Policy fine-tuning needed

Updated: 2013-07-02 08:05

(China Daily)

|

||||||||

The signs suggest that China's economic slowdown has become more entrenched as both official and private manufacturing activity indices continued to edge down in June.

The official purchasing managers' index dropped to 50.1 in June from 50.8 in May, while the HSBC PMI for June declined to 48.2, its lowest level since September 2012 and down from May's final reading of 49.2.

While the official PMI reading was slightly better than market expectations, it is worrying that the indices indicate there has been an across-the-board weakening across the economy.

The possibility is high, therefore, that the GDP growth in the second quarter could be lower than the 7.7 percent growth of the first quarter.

China's 7.8 percent year-on-year GDP growth last year was the lowest in 13 years. If economic growth turns out to be that low this year, both the corporate sector and the financial market will be under heavy pressure, and, in the worst-case scenario, it could spell trouble for the labor market.

And the challenges resulting from an economic slowdown are being aggravated by the rising asset prices and the potential risk of financial turbulence. House prices, for example, have failed to show any signs of weakening. Prices in the 100 main cities continued to rise in June from a year earlier, with prices up 7.4 percent on average from a year ago, while on a month-on-month basis, prices rose by 0.77 percent on average, according to the China Index Academy, a private data provider.

If prices continue to rise unabated they will only pose more challenges to policymakers amid slowing economic growth.

The financial market, meanwhile, has been showing distress following the largely structural "cash crunch" in the interbank market last month, which could slow the expansion of the problematic off-balance-sheet lending and ultimately bring about reduced money supply for the overall economy.

But the authorities are well aware of the issues, and they are making appropriate efforts to address them and prevent any disastrous shocks to the national economy.

With policymakers subject to the multiple challenges of slowing growth, rising asset prices and growing financial risks, they could resort to policy fine-tuning to address the situation. A temporary easing in the appreciation of the yuan, for example, could help alleviate the hardship of the export sector and the economy as a whole.

(China Daily USA 07/02/2013 page11)

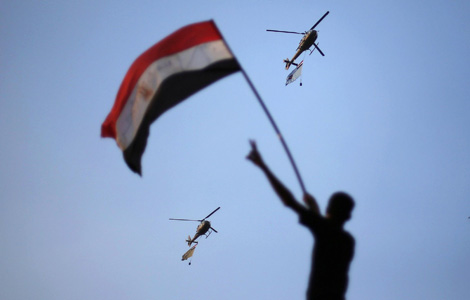

Egypt army gives Mursi 48 hours to share power

Egypt army gives Mursi 48 hours to share power

No quick end in sight for Beijing smog

No quick end in sight for Beijing smog

New filial law sparks debate

New filial law sparks debate

Bakelants claims Tour de France second stage

Bakelants claims Tour de France second stage

2013 BET Awards in Los Angeles

2013 BET Awards in Los Angeles

Gay pride parade around the world

Gay pride parade around the world

Four dead in Egypt clashes, scores wounded

Four dead in Egypt clashes, scores wounded

New NSA spying allegations rile European allies

New NSA spying allegations rile European allies

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Kerry hails China's denuclearization bid

19 firefighters killed in Arizona fire

Book reveals islands' true history

Tokyo warned not to resort to 'empty talk'

Snowden applies for Russian asylum

No quick end in sight for Beijing smog

New home prices defy curbs

Mandela 'still critical but stable'

US Weekly

|

|