Business

Sources: SAIC to take stake in GM

By Kevin Krolicki, Soyoung Kim and Clare Baldwin (China Daily)

Updated: 2010-11-16 07:56

|

Large Medium Small |

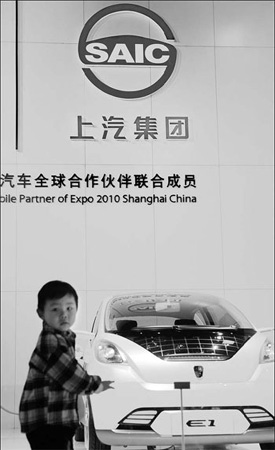

A child stands next to SAIC's ROEWE E1 concept vehicle at the 2010 Beijing International Automotive Exhibition. SAIC has agreed to take a stake in General Motors Co, sources said. Da Wei / For China Daily

NEW YORK - China's SAIC Motor Corp Ltd (SAIC) has agreed to take a stake in General Motors Co (GM) if Chinese regulators approve the deepening of an alliance between the two automakers, four people familiar with the matter said.

The potential investment from SAIC is part of a surge in investor interest in GM that is expected to push the pricing of its shares to $29 or above in the US automaker's IPO, one of the sources said.

Another source said SAIC would take a stake of around 1 percent in the automaker, majority owned by the US Treasury after a bailout last year.

An investment of just over $500 million would represent about 1 percent of the common stock in GM if the IPO prices at the high end of the proposed range this week.

Apart from further cementing their partnership in China, SAIC was also taking part in the deal to gain access to GM's sales networks outside China, including in Europe, one source said.

SAIC Chairman Hu Maoyuan had said previously the automaker will revive production at its plant in the United Kingdom and make MG cars available in the UK and the rest of the European Union in 2011 as part of its move to revive the acquired British marquee.

"That would be a great help for the Chinese automaker which had aimed to start selling its MG cars in Europe next year," said another industry source.

Talks between the two sides have been under way for more than two months and have covered a range of topics including the deepened cooperation in the development of electric vehicles and support for SAIC's ambitions to move beyond the China market, sources have said.

At one point last week, US and Chinese officials became involved in the discussions between GM and SAIC, the person said.

Until this week's expected IPO, the US Treasury will hold almost 61 percent of GM as a result of the Obama administration's decision to fund the top US automaker's restructuring in a 2009 bankruptcy.

The discussions between GM and SAIC remain private because of securities regulations related to GM's IPO.

A decision by SAIC to invest in GM would underscore the US automaker's competitive strength in China, now the world's largest auto market, analysts have said.

A central part of GM's pitch to investors has been its Shanghai-GM joint-venture with SAIC. The Chinese automaker has a 51 percent stake in that joint venture as part of a deal struck with GM in 2009.

That deal will give GM a 44 percent stake in the joint venture for $51 million subject to approval by the Chinese government. Through its joint ventures in China, GM claims a 13 percent market share in China, the largest in the industry.

Morgan Stanley, JPMorgan, Citi and Bank of America are the lead underwriters on the deal, which has a total of 35 underwriters, including Industrial and Commercial Bank of China Limited and China International Capital Corporation Limited.

Reuters