Health is wealth, going private 'is the future'

Updated: 2013-07-15 07:25

By Chen Yingqun in Beiing, Cecily Liu in London and Ren Qi in Beijing (China Daily)

|

||||||||

|

People stand in long lines to register at a children's hospital in Nanjing, Jiangsu province, on July 3. Wang Qiming / For China Daily |

Urbanization is the new calling card for foreign healthcare companies

Although China's rapid urbanization is putting a huge strain on the country's healthcare resources, it is also creating opportunities for foreign healthcare providers to sell products and services or provide training for their Chinese counterparts.

A rapid influx of population into urban centers has meant that cities are unable to provide adequate services in an orderly manner to all citizens, while an imbalance of funding in China's rural areas has resulted in poor healthcare services.

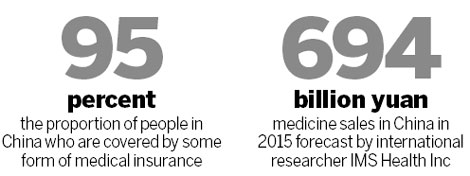

To solve these problems, China has embarked on serious healthcare reform in recent years. Key measures include the development of healthcare infrastructure in China's lower-tier cities and rural areas, as well as insurance plans, through which more than 95 percent of the population now has some form of coverage.

Such encouraging signs are set to continue, as confirmed in a speech delivered in late 2011 by then vice-premier Li Keqiang. Li outlined the government's commitment to establish a universal basic healthcare system providing "safe, effective, convenient and low-cost" healthcare services by 2020.

One current challenge for China's urban centers is congestion and the long waiting times in urban hospitals because of a rapid influx of population in cities and a lack of a robust primary care system that encourages residents to see their local healthcare providers first.

"Lack of a good primary care infrastructure system means that most patients go directly to China's 3-A hospitals in big cities, instead of going to their local healthcare providers first. This creates a misuse of precious resources," says Zhu Hengpeng, a professor at the Chinese Academy of Social Sciences.

Key problems

"The key problem with primary care is the poor level of services and healthcare expertise common among primary care providers. The health risks associated with inappropriate medicine prescription at primary care providers is also greater."

He says the key to reform is to improve the quality of primary care provision and allow more private sector players to enter this market and improve quality through competition.

Liu Yuanli, director of Harvard School of Public Health China Initiative, says that a key aspect of healthcare reform is to make sure that patients trust the primary service providers' level of expertise.

"I once undertook a study in Shanghai's big hospitals, and found that more than 30 percent of patients that went there were not ill to the extent they needed to receive treatment from big hospitals. They went because they could not trust primary care providers," Liu says.

Liu says another challenge to Chinese healthcare reform is to ensure equality of healthcare insurance, so that rural people, urban citizens and migrant workers can all enjoy the most appropriate form of health care.

"China currently has a fragmented insurance system," Liu says. "Those who have formal jobs in urban cities are covered by a basic social insurance program and those who do not have formal jobs are covered by urban residence insurance, which has less coverage in terms of healthcare provision."

"Therefore, when those with urban residence insurance become ill, and often they are migrant workers, they would pay for the healthcare themselves. Alternatively they can seek healthcare services in rural areas where they have permanent residence, but their condition may have worsened during the waiting time," Liu says.

Private sector

As China's large hospitals are experiencing long waiting times, already some foreign players are expanding into China to fill this market gap. One example is Chindex International Inc, founded in 1981 by two US women who had moved to China in the late 1970s.

Roberta Lipson, CEO of Chindex, says that private healthcare services in China used to have a bad reputation because its quality was perceived to be poor, but Chindex and its healthcare services division, United Family Healthcare, has worked hard to change this perception.

"In the old days, only people who couldn't get care or were embarrassed to get care at public facilities would seek care in the private market," Lipson says.

Lipson says one key challenge that private hospitals experienced was the difficulty to attract Chinese doctors from the public system, for reasons including problems in transferring academic titles and accrued social benefits.

To address this challenge, the Chinese government has devised a new regulation allowing doctors to practice at more than one site. Since then several cities have implemented the rule.

However, Lipson says this is impractical because some public hospital heads do not agree with the policy and do not give doctors permission to practice outside their hospitals. "So the human resources flow continues to be challenging," she says.

Lipson says another challenge is that private hospitals are not covered by health insurance, making the service expensive for patients.

"So we want to say to the government: Please, if the patients get $5 reimbursement for service in the public hospital from insurance, they should get the same $5 reimbursement here and, if the price is higher here, they can choose to pay the price difference themselves," Lipson says.

She says that when United Family Healthcare was first launched, most of its patients were foreigners but, over the past few years, the number of Chinese patients has increased and now more than half of all patients are Chinese.

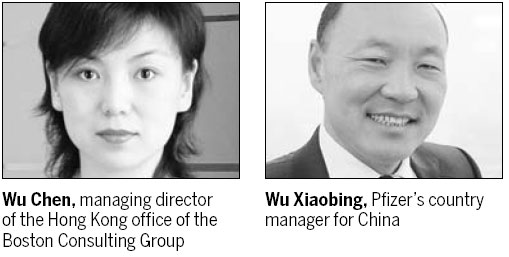

In recent years, many private hospitals operating on the Chinese mainland have come predominantly from Singapore and Taiwan, says Wu Chen, managing director of the Hong Kong office of Boston Consulting Group.

Foreign investment

"There is great potential for foreign investment in China's hospitals sector because China's pharmaceutical and medical equipment markets are already quite saturated, while the field of hospitals still has plenty of space for development," Wu Chen says.

Wu Chen says generally foreign hospitals have the advantage of management expertise over their Chinese counterparts, including aspects such as making appropriate equipment arrangements for operations and assessing the performance of doctors.

"Chinese hospitals can still improve their management processes to improve efficiency and reduce costs," Wu Chen says.

"For example, Chinese hospitals charge patients high fees for medicines and low fees for a doctor's time. But in globally leading foreign hospitals, most of the income is generated from the doctor's time as opposed to medicines, so doctors will place greater focus on treating patients."

She says one way for foreign hospitals to enter China's market is by setting up a wholly owned foreign hospital targeting the premium segment of the healthcare market and maintaining the quality of service offered in the Chinese market.

The second way is for them to expand into the Chinese market through partnership with local service providers, effectively transferring their management expertise in the process.

Many foreign pharmaceutical companies have actively expanded into the Chinese healthcare market, often with manufacturing and research and development sites in China to cater their medicines toward China's needs.

China became the world's third-largest pharmaceutical market in 2010, according to the international healthcare market researcher IMS Health Inc. Sales of medicines are expected to reach 694 billion yuan ($110 billion) by 2015.

One example is the US pharmaceutical giant Pfizer Inc, which has launched 50 drugs designed for the Chinese market so far and plans to introduce more, says Wu Xiaobing, Pfizer's country manager for China.

"In China, we have seen rising incidences of non-communicable diseases as a result of lifestyle changes brought about by increased economic wealth - an example is cardiovascular disease. Our cardiovascular expansion program aims to raise awareness about the diagnosis and treatment of these diseases," Wu Xiaobin says.

According to Wu Xiaobin, Pfizer already has a strong presence in 250 Chinese cities. One of its key strategies is to accelerate the expansion in China's third- and fourth-tier cities to capture "the unmet medical needs in these areas".

Another example is the French pharmaceutical company Sanofi SA, which has sought expansion into rural China by establishing a business unit dedicated to China's county-level markets.

By the end of 2012, this business unit had covered more than 200 counties in nine provinces and autonomous regions with more than 200 million people. It also supported medical associations to train more than 120,000 county physicians in 2012 alone, according to a spokesperson in China.

Research partnership

Medical research collaboration with China is another area of opportunity, because of China's existing medical research expertise and also the country's abundance of research funding, says Rob Buckle, director of the regenerative medicine platform at the UK's Medical Research Council.

Buckle is currently leading a stem cell research project jointly funded by the National Natural Science Foundation of China and his council.

His council "has realized the importance of working with China. The investment and organization of the stem cell biology field in China has seen a sea change over the last few years", Buckle says.

The two partners have currently funded nine groups of researchers. "Each group involves a UK lab and a Chinese lab because we want to encourage scientists from both countries to work together," says Buckle.

Despite China's rising standards of medical research, it still needs to improve the environment for large clinical trials, says Rury Holman, a professor of diabetic medicine and director of the University of Oxford Diabetes Trials Unit.

"China needs more trained people in hospitals to do clinical research. It also needs to develop a research culture that provides doctors and research nurses with the dedicated space and time needed to undertake research in hospitals," Holman says.

Holman is currently leading a team of academics in researching how to reduce the risk of cardiovascular disease and diabetes in China. Starting in 2008, this large trial is expected to finish in 2017. It is collecting data over six years from 7,500 patients across 150 Chinese hospitals.

This project and other research programs also seek to discover the long-term effects of specific diabetes drugs for the Chinese population because China often lacks such data and its government guidelines on diabetes drugs rely heavily on guidelines of Western countries.

"China's State Food and Drug Administration will have the option of using the results of our research work to create its own guidelines on diabetes, which will include, for example, drugs for first-line treatment and then how to personalize drugs for patients," he says.

Looking to the future, China's healthcare sector will provide many more opportunities for foreign players, especially in the fields of drugs, medical insurance investment, IT and medical equipment, says Norbert Meyring, head of KPMG Life Science in China and Asia-Pacific. "I assume there will be an 18 percent to 20 percent annual growth in Chinese drug spending through 2015 due to robust economic growth and a rising middle class."

He says China's medical sector and basic medical insurance system are opening up to private and foreign capital and, at the same time, more global IT providers are entering China's medical market to drive a faster transformation in the country's healthcare system.

"China's healthcare reform will also trigger a vast demand in the medical devices segment. China's medical device market is expected to become the world's second-largest by 2015," Meyring says.

Contact the writer at chenyingqun@chinadaily.com.cn

(China Daily USA 07/15/2013 page16)

US star sprinter fails drug test

US star sprinter fails drug test

Protests erupt after verdict

Protests erupt after verdict

Color Run in London promotes healthy living

Color Run in London promotes healthy living

Urumqi residents hand in weapons

Urumqi residents hand in weapons

Pool jammed in summer heat

Pool jammed in summer heat

Last stop for the telegrams of India

Last stop for the telegrams of India

Heavy rain, strong winds as Soulik heads inland

Heavy rain, strong winds as Soulik heads inland

8 dead, 19 injured after bus leaves road in Jinghong

8 dead, 19 injured after bus leaves road in Jinghong

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Four GSK China execs held for investigation

Asiana survivors coping with post traumatic stress

China's Q2 GDP growth slows to 7.5%

Canada mourns victims of train accident

Air crash students return to families

Snowden says he won't release harmful US data

Local governments face financing woes

Zimmerman not guilty

US Weekly

|

|