Markets inch up after Fed's testimony

Updated: 2013-07-18 11:09

By Zhang Yuwei in New York (China Daily)

|

||||||||

The US central bank will carry on with its plan to start scaling back its bond-purchasing stimulus program later this year, but not on a fixed schedule, according to Federal Reserve Chairman Ben Bernanke on Wednesday.

"Because our asset purchases depend on economic and financial developments, they are by no means on a preset course," Bernanke said in his prepared semi-annual testimony before the House Financial Services Committee.

"If economic conditions were to improve faster than expected, and inflation appeared to be rising decisively back toward our objective, the pace of asset purchases could be reduced somewhat more quickly," he added.

Markets closed higher on Wednesday with the chairman's remarks indicating that options in tapering the plan were still left open.

With mostly gains in Standard & Poors, the Dow, and Nasdaq, markets in Europe gained on closing and markets in Asia mostly closed higher, except for China's Shanghai Composite Index, which fell 1 percent.

Experts said the markets' calm reaction to Bernanke's remarks was because his testimony contained little "new information". It was, they said, simply a reiteration of his June indication of tapering off the Feds' $85 billion-a-month buying program of Treasury bonds and mortgage-backed securities - the so-called quantitative easing 3, or QE3 - to hold down long-term interest rates and boost the economy.

"QE tapering is still in the cards for later this year, while the Fed is likely to continue to emphasize its 'no rate hike until 2015' forward guidance amid modest-to-moderate economic domestic growth," said Sophii Weng, an economist with Standard Chartered Bank in New York.

Steven Leslie, a financial analyst at the Economist Intelligence Unit in New York, said Bernanke made no shifts in policy or in emphasis on policy - as expected.

The lack of over-explaining his positions has been one of the few weaknesses of an otherwise exemplary central banker, said Leslie.

"The key takeaway here is that the Fed is mulling over a shift away from policies adopted in the financial crisis to return to normal monetary stances in the coming years," said Leslie. "Although the timing is unclear, the economic tailwinds will ebb, interest rates will rise and demand for Treasuries and agency bonds will weaken."

However, a weaker demand in Treasuries doesn't mean investors will stop buying them.

China, the US' biggest creditor, increased its holdings of US Treasury bonds by 2 percent in May to $1.32 trillion, even as foreign demand for the bonds fell for a second consecutive month, according to the Treasury Department.

"They are not a willing buyer," said Leslie. "They have to be a buyer. Bonds come to maturity, so they get cash for them. Even if China was to let its reserves run down a little, it would still have to be buying US Treasuries, as well as other Euro-dominated bonds."

"As the economic recovery and the end of QE3 in the US coincide with the slowing economic activities in China, we see that some international capital flew out of China, which put some pressure on the yuan's depreciation," said Guo Feng, a senior economist with Washington-based Institute of International Finance .

The world's No 2 economy posted a second quarter growth rate of 7.5 percent on Monday.

The International Monetary Fund predicted that China's economic growth will pick up moderately - to 7.75 percent - from the third quarter as the lagged impact of strong growth in total social financing takes hold, in line with a projected mild recovery in the global economy.

The IMF said on Wednesday that growth of 7.75 percent in China this year is possible.

Weng said that with the US maintaining its growth momentum - even with few signs of a synchronized global economic recovery - appears to see further US dollar gains entering the third quarter.

During the question-and-answer session after his testimony, Bernanke said that "markets are beginning to understand" the Fed's plan and the central bank's benchmark short-term interest rate is likely to stay near zero "for the foreseeable future".

"With unemployment still high and declining only gradually, and with inflation running below the committee's longer-run objective, a highly accommodative monetary policy will remain appropriate for the foreseeable future," he said.

"The Fed had gained more confidence in the labor market outlook and expected to begin phasing out asset purchases," said Guo. "But the Fed needs to clarify more information on the timing of QE3 easing to reduce market tensions."

Chen Jia in Beijing contributed to the story.

yuweizhang@chinadailyusa.com

(China Daily USA 07/18/2013 page1)

Detroit files biggest ever US municipal bankruptcy

Detroit files biggest ever US municipal bankruptcy

Plane crash victims' parents seek answers

Plane crash victims' parents seek answers

'Improving' Mandela marks 95th birthday

'Improving' Mandela marks 95th birthday

Qingdao eatery finds use for pesky seaweed

Qingdao eatery finds use for pesky seaweed

From university campus to boot camp

From university campus to boot camp

FIFA head: World Cup in Brazil could be mistake

FIFA head: World Cup in Brazil could be mistake

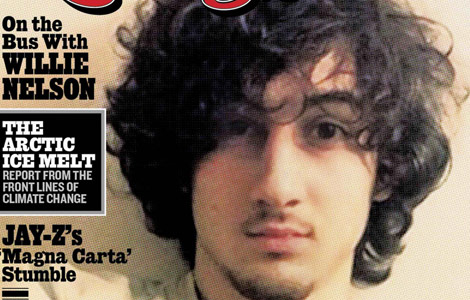

Bomber as rock star? Rolling Stone cover outrage

Bomber as rock star? Rolling Stone cover outrage

German band performs with 3D stage set

German band performs with 3D stage set

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Obama weighs canceling Moscow talks with Putin

Pentagon to field 4,000-person cyber squad

NSA implements new security measures

Detroit files biggest ever US municipal bankruptcy

China's Sansha city dock begins operating

Yuan: Collateral types to expand

Autopsy ordered for Hunan fruit seller

Plane crash victims' parents seek answers

US Weekly

|

|