Land market at 5-year high3

Updated: 2013-07-01 08:02

By Hu Yuanyuan (China Daily)

|

||||||||

|

Soaring sales, increasing prices, improved cash flow and confidence are the major drivers in Chinese developers' eagerness to boost the size of their land banks. Provided to China Daily |

Statistics show continued rapid growth in sector in 10 key cities

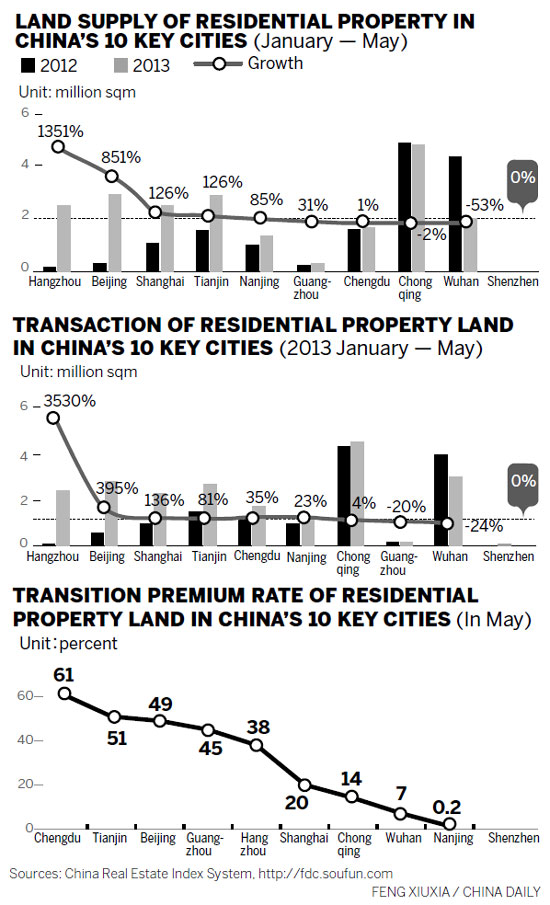

China's land market sizzled in May, with the land transfer fees in the country's 10 key cities reaching a record high since 2008, industry statistics showed, indicating pressure for further home price hikes in the market.

The land transfer fees in the 10 major cities monitored by E-House China Real Estate Research and Development Institute stood at 66.99 billion yuan ($11.2 billion) last month, an increase of 392.6 percent year-on-year, a report from the institute showed.

Meanwhile, the average price of transacted land parcels was 3,015 yuan per square meter in May, up 215.7 percent over the same period last year. It also reaching a three-year high, according to the report.

Another report from real estate service provider Centaline Group indicated a similar trend: Land transfer fees in the country's four key cities - Beijing, Shanghai, Guangzhou and Shenzhen - in the first five months of this year were 141.18 billion yuan, up 350 percent on the same period last year.

"Land prices showed an obvious increase since the second quarter and reached a peak in May," said Zhu Guang, an analyst with E-House China Real Estate Research and Development Institute. "With the market continuing to be brisk, the land transfer fees will maintain a rapid growth rate in the next quarter."

Soaring sales, growing prices, improved cash flow and developers' confidence in the market are the major drivers in their eagerness to boost the size of their land banks, analysts said.

Property prices in China's major cities rose on both a monthly and yearly basis in May, according to figures released by China Index Academy, a Beijing-based real estate research institute.

The average price of new homes in 100 cities monitored by the academy was 10,180 yuan ($1,642) a square meter during May, up 0.81 percent over the previous month. It was the 12th consecutive price increase month-on-month.

On a yearly basis, the growth was 6.9 percent last month, compared with a 5.34 percent year-on-year increase in April. It was the sixth time that the 10 cities saw a price hike on a yearly basis, with the growth rate further accelerating.

Meanwhile, property transactions in major real estate markets also rebounded in May, a report from real estate brokerage firm Century 21 showed. A total of 13,000 new homes were sold and registered online in Beijng in May, up 18 percent over the previous month. The transactions and price of high-end residential apartments, in particular, saw a marked increase.

He Meng, a marketing director at Maoyuan Real Estate Co, said the latest tightening policies have had a limited effect on high-end projects.

"Wealthy buyers can handle further increases in down-payments," said He. She was responsible for the marketing of Eothen - a high-end project along the capital's northeast third ring road with a unit sales price of more than 60,000 yuan per sq m. The contracted sales value of the project stood at 348 million yuan in the first five months this year, exceeding the property developer's expectations.

The company plans to build 44 luxury apartments soon, taking advantage of the recent market rebound.

The rigorous measures on home purchase qualification and pricing limitation, however, will partly dent demand and the market, He added.

Beijing authorities said that single adults with a hukou - a registered permanent residence - in the city are allowed to purchase only one apartment, as opposed to two previously. And the government will also not grant sales licenses to projects priced "much higher" than the average rate in the region.

"Because we received the sales license before this round of tightening, our project is not subject to the pricing limitation policy. But this policy will definitely have a far-reaching effect on the market because there is almost no way for property developers to increase their sales prices by large amounts," He said.

Based on the rosy forecast for the market, Maoyuan Real Estate is actively seeking opportunities to boost its land parcels.

Statistics from Centaline Group also showed the country's top 10 property developers spent 16.2 billion yuan in boosting land parcels in May, up 26 percent over the previous month.

Moreover, the asset-liability ratio of listed property developers saw a slide in 2012, the first drop since 2009, according to a TOP 10 research report by the China Index Academy and Real Estate Institute of Tsinghua University.

The ratio of listed property developers in Shanghai and Shenzhen stood at 62.27 percent by the end of 2012, down 1.16 percentage points on the previous year.

"Profitability is also expected to rebound this year because of their improved cost management," said Jiang Yunfeng, research director of China Index Academy.

The gross profit margin of listed property developers stood at 37.95 percent in the first quarter, while their net profit margin stood at 14.13 percent, both higher than the same period last year, the report showed.

huyuanyuan@chinadaily.com.cn

(China Daily USA 07/01/2013 page13)

Gay pride parade around the world

Gay pride parade around the world

Four dead in Egypt clashes, scores wounded

Four dead in Egypt clashes, scores wounded

New NSA spying allegations rile European allies

New NSA spying allegations rile European allies

Foreign minister makes ASEAN debut as tensions flare

Foreign minister makes ASEAN debut as tensions flare

Yao stresses transparency in charity

Yao stresses transparency in charity

NYC's gay pride march for celebration

NYC's gay pride march for celebration

Massive debt plagues local gov't

Massive debt plagues local gov't

Looking abroad for better investment

Looking abroad for better investment

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese, US deals will grow this year

US updates duties on Chinese honey

Looking abroad for better investment

Mixed outlook for EV makers in China and US

Obama to announce new power initiative for Africa

China's June manufacturing PMI falls to 50.1

Longer term for visas to attract talent

Putin signs anti-gay measures into law

US Weekly

|

|