Pharma boss likes a fit lifestyle

Updated: 2013-07-11 07:30

By Liu Jie (China Daily)

|

||||||||

|

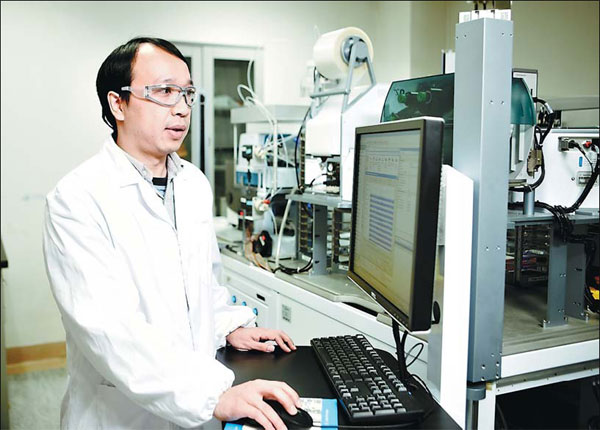

A laboratory in China Novartis Institutes for BioMedical Research in Shanghai, The facility is Switzerland-based Novartis AG's third-largest research and development center in the world. Provided to China Daily |

CEO likens sport discipline to rigor of global business

As a former competitive swimmer, the dedication Joseph Jimenez had to display on a daily basis helps in his current position as chief executive officer of pharmaceutical giant Novartis AG.

"Being a competitive swimmer, you are taught the discipline of working hard, then training for the big event, achieving a result and then celebrating once you win," he said. "That's very close to what we do at Novartis. We work very hard toward a goal. We set the objective then we deliver it. And then we try to celebrate - but only for a short time - until we set the next goal."

In addition, strong mettle, courage and consistency are characteristics required in both top-level swimming and business.

Upon joining Novartis in 2007 as division head of the consumer health unit - the over-the-counter drugs business - Jimenez had no scientific or pharmaceutical background but did possess rich experience in the consumer goods industry and business degrees from Stanford University and University of California, Berkeley.

He discovered a fellow employee with a science background who was good at communicating clearly on the topic of complicated pharmaceuticals and invited him to his office on many early mornings to go over in detail every drug that Switzerland-based Novartis produced: the biology of the disease each one treated and the mechanism through which they worked, just like morning training in the world of sports.

"I needed to win the respect of the company's scientists and, ultimately, I had to understand the products so that we, together, could make some key decisions," he said.

In 2007, Jimenez was appointed to lead the pharmaceuticals division - a core business of Novartis engaged in innovative drugs. At the time the company was facing the challenge of stricter regulations in the United States and Europe and medical policies in various nations were changing. The Novartis board wanted to bring a fresh eye to the issues.

Because of his success in leading the transformation of the pharmaceutical portfolio to balance mass market and specialty products and significantly increasing the percentage of sales from newly launched products, Jimenez was promoted to the CEO position in 2010. His job was to manage the medical regimes of five business units - pharmaceuticals, eye care, generics, vaccines and diagnostics, as well as over-the-counter drugs and animal health.

At the moment Jimenez and the industry in general are facing a trio of huge challenges: the expiry of patents on certain highly popular drugs, price-cutting pressure from governments around the world and the global economic slowdown.

What is known in the industry as the "patent cliff" means after patent expiration of a blockbuster drug, other companies can produce a generic with the same essential chemicals at a much lower price to capture a high market percentage. Blockbuster drugs are defined as medicines that provide revenues of more than $1 billion sales per year. High profits are required to pay for the high costs of research and development required by the pharmaceutical industry.

For more than a decade, the top-selling Novartis product had been Diovan, an anti-hypertensive medicine. People who need it should take it every day. In 2011 and 2012, the patent on Diovan in Europe and the United States expired, and around a dozen drugmakers began manufacturing generic versions at much lower prices. In 2007, the Novartis pharmaceuticals division as a whole had revenues of $24 billion, of which $5 billion came from sales of Diovan.

Novartis is not alone in facing the issue. The patent for US-based Pfizer Inc's Lipitor, the best-selling prescription drug in history, ended in 2011. Analysts said Lipitor sales will decline from about $11 billion in 2009 and 2010 to just above $3 billion in 2015.

IMS Health, a healthcare information provider, forecasts that by 2016 patent expirations will have caused a loss of $106 billion in sales from branded drugs over the previous five years, with the heaviest burdens occurring in 2012 and 2013.

To deal with the problem, innovation-centered drugmakers are taking various measures, such as further enhancing their R&D strengths and expanding their own generic business. US drugmaker Eli Lilly and Co's Chairman, President and CEO John C. Lechleiter said his company would continue to put 20 percent of its sales into R&D in the coming years. Pfizer announced a $545 million generic joint venture deal with Zhejiang Hisun Pharma last February, saying that it wants to keep pursuing "opportunities" in China and India to expand its portfolio of generic drugs.

Jimenez believes the concept of blockbuster drugs, which has been the major driving force of big drugmakers around the world, should be rethought. In the past, drugs were developed to fight the most prevalent problems such as heart disease, diabetes and hypertension. Novartis is now putting its effort into a converse approach: Instead of targeting very large patient pools with broad therapy areas, it follows a science-based approach by researching pathways of rare diseases, which may play a role in more common diseases.

It wants its scientists to figure out the molecular pathway by which a disease works and how to interrupt it. From there, they can expand to other diseases that are affected by the same mechanism and create a multiple-disease therapy.

The company has already seen some success with this method. Afinitor, for example, was first approved to treat kidney cancer. But research demonstrated that it also works in patients with certain lung and breast cancers. With indications across five areas, Afinitor is expected to reach blockbuster status with sales of more than $1 billion.

Jimenez's previous career in the consumer goods industry - at one time heading H.J. Heinz Co, one of the most global US-based food companies - in North America and later Europe required him to "look at the external world and how it is changing". His board recognized that his experience and insight would be valuable in the healthcare sector as it undergoes great changes.

National governments, including China, are calling for a reduction in medical care costs. China has been implementing medical reform, aiming to provide universal medical care for its 1.3 billion population. It has urged drugmakers, especially international ones, to reduce prices, especially for medicines that are out of patent, and cut the price of drugs on its national reimbursement list nearly 20 times since 1997.

"Governments around the world are lowering the prices of pharmaceuticals and China is no exception," Jimenez said, stressing that Novartis as a healthcare group has both innovative pharmaceuticals that are patent-protected and a division named Sandoz focusing on high quality but low cost generics, which it considers to be a diversified and balanced portfolio.

On the other hand, the CEO said: "Obviously the price declines influenced our thinking about the amount we can invest (in R&D), but we're committed to upholding our high investment in innovation." He called for the rewarding of innovation with prices that can sustain R&D investment in the next generation of drugs.

The healthcare industry is rather unique, given its huge investment in R&D and close relationship with government policies, according to Luo Jing, a senior analyst of Shenyin Wanguo Securities Co Ltd.

In recent decades, it generally took 10 years and at least $1 billion to bring a new drug to the market but the cost is now rising.

"The price of medicine is a double-edged sword in the industry and the bargain between governments and pharmaceutical companies is endless internationally, including China. It is a question of finding a balance, which is a challenge to both policymakers and drugmakers," she added.

Jimenez insists that R&D is fundamental to Novartis. The company spent more than $9.1 billion on R&D last year. Meanwhile, it has increased its research in emerging markets, including China.

The Swiss health major has committed $1 billion to the construction of a new R&D center in Shanghai, which is to be one of nine such facilities to support a global R&D network.

"The role China is playing is top-line growth for Novartis. It helps us see the fruit of our R&D investments we have made in many of our pipeline products," said the global CEO.

Last year, sales of Novartis products in China grew 24 percent at a time when the company's global performance was essentially flat because of Diovan's patent expiration.

In the coming years, the growth in China "will remain constant with strong growth in double digits" and "we could grow slightly faster than the market", said Jimenez.

Being the CEO of a global company is not easy. In fact it is extremely strenuous, said the 53-year-old. Sports are still his favorite form of relaxation. To keep his energy levels up and make sure his head is always clear, Jimenez does a lot of athletics, such as going to the gym, swimming and indulging his new hobby of fly-fishing.

But what Jimenez enjoys most is spending time with his children and family on the weekends - the best way to maintain a good work and life balance and refresh himself, he said.

liujie@chinadaily.com.cn

(China Daily USA 07/11/2013 page15)

China investigates GSK executives for bribery

China investigates GSK executives for bribery

China, Russia complete 3-day joint naval drill

China, Russia complete 3-day joint naval drill

US drone completes 1st carrier landing

US drone completes 1st carrier landing

Sino-US talks 'help build trust'

Sino-US talks 'help build trust'

Boston Marathon bombing suspect pleads not guilty

Boston Marathon bombing suspect pleads not guilty

Caution urged in seeking experts from abroad

Caution urged in seeking experts from abroad

Shanghai struggles with growth

Shanghai struggles with growth

Trade town turns to tourism

Trade town turns to tourism

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Senators skeptical about Smithfield deal

Beijing has world's most delayed airport

Caution urged in seeking experts from abroad

Snowden is likely Venezuela bound

Talks 'help build trust' between China, US

Obama pushes House Republicans on immigration

Chinese researcher pleads guilty in US drug case

US Navy completes 1st unmanned carrier landing

US Weekly

|

|