuling Minimax.

Generating wide media coverage thanks to Detroit being home to the Big Three US automakers, the North American International Auto Show has the power to boost brand development.

But Tim Dunne, director of global automotive industry analysis for California-based market research firm JD Power and Associates, said exhibiting at Detroit can backfire if the media decides the products displayed are not competitive.

"That happened in the past when some car magazines and auto enthusiast websites and blogs panned some of the Chinese vehicles, or the overall Chinese brand presentation at the show," said Dunne.

Last year, State-owned Guangzhou Automobile Group was the lone exhibitor from China. This year, GAG Motors, China's sixth-largest automaker, is staying at home.

Wang Shunsheng, head of international business at GAG, was quoted as saying that the Guangzhou-based company skipped Detroit this year because entering the US market "requires a lot of study and investigation, and we're still in the process".

BYD Co, the Shenzhen-based electric vehicle automaker backed by billionaire US investor Warren Buffett, is also giving Detroit a miss despite announcing this month that it plans to introduce several models to the US by the end of 2015.

A BYD spokesman said the show's focus made attendance inconvenient, The Wall Street Journal reported.

Spokesmen for Qoros Automotive, a joint venture between Chery Automobile Co in Wuhu, Anhui province, and Tel Aviv investment group Israel Corp, and Great Wall Motor in Baoding, Hebei province, also said their companies would not attend the show, the newspaper reported.

China's motivation to use its automotive industry as a platform for exports is questionable considering that the domestic market already accounts for a quarter of global light-vehicle sales.

A number of China's automakers have announced plans over the years to sell to the US, but no vehicles have materialized.

In August, Geely Automotive Holdings said that in two years it would begin exporting cars to the US that it co-develops with Swedish multinational Volvo. David Sedgwick, an analyst and former editor of Automotive News, told China Daily at the time he doubted that US consumers were ready for a Geely-badged car in the US, even one on a Volvo platform.

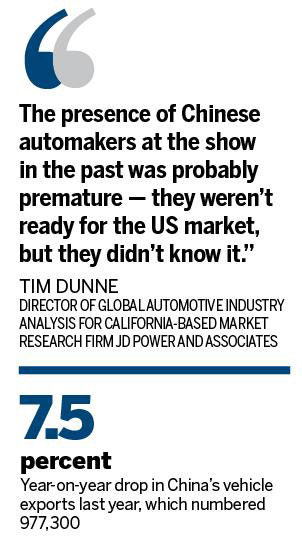

Dunne said this view ties in with China's absence from the Detroit show. "The presence of Chinese automakers at the show in the past was probably premature — they weren't ready for the US market, but they didn't know it," he said.

"If a Chinese automaker wants to launch in the US in 2015, it has more pressing issues than showing a car in Detroit," Dunne said.

"This includes meeting US regulatory requirements for safety and emissions, improving the quality and appeal of vehicles, setting up a US sales and distribution company and signing up dealers."

Chinese car companies "still have their eye on developed markets, but they understand it is going to take a more strategic approach, with a lot of research and planning", Dunne said.

China's vehicle exports dropped by 7.5 percent year-on-year to 977,300 last year, according to the China Association of Automobile Manufacturers.

- Detroit auto show features fuel-efficient cars

- China to account for one third of new auto sales

- Liquor maker jettisons public autos at auction

- Auto Special: Daimler and Mercedes charging ahead in Year of Horse

- China's 2014 auto sales may rise 10%

- Vintage car exhibition opens in Shanghai

- China importing more vehicles produced in US

Detroit auto show features fuel-efficient cars

Detroit auto show features fuel-efficient cars

Palestinian students show military skills

Palestinian students show military skills

Cristiano Ronaldo wins FIFA best player award

Cristiano Ronaldo wins FIFA best player award

Xuelong carries on mission after breaking from floes

Xuelong carries on mission after breaking from floes

Beijing and Sofia vow new initiatives

Beijing and Sofia vow new initiatives

71st Golden Globe Awards

71st Golden Globe Awards

Bangkok unrest hurts major projects and tourism industry

Bangkok unrest hurts major projects and tourism industry

No pant for cold subway ride

No pant for cold subway ride

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Air China ups Houston-Beijing service to daily

Two students hurt in New Mexico school shooting

Chinese have new friend for US tours

15 flu-related deaths reported in Arkansas, US

New workstation in Silicon Valley

At least 16 dead in E China factory fire

Xi calls for reform to fight graft

S. China Sea rules no threat to peace

US Weekly

|

|