Top Stories

PBOC counteracts Fed move

By Lian Mo, Lan Lan and Chen Jia (China Daily)

Updated: 2010-11-11 14:17

|

Large Medium Small |

Fourth rise this year targets liquidity following US quantitative easing

BEIJING-The People's Bank of China on Wednesday said it will raise the required reserve ratio for all lenders by 50 basis points, its fourth increase this year, amid rising liquidity partly caused by quantitative easing in the United States.

The move, which requires lenders to set aside part of their deposits as reserves, will take eff ect from Nov 16 and is expected to absorb liquidity of about 300 billion yuan ($45.1 billion). Media reports previously said it would target only selected lenders.

"The move is definitely related to the US quantitative easing," said Dong Yuping, senior economist at the Chinese Academy of Social Sciences (CASS).

"It (the US policy) will increase commodity prices and lead to excess liquidity in other parts of the world, especially in the emerging markets, pushing up inflation."

The Federal Reserve launched its latest round of quantitative easing by buying $600 billion in government bonds to prop up the ailing US economy.

It is feared that the move will drive down the dollar and push up commodity prices, including China's. "China's economic linkage with the outside world has been increased greatly, as shown by the country's expanding trade volumes," Dong said.

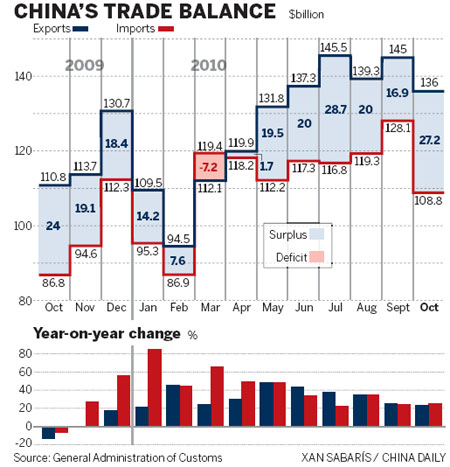

China's exports to the US rose 29.2 percent year-on-year to $25.1 billion in October while imports jumped 31.8 percent to $7.1 billion, resulting in a surplus a bit above $18 billion, according to data from the General Administration of Customs on Wednesday.

Trade surplus with the US surged 19.25 percent yearon-year in October, a growth experts said may put added pressure on China to revaluate the yuan ahead of the G20 summit.

In 2008, China had a trade surplus with the US of $170.9 billion. In 2009, it dropped to $143.4 billion.

The US and other nations are pushing for China to ease its currency controls and are blaming their unemployment issues on China's trade surplus.

"With the start of the G20 summit in Seoul this week, the surplus will increase pressure on the yuan," said Song Hong, director of the Institute of World Economics and Politics of CASS, in Beijing. "That gives Washington an excuse to continue to push China on the yuan as its unemployment rate and financial deficit remain high."

Vice-Foreign Minister Cui Tiankai repeated Beijing's stance over its monetary policy. Cui said on Wednesday that if China or the US becomes confrontational in discussions about the yuan, "I think everybody will come out losers".

He said China's currency policy shouldn't be a focus of the G20 summit.

If China fails to act on its currency, the US has threatened to impose damaging measures. In late September, the US House of Representatives passed a bill to allow the US government to impose tariffs on imports from countries with undervalued currencies. The bill awaits Senate approval and the president's endorsement before going into effect.

US lawmakers claim the Chinese currency has been undervalued by 25-40 percent and has caused trade imbalances between the two nations.

"The imbalance is decided by the economic structures of the two countries, which won't be changed in short time," said Xiao Lian, director of the Center for US Economic Studies at CASS.

Xiao said that the US enjoyed a trade surplus during the 1970s when it was a manufacturer.

Liu Wenge, professor at the Central University of Finance and Economics in Beijing, predicted that the yearly trade imbalance between the two countries will shrink. He said that because China's growth in exports is currently outweighing imports, the imbalance will level off.

Experts also said that China's growing trade surplus may prompt the US to step up efforts to persuade G20 members to cap their current account surplus under 4 percent of GDP. The current account mainly covers trade.

Xiao said China and other nations will likely oppose the idea. "The proposal also targets other export powerhouses, including Germany and Japan, so chances for it to get approved is dim," Xiao said.

For the past year, tension over trade between China and the US has been running high.

The United Steelworkers union filed a trade case with the World Trade Organization against China's subsidies on its clean energy sector. It claimed that China is threatening the future of the US alternative and renewable energy industry. The US government began an investigation into the issue, which involves 154 businesses in China.

Experts said that the US will likely initiate more trade cases against China as it attempts to recover from a deep recession.

Xin Zhiming contributed to this story.