Frankfurt joining race to become key yuan center

Updated: 2013-07-04 07:54

By Li Xiang in Frankfurt and Fu Jing in Brussels (China Daily)

|

||||||||

Frankfurt, the German financial capital, is joining the race to become a major offshore yuan trading hub in Europe as local financial institutions push for a potential currency swap agreement between the European Central Bank and the People's Bank of China.

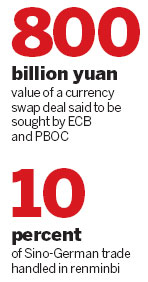

Frankfurt Main Finance, a financial association that represents major German banks, is expecting the ECB to sign an 800 billion yuan ($130 billion) currency swap with Beijing, according to a Bloomberg report.

But both the ECB and the PBOC declined to comment on the currency swap when contacted by China Daily.

If the agreement becomes reality, it will dwarf the 200 billion yuan agreement signed by the Bank of England and the PBOC.

"The fact that about 10 percent of Sino-German trade is handled in renminbi shows the opportunities for a yuan-trade center in Frankfurt," said Lutz Raettig, president of Frankfurt Main Finance.

While some market observers said that liquidity is one of the main hurdles for Frankfurt to develop its yuan-trading market, Raettig said that trading risk and hedging costs will drop significantly if the swap agreement is reached, which could lead to significant yuan savings and could further boost trade between Germany and China.

Raettig also emphasized the supportive role of Frankfurt in deepening Sino-German economic relations and noted that such close ties between the financial sector and industries are not found in other financial centers in Europe.

Frankfurt, also home to the ECB, is facing off with rivals such as London, Paris and Zurich to win yuan business for German financial institutions and exporters as China has been keen to lift the global profile of its currency.

"Frankfurt has a better chance to win as it is the ECB headquarters and Germany has the most outstanding trade and investment relations with China in Europe," said Stefan Strater, manager of the Frankfurt branch of Industrial and Commercial Bank of China.

Strater said that while China needs to further liberalize its financial market to convince international investors of the value of its currency, a currency swap between the ECB and PBOC is the first step, which will significantly boost yuan business for banks in Germany.

Yuan payments in Germany increased by 71 percent between April and May, the biggest increase in the top 20 countries in yuan payments, according to the Society for Worldwide Interbank Financial Telecommunication, known as SWIFT, which provides messaging services to banks.

Germany is ranked No 8 in the world in terms of the value of yuan payments, excluding the Chinese mainland and Hong Kong.

Paul De Grauwe, former adviser to the European Commission president, said it is natural for the European and Chinese central banks to negotiate a currency swap deal to inject liquidity into each other.

"The ECB has done so with the US Federal Reserve. All these aim to help provide liquidity lines when necessary," said De Grauwe, professor of European political economy at the London School of Economics and Political Science.

De Grauwe said the internationalization of the Chinese currency is heading in the right direction in the long run, but suggested that China should slow the pace in the short term.

China is trying to contain its financial bubbles by tightening the credit supply, so it should slow the pace of yuan internationalization, he said.

Frankfurt's push for a currency swap with China reflects the intensifying competition among major European financial centers to build an offshore yuan-trading center.

London is so far the largest offshore yuan market in Europe with total deposits exceeding 100 billion yuan.

Paris is catching up with its renminbi deposits reaching 10 billion yuan.

Contact the writers at lixiang@chinadaily.com.cn and fujing@chinadaily.com.cn

(China Daily USA 07/04/2013 page1)

Ecuador finds spy mic for Assange meeting

Ecuador finds spy mic for Assange meeting

US martial artists arrive at Shaolin Temple

US martial artists arrive at Shaolin Temple

July 4 in Prescott: Balance of grief, patriotism

July 4 in Prescott: Balance of grief, patriotism

Jubilant crowds celebrate after Mursi overthrown

Jubilant crowds celebrate after Mursi overthrown

Growth slowing for services

Growth slowing for services

Venezuela eyed as Snowden seeks asylum

Venezuela eyed as Snowden seeks asylum

Anti-terror drill staged in Xinjiang

Anti-terror drill staged in Xinjiang

Memorial service held for 19 Arizona firefighters

Memorial service held for 19 Arizona firefighters

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US welcomes China's engagement in Africa

Data show shifts in US, China economies

Obama, Merkel agree talks on surveillance program

Filipino executed for drug trafficking

Obama orders US to review aid to Egypt

Snowden still in Moscow

China urges more efficient uses of fiscal funds

Egypt army topples president Morsi

US Weekly

|

|