Chinese institutions eyeing properties abroad

Updated: 2013-07-11 07:31

By Wang Ying in Shanghai (China Daily)

|

||||||||

|

Exhibition area of China Vanke Co Ltd, China's largest property developer, at the Wuhan Spring Real Estate Trade Fair in May. A growing number of Chinese individuals and developers are investing in the real estate market abroad. Provided to China Daily |

Limited investment options and abundant liquidity are prompting Chinese investors to look abroad for alternative opportunities, and a real estate consultancy is forecasting that mainland individuals will put up to 1.1 trillion yuan ($179 billion) into global real estate markets.

Chinese individuals, property developers and institutions have increased their holdings of overseas real estate in recent years.

They have been driven by factors including limited investment channels in China, abundant liquidity, divergent domestic and overseas credit conditions, a stronger yuan and relatively cheap overseas assets in the wake of the 2008 global financial crisis, a report from commercial real estate firm CBRE said on Wednesday.

About 5 percent of investable assets from Chinese high net worth individuals, who have assets of more than 10 million yuan, will be channeled into overseas real estate markets in the future, the report said.

Chinese individual investors, who have been particularly active in overseas real estate markets in recent years, are extending their primary investment objectives from immigration and children's education to wealth preservation and creation.

Seeing the great potential from Chinese individual investors for overseas properties, a growing number of domestic real estate companies are expanding overseas.

One of the latest examples is China Vanke Co Ltd, the largest Chinese property developer, which started its first project in North America with its American partner Tishman Speyer earlier this year.

According to the CBRE report, institutions are also motivated to invest overseas.

For instance, after gaining permission from the China Insurance Regulation Commission for overseas investment in 2012, domestic insurance institutions, which possess abundant, cheap and long-term capital, are expected to become major buyers in overseas real estate markets.

Also, China's well-capitalized sovereign wealth funds have begun allocating capital to real estate, as they seek capital gains and long-term stable rental income from undervalued overseas core property assets.

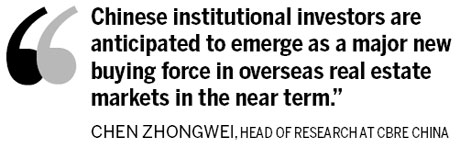

"Chinese institutional investors are anticipated to emerge as a major new buying force in overseas real estate markets in the near term," said Chen Zhongwei, head of research at CBRE China.

Compared with domestic real estate developers, China's institutional investors have a shorter history of direct property investment.

However, Chen said, China's insurance and sovereign wealth funds will become active in overseas property markets, with many seeking quality office properties in international gateway cities.

Although there are no successful cases of outbound real estate investment so far for Chinese insurance funds, the report said they are soon to come.

In the future, about $14.4 billion in Chinese insurance capital will be invested in overseas real estate markets, the report estimated.

Sovereign wealth funds are also heavyweight players in overseas property investment, said the report, citing the history of capital allocation of global sovereign wealth funds to real estate property investment and recent activity by China's sovereign wealth funds in real estate investments.

As of the end of 2012, China's sovereign wealth funds were the world's largest, with total assets of $1.49 trillion, according to the report.

While Chinese investors are setting sight overseas, the Chinese real estate market and Shanghai in particular are hot spots for investors.

In the first half, Jones Lang LaSalle said, about 20.4 billion yuan worth of properties were traded in Shanghai, up 64 percent year-on-year.

"An increased focus on first-tier cities has coincided with an increased allocation of capital to China by global core investors, such as pension funds and sovereign wealth funds, which previously viewed the market here as too risky," said Alan Li, head of investment for Jones Lang LaSalle Shanghai.

"These buyers are now increasingly focused on Shanghai's commercial market as a source of core and core-plus investments," said Li.

wang_ying@chinadaily.com.cn

(China Daily USA 07/11/2013 page13)

China investigates GSK executives for bribery

China investigates GSK executives for bribery

China, Russia complete 3-day joint naval drill

China, Russia complete 3-day joint naval drill

US drone completes 1st carrier landing

US drone completes 1st carrier landing

Sino-US talks 'help build trust'

Sino-US talks 'help build trust'

Boston Marathon bombing suspect pleads not guilty

Boston Marathon bombing suspect pleads not guilty

Caution urged in seeking experts from abroad

Caution urged in seeking experts from abroad

Shanghai struggles with growth

Shanghai struggles with growth

Trade town turns to tourism

Trade town turns to tourism

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Senators skeptical about Smithfield deal

Beijing has world's most delayed airport

Caution urged in seeking experts from abroad

Snowden is likely Venezuela bound

Talks 'help build trust' between China, US

Obama pushes House Republicans on immigration

Chinese researcher pleads guilty in US drug case

US Navy completes 1st unmanned carrier landing

US Weekly

|

|