EU-US free trade imperative

Updated: 2013-07-02 08:05

By Alfred Gusenbauer (China Daily)

|

||||||||

The confirmation of Michael Froman as the US Trade Representative is a fitting moment to highlight the many opportunities that a free-trade agreement between the European Union and the United States would offer Europe, America and the world.

Today's three-tier global economy - 6 percent growth in emerging markets, 2 percent growth in the US and no growth in Europe - shows ominous signs of paralysis and nationalistic unilateralism. Many see currency wars looming.

In such an economically insecure global environment, riddled with protectionist booby traps, a free-trade pact between two of the world's largest trading blocs, accounting for roughly 40 percent of global GDP, has never been more important. Historically, free trade and economic growth have gone together, as have protectionism and stagnation, and deeper trade integration of the US and the EU economies would strengthen growth on both sides of the Atlantic.

The US economy's projected 2 percent growth this year, despite a 1.8 percent-of-GDP cut in government spending, implies real private-sector growth of 3.8 percent. Although the US Federal Reserve and the European Central Bank both have actively intervened to boost economic recovery, the results could not be more different.

In the US, the banking crisis was tackled rapidly and in a sustainable manner, while Europe is still going from one bailout to the next. Moreover, the US' stimulus program did work, notwithstanding criticism from the left for being too small and attacks from the right for being too large. Another contributing factor may be a basic difference in mentality: many Europeans tend to over-emphasize risk when assessing opportunities.

In any case, the US is the first country in the recession-stricken part of the global economy where public stimulus has led to enough private investment and growth to make fiscal consolidation possible. The more the US and the EU grow together, the more the EU will benefit from the US recovery.

Demand for European goods will increase, and the EU member states can - and should - align their economies with US growth. History suggests that the hope for a self-sustained recovery in Europe might well prove deceptive; almost always, the European economic cycle has followed and reinforced that of the US. Today, for example, a prolonged recession in Europe is, alongside budget cuts, generally seen as posing the greatest risk to a sustained US recovery.

Labor costs in the US industrial sector are currently 25 percent lower than the European average. Even more significant, however, are the differences in energy costs, which are now up to 50 percent lower in the US - a gap that is likely to widen further as America's shale-gas revolution continues.

This has led energy-intensive European industries - including producers of glass, steel, chemicals and pharmaceuticals - to invest heavily in the US. Often, they manufacture high-quality upstream products, which are then processed further in Europe.

Austrian steel producer Voestalpine AG, for example, will start producing steel pellets in the southern US that will then be upgraded to high-quality alloys in Austria.

The combination of lower production costs in the US and Europe's world-class finishing capabilities is a recipe for first-rate products at competitive prices. In this way, European investment is contributing to the re-industrialization of the US while simultaneously ensuring high-quality European jobs.

But Europe must do more to reinvigorate its own manufacturing sector. The last attempt to create an EU-US free-trade zone, when Bill Clinton was the US president, failed because of the EU's rigid, antiquated agricultural policy. A new effort would help Europe to replace its agricultural policy with a research and development policy aimed at boosting industrial competitiveness.

Despite all the lip service paid at multilateral summits to policy coordination, imbalances within the global economy are fueling a rise in tensions. At a time when many are seeking salvation in nationalism, an EU-US free-trade zone would be a powerful symbol of cooperation in overcoming global challenges.

The increasing economic weight of Asia is also a geopolitical game-changer. So the focus in world politics is shifting from the Atlantic to the Pacific.

Europe should know where it belongs. An EU-US free trade zone would strengthen transatlantic political bonds and effectively refute the frequent lament that the US has lost interest in Europe.

In his second inaugural address, US President Barack Obama called an EU-US free-trade zone a core project of his second term. Secretary of State John Kerry repeated this during his visit to Germany in spring. Now it is up to export-oriented EU countries like Germany, the Netherlands, Sweden and Austria to press for action on the US offer of negotiations.

Europe has engaged in navel-gazing for too long. Its malaise has raised questions about whether its democratic capitalism will survive the economic challenge.

I, for one, prefer making political decisions to wallowing in doubt and self-pity. A transatlantic trade pact would align the US and EU economies.

The author was Chancellor of Austria in 2007-2008.

Project Syndicate.

(China Daily USA 07/02/2013 page12)

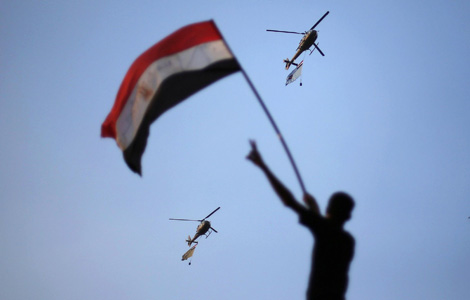

Egypt army gives Mursi 48 hours to share power

Egypt army gives Mursi 48 hours to share power

No quick end in sight for Beijing smog

No quick end in sight for Beijing smog

New filial law sparks debate

New filial law sparks debate

Bakelants claims Tour de France second stage

Bakelants claims Tour de France second stage

2013 BET Awards in Los Angeles

2013 BET Awards in Los Angeles

Gay pride parade around the world

Gay pride parade around the world

Four dead in Egypt clashes, scores wounded

Four dead in Egypt clashes, scores wounded

New NSA spying allegations rile European allies

New NSA spying allegations rile European allies

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Kerry hails China's denuclearization bid

19 firefighters killed in Arizona fire

Book reveals islands' true history

Tokyo warned not to resort to 'empty talk'

Snowden applies for Russian asylum

No quick end in sight for Beijing smog

New home prices defy curbs

Mandela 'still critical but stable'

US Weekly

|

|