Playing a trump card in global business

Updated: 2013-07-15 07:24

By Meng Jing (China Daily)

|

||||||||

Innovation may well turn out to be China's next important advantage

For the last 120 years, customer preferences of Americans have largely dictated the taste and looks of the chocolates and sweets made by Hershey Co of Pennsylvania, the largest producer of quality chocolate in North America. But as Hershey sets up a new innovation center in Asia, there are early indications that Chinese preferences will soon have a say in the final product mixture.

The innovation center in Shanghai is not only expected to help Hershey quickly develop, test and launch new products suited for customers in China and Asia, but also for the rest of the world, say company officials. Yuan Qingbin, head of the center, says it is only a matter of time before Chinese preferences will define the future taste and style of Hershey chocolates and sweets.

"We have the ambition and desire to make some powerful products in China, across Asia and the rest of the world. Chinese preferences in food and drinks, such as tea, are gaining ground in the West. I don't see why Chinese customers cannot decide the taste of global products," says Yuan, who worked for Hershey in the United States for seven years before taking up the Shanghai assignment.

Hershey is just one of several multinational companies that are moving their research and development facilities to China with an eye on the nation's huge domestic market and growing high-end talent pool, apart from the desire to reduce product development costs.

That transition has also prompted several multinational firms to change their R&D focus from "made-for-China" to "made-for-the-world", something that gels well with China's vision of being a global innovation hub, say experts.

Changing trends

"Foreign multinational companies are keen on housing R&D facilities in China to tap the huge market and enjoy benefits such as cost efficiency. This is gradually turning China from a world factory to a global innovation hub," says Dan Steinbock, research director of International Business at the India, China and America Institute, a think tank in the US, who believes that China can complete the transformation in 10 years.

"Innovation is often measured by input indicators, such as R&D and output indicators, such as patents," Steinbock says. "The global patent power is shifting from the West to China, as measured by the number of patent applications received. In terms of R&D expenditure, China is still significantly behind the US, but the gap is shrinking and China is likely to overtake America as the world's greatest innovation investor in about a decade." The indicators are crude, but they do reflect significant trends, he says.

China, which spent $134 billion on R&D in 2011, ranked third in the world while the US retained the top slot, spending $415.19 billion.

However, China had had the most rapid growth in R&D expenditure worldwide with average annual growth of 17.1 percent between 2005 and 2011, according to the Chinese Academy of Science and Technology for Development.

In output, China overtook the US, becoming the country that registered the most patent applications globally in 2011 for the first time. The US regained the top position last year, but the World Intellectual Property Organization based in Geneva said China, which ranked the fourth in the world, still saw strong double-digit growth in filings.

Despite the promising future, the Global Innovation Index 2013 published on July 1 by Connell University, INSEAD (European Institute of Business Administration) and WIPO (World Intellectual Property Organization) shows that China ranks 35th among all the 142 sampled countries in innovation, compared with 34th in 2012 and 33rd in 2011.

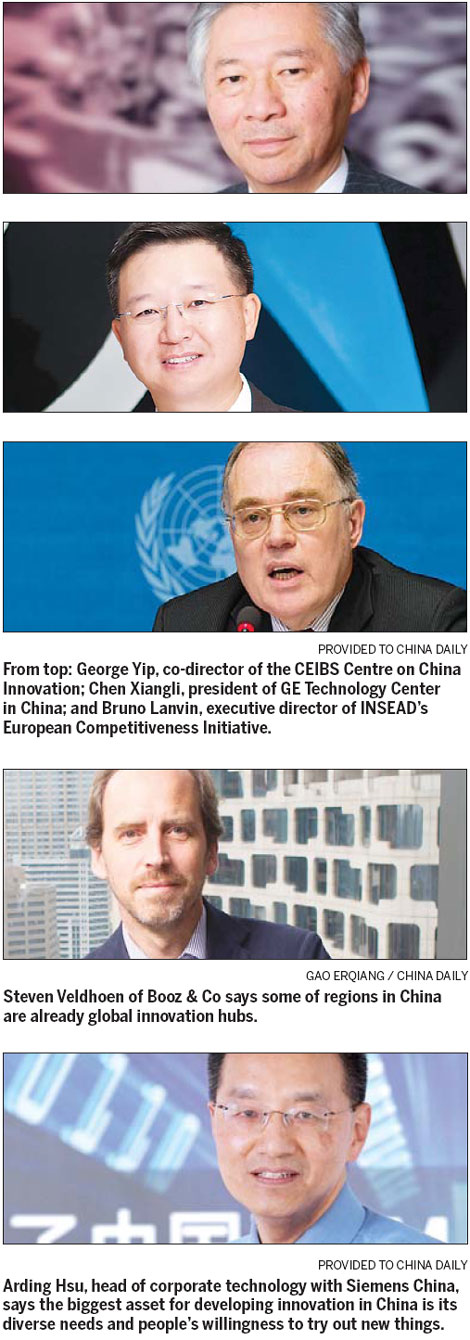

However, Bruno Lanvin, the report's co-editor and executive director of INSEAD's European Competitiveness Initiative, does not doubt China's future as a global innovation hub. He says the decline in its ranking is because of the changed methodologies used in the research and China continues to outpace its peers in middle-income economies in innovation.

China is categorized as one of the 18 innovation learners, which are mostly countries ranked from 19th to 36th in Lanvin's index. "There is no doubt that these innovation learners are tomorrow's innovation leaders," he says, adding that innovation has a strong link to per capita GDP.

Lanvin says emerging countries, such as China, are quickly moving up the ladder in GDP. But given the demography and the geography of China, the per capita GDP will grow at a lower rate.

Hu Zhijian, Party chief of China Academy of Science and Technology for Development with the Ministry of Science and Technology, says China will certainly move up the ladder, but more slowly than in previous years.

"This is because the higher you climb, the stronger is the competition you will face," says Hu, whose organization published an annual innovation index in May that ranked China 20th among all the 40 sampled countries. Switzerland, Japan and France took the top three positions.

Hu says that in his index China jumped from the 38th slot in 2000 to 25th in 2005 and to 20th in 2010. "The momentum is becoming slower and slower, because it is getting more and more difficult."

As part of its 12th Five-Year Plan (2011-2015), China has pledged to turn itself into an innovative economy and also set a goal of achieving the 18th rank by 2015 in Hu's index.

Although it looks challenging, many experts say gaining a high score in innovation does not necessarily mean that the country is a global innovation hub.

Steven Veldhoen, partner with Booz & Co, a global management consultancy, which published a report titled Innovation: China's Next Advantage last year, says that although any country can be as innovative as Denmark or Finland (among the top 10 countries in the INSEAD Global Innovation Index 2013), it still does not mean they are global innovation hubs.

The Beijing-based Veldhoen, who specializes in improving corporate innovation and operation capabilities, says that when it comes to one country's innovative capability, people often talk about the R&D spending over GDP.

Although China has increased the number from 0.9 percent in 2000 to almost 2 percent last year, it is still small compared with the 4 percent or 5 percent in developed countries.

"It is not fair to China because it is such a big and diverse country. But if you consider the greater Beijing area a country or Shanghai and Jiangsu province a country, their investment in R&D over GDP are already at 4 percent or 5 percent. Some of the regions in China are already global innovation hubs."

Although it is difficult to quantify one country's status as a global innovation hub, Veldhoen says: "There are very few companies that consider themselves as global innovators who don't have an innovation center in China. That's a very good way to measure whether China is a global innovation hub."

Knowledge factor

The Ministry of Commerce says there are about 1,200 foreign multinational R&D centers in China, representing a total investment of about $12.8 billion in 2010.

Though cost was the key-driving factor a decade ago, foreign companies' interests in coming to China for R&D are now largely driven by market conditions and knowledge factors.

Yuan Qingbin, head of Hershey's Asia innovation center, admits the main reason that prompted the US company to set up an R&D facility in Shanghai was the robust sales performance and growing middle-class in China, particular considering the sales performance in developed markets.

"China is currently Hershey's fastest growth market, moving from No 7 to No 3 in chocolate share in just five years with overall chocolate share more than quadrupling by 2012. So we are betting big on China," he says.

The cost of Chinese talent is no longer an advantage for the company, according to Yuan. Some of the top Chinese R&D expertise can sometimes cost more than the equivalent in the US because of scarcity.

Paul Ebertz, vice-president and global HTS-aerospace leader at Honeywell Aerospace, says his company has identified China as a key growth market and intends to double the current Chinese R&D workforce of 350 over the next few years.

"Commercial aviation growth in Asia-Pacific is still on the upswing and our decision to house the APAC headquarters in Shanghai clearly underlines the importance of China in Honeywell's overall technical innovation and growth strategy," Ebertz says.

Despite the big market, Arding Hsu, the head of corporate technology with Siemens China, says the biggest asset for developing innovation in China and the main driving force for China's future role as a global innovation hub is the country's diverse needs and its people's willingness to try out new things.

"There is no country in the world that has as many diversified demands as China," he says. "As long as we can understand the needs of Chinese customers, there are better chances for us to become game changers."

Hsu cites his company's WLAN-based moving block technology as an example. The technology, which was developed in China based on the needs of transferring huge numbers of passengers through the subway network in China's megacities, has successfully reduced train interval times from 3 minutes to as short as 80 seconds in real-time operations.

Siemens is not the only company to have discovered that made-for-China products can be sold in other countries as well. According to Booz & Co's report in 2012, which surveyed 100 Chinese and multinational companies in China, the importance of China for companies as a regional and even global hub for innovation is clear.

Nearly 40 percent of the multinational companies and 50 percent of Chinese companies surveyed already develop products in China for markets outside the country. This trend is set to intensify, with the survey finding that, by 2022, more than 60 percent of all multinational companies and local companies expect to conduct R&D in China for global markets.

Future perfect

All the experts agree that China will be a major global innovation hub in the future. Many feel the country's ability to spur creativity and attract talent will be the core issue that it will need to tackle if it wants to be the global innovation hub.

George Yip, co-director of the Shanghai-based CEIBS Centre on China Innovation, says that in the next couple of years, China can indeed become a global innovation hub. "But, in China, people always talk about being the No 1, so it is still a long way off," Yip says, adding that it depends on individual industries.

"In the next decade, China will be one of the top innovation hubs for labor and engineering intensive sectors, such as telephones, in which China has already done a lot of work."

In the automobile industry, China is still far behind. It will be 20 years before it can reach the peak. For aerospace, it could take as long as 30 years, Yip says. China has lower per capita income than the US and Japan, but even countries such as Japan have become global innovation leaders only in certain categories.

Chen Xiangli, president of GE Technology Center in China, agrees, saying it will be difficult for China to overtake the US in innovation in the foreseeable future, as the latter is still an attractive destination for most top-quality talent. His R&D team in China has made significant progress since the center was set up in Shanghai in 2000, he says.

"For the first five years, our focus was to learn how to localize the products developed by GE's R&D labs in other parts of the world. Then over the next five years, we started to develop products for Chinese customers. Over the past two to three years we've been developing products for China as well as the rest of the world.

"For some products, more than 80 percent of our research outcome is now sold to countries outside China," Chen says, adding that the trend signifies the growing capability of Chinese innovators.

But he still believes talent is the key challenge for China because R&D has a long history in the US, thereby creating a huge pool of experienced professionals. "The majority of our R&D team in China has work experience of less than five years, but in the US you can find a lot of people with 20 to 30 years of experience."

But that is not the end of the story for China, Chen says. China's real opportunity in innovation lies in the middle-end products, which do not require the most complicated science skills but are still in high demand not only in China but also in other emerging as well as developed economies, he says.

Shen Jingting and Wang Wen contributed to this story.

mengjing@chinadaily.com.cn

(China Daily USA 07/15/2013 page12)

US star sprinter fails drug test

US star sprinter fails drug test

Protests erupt after verdict

Protests erupt after verdict

Color Run in London promotes healthy living

Color Run in London promotes healthy living

Urumqi residents hand in weapons

Urumqi residents hand in weapons

Pool jammed in summer heat

Pool jammed in summer heat

Last stop for the telegrams of India

Last stop for the telegrams of India

Heavy rain, strong winds as Soulik heads inland

Heavy rain, strong winds as Soulik heads inland

8 dead, 19 injured after bus leaves road in Jinghong

8 dead, 19 injured after bus leaves road in Jinghong

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Four GSK China execs held for investigation

Asiana survivors coping with post traumatic stress

China's Q2 GDP growth slows to 7.5%

Canada mourns victims of train accident

Air crash students return to families

Snowden says he won't release harmful US data

Local governments face financing woes

Zimmerman not guilty

US Weekly

|

|