Life

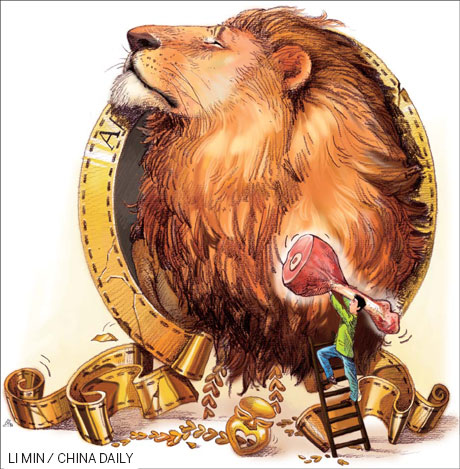

Dragon's lair for US lion?

By Liu Wei (China Daily)

Updated: 2010-11-16 07:56

|

Large Medium Small |

Debt-ridden Hollywood icon, MGM, is awaiting approval of its reorganization plan and a Chinese company may be eyeing a stake. Liu Wei reports

A Chinese company is said to be trying to buy a stake in debt-ridden Metro-Goldwyn-Mayer Inc (MGM), which is still awaiting regulatory approval, but industry insiders are not overly excited. Zhou Tiedong, president of China Film Promotion International of the China Film Group, told a local newspaper earlier in November, "A Chinese company wants to buy a stake of MGM and US law firm Kaye Scholer LLP is taking care of it."

Zhou would not say which company it was, but speculation pointed in the direction of private entertainment group Huayi Brothers or Polybona.

A federal bankruptcy court in Manhattan has set Dec 2 as the date for MGM to seek final approval of its reorganization plan.

Huayi has denied the news, but Yu Dong, president of Polybona, gave an ambiguous answer.

"Maybe you should ask Wang Zhongjun (chairman of Huayi Brothers)," he was quoted as saying in another local newspaper. "But the Chinese film market is growing steadily and will have a better future if we cooperate with international companies and enter the global market," he added.

In September, Legendary Pictures sold a 3.3 percent stake to China's Orange Sky Golden Harvest Entertainment for $25 million, making it the first Chinese film company to own a stake in a Hollywood studio.

Despite widespread excitement and anticipation, industry insiders are not optimistic about the MGM stake.

The most sought after treasure of MGM now is its library, says Ben Ji, president of Angel Wings Entertainment, a Beijing-based film financing and production group. The Hollywood studio stocks about 4,100 feature films and 10,800 episodes of TV programs, including the Bond series. But censorship and cultural differences could pose a major challenge to converting them into cash.

"For many years MGM has lacked such important things as producer deals, a global marketing and distribution network, a financing platform and a multi-media network," says Ji, who used to work in Warner Brothers' international distribution division and Walt Disney Studios in China.

Ji believes MGM is most valuable for Chinese broadcasters who have platforms and distribution networks but lack content. However, owing to censorship and cultural differences, they may find it hard to make full use of MGM's content.

"They can broadcast or remake the classics, while licensing the side products such as toys, comic books and online games," he says. "But the problem is, first of all, China's censorship is a long and tedious affair; in addition, many films are classics in the US that have been shown on cable TV hundreds of times but are not at all well known in China, such as The Apartment or Sunset Boulevard."

Ji is also skeptical of the rumor that Polybona is interested in the deal to enhance its efforts to go public on NASDAQ.

"An unknown Chinese company buying a stake in a major Hollywood studio sounds exciting and may help build the brand value of Polybona," he says. "But think about the debt, the risks and the operations of the company, it is not an easy decision to make."

Producer Guan Yadi sees the news more as hype than market behavior.

"With the Chinese economy's steaming hot growth, Chinese capital has bought into international brands such as Volvo and Thinkpad, which has helped fuel the illusion that some Chinese company can buy MGM," he says.

Guan adds that even if there is such a company, the most valuable part of the exercise would be the negotiations.

"To talk with experts on the US economy and laws itself is a good opportunity for learning about the Hollywood system," he says. "The Chinese film industry is too young to marry Hollywood now, we had better take the chance to learn more during the courtship."