Iron ore miners face lackluster demand

Updated: 2013-07-16 07:13

By Du Juan in Beijing and Zheng Jinran in Qinhuangdao, Hebei (China Daily)

|

||||||||

Iron ore producers and traders face a weak market with falling prices, and analysts believe these conditions will persist through the third quarter.

During the first four months of the year, about 2.13 million metric tons of iron ore were unloaded at Qinhuangdao port, a major commodity trading port that is seen as an economic bellwether.

The volume was basically flat compared with the same period of last year, according to General Cargo Branch Co, which handles the port's iron ore business.

The company declined to release more recent data. But visitors to the port can easily see that unloading facilities are idle. And workers have observed a slowdown, too.

A 40-something man who declined to give his name, who said he has worked in the port for six years, noted that iron ore shipments had become irregular, with two or three arrivals spaced over four days or a week.

"In previous months, large volumes were common," he said.

Another male worker at the storage yard said companies have been stockpiling iron ore there for longer periods recently.

"Steel companies are pessimistic about the market outlook, so they have been reducing raw material inventories, mainly iron ore," said Xu Xiangchun, information director of Mysteel.com, a steel industry website and consultancy company based in Shanghai.

"In addition, many steel companies are short of money at present," he said. "Steel companies are trying to improve their cash flow by reducing or even selling iron ore stockpiles."

According to the China Iron and Steel Association, 30 of the country's 86 medium-sized and large steel companies reported losses in the first quarter.

Domestic producers' profit margins averaged just 0.9 percent, with collective industry profits of 2.5 billion yuan ($406 million) for the first quarter.

These profits are meager for an industry with total assets worth 4.3 trillion yuan.

The CISA said the profits of medium-scale and large producers are contracting by the month, falling from 1.3 billion yuan in January to 998 million yuan in February. In March, the figure was just 267 million yuan.

Facing weak downstream demand and oversupply, the major steel mills including Baosteel Group, Anshan Iron and Steel Group and Wuhan Iron and Steel Group, have all cut product prices by 100 yuan to 250 yuan per ton for June.

The average price of hot-rolled steel products offered by Baosteel Group fell by 180 yuan a ton, to a new price of 4,572 yuan a ton.

According to Mysteel.com, iron ore inventories at 30 major domestic ports reached about 69.62 million tons in May, 3.08 million tons above the year's low, which was set on March 8.

Meanwhile, steel companies' internal iron ore inventories slid to 2.15 million tons in late May as they liquidated stockpiles.

The weak market pushed down iron ore import prices. The price of 62-percent-grade Australian iron ore, a benchmark in the international iron ore market, dropped 12.5 percent in just one month. It was offered at $123 a ton on May 20, the lowest level in five months.

Iron ore trading has been weak on China's spot iron ore trading platform, with fewer transactions, according to the platform.

Iron ore traders have been active on the platform, with many repeatedly cutting their asking prices. But buyers have been scarce, said the platform.

The iron ore spot trading platform was launched by the China Beijing International Mining Exchange, the CISA and the China Chamber of Commerce of Metals, Minerals & Chemicals Importers & Exporters.

Signals from the financial markets and macroeconomy offer little hope as well.

China's first-quarter GDP growth slowed to 7.7 percent, from 7.9 percent in the fourth quarter of 2012, according to the National Bureau of Statistics. In the second quarter, growth slowed further to 7.5 percent, the NBS said Monday.

Figures from the NBS show China produced 11,053 tons of iron ore in April, up 5.7 percent year-on-year, with total output during the first four months up 9.9 percent to 39,801 tons.

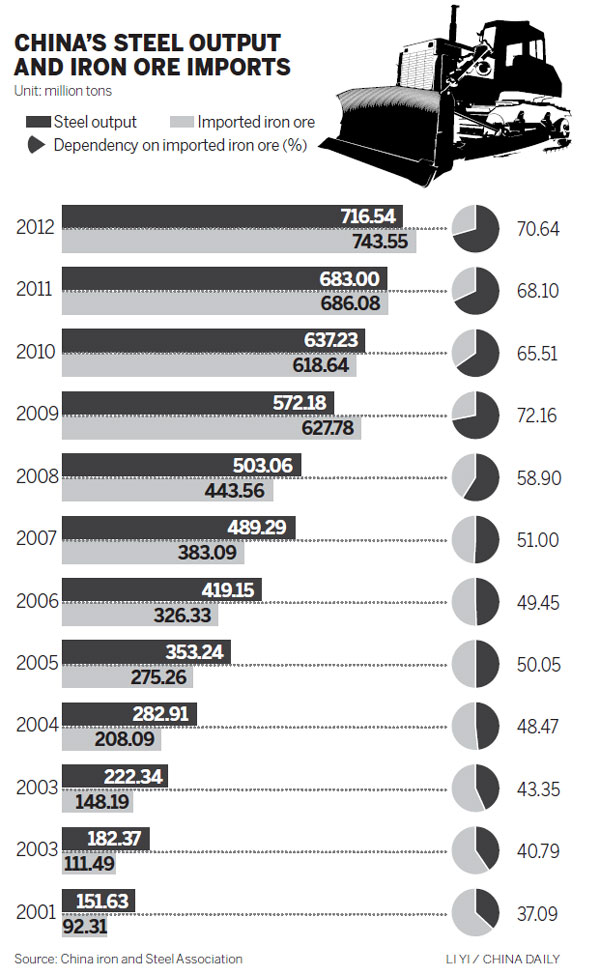

China is the world's top iron ore consumer and buyer, and half of its iron ore consumption must be imported.

It imported 740 million tons of iron ore last year, up 8.4 percent, the General Administration of Customs said.

Analysts said China's macroeconomic situation has affected iron ore imports, and iron ore prices will keep falling.

"Iron ore prices will drop around $5 to $10 a ton in the near future," said Zeng Jiesheng, another senior analyst at Mysteel.com. "There is no sign of a rebound of the macroeconomy and it is not likely that incentive policies can be carried out any soon."

He said domestic steel producers will cut production to survive, which will result in continued price declines for iron ore.

Contact the writers at dujuan@chinadaily.com.cn and zhengjinran@chinadaily.com.cn

(China Daily USA 07/16/2013 page14)

Obama urges restraint amid protests

Obama urges restraint amid protests

Putin wants Snowden to go, but asylum not ruled out

Putin wants Snowden to go, but asylum not ruled out

Apple to probe death of Chinese using charging iPhone

Apple to probe death of Chinese using charging iPhone

Investment falters as industrial activity flags

Investment falters as industrial activity flags

Rape victim's mother wins appeal

Rape victim's mother wins appeal

Reproduction of 'Sunflowers' displayed in HK

Reproduction of 'Sunflowers' displayed in HK

Land Rover enthusiasts tour the world

Land Rover enthusiasts tour the world

US star sprinter fails drug test

US star sprinter fails drug test

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Spain apologizes to Bolivia for plane delay

International cotton contract in the works

Smithfield shareholder still presses for break up

China calls for new talks on Iran nuclear issue

Global warming may largely raises sea level

Putin wants Snowden to go, asylum not ruled out

US: China can balance own growth

Top foreign study destinations for Chinese

US Weekly

|

|