Monetary system needs overhaul, says report

Updated: 2013-07-19 12:02

By Michael Barris in New York (China Daily)

|

||||||||

The global business community should push government officials and financial institutions to overhaul the international monetary system to assure its stability as the US dollar's dominance erodes and other national currencies come into widespread use, a professor at Toronto's York University says.

Gregory Chin, a political science professor who led the Centre for International Governance Innovation (CIGI) in a study of international monetary reform conducted with two other organizations, said in an interview Thursday that "If you have multiple currencies, but no coordination, it's extremely messy".

A new report released by CIGI, a nonpartisan thinktank on global governance, and its study partners, the Asian Development Bank and the Hong Kong Institute for Monetary Research, sees the US backing away from its four-decade role as a key currency while other nations seek widespread use of their currencies.

The report, Reluctant Monetary Leaders? The New Politics of International Currencies, was written by Eric Helleiner, faculty of arts chair in international political economy and political science professor at the University of Waterloo, Ontario.

Helleiner - who couldn't be reached for comment - writes that the 2007-2008 US financial crisis raised doubts among foreign policy makers on "whether the world is well served by the current dollar-centered international monetary system", giving impetus to China's move to begin promoting the internationalization of the yuan.

Helleiner points out that some experts have speculated that the yuan will replace the dollar as the world's key currency within a decade or so. Other analysts, he says, see the dollar giving way to "a world of several international currencies".

The paper shows that a redrawing of the global currency landscape is "a complex process" and is "not going to happen overnight", Chin said. In addition to suggesting that "we're moving toward a messy scenario", Helleiner's research also suggests the monetary system could eventually see more use of Special Drawing Rights, or SDRs -essentially IOUs that countries can exchange for cash, Chin said.

Helleiner argues that the world could drift toward a "leaderless currency system", as the US, China and other major powers become reluctant to bear the political and financial costs of having a more widely used currency.

For instance, China might have to give up some of the capital controls that have undergirded its financial system for decades to allow for the "freer flow of the yuan as an international currency", Chin said. "It's not clear to what degree the Chinese authorities are willing to make those changes in the overall model," the professor said. "This is where you get into some domestic political economy questions."

"There are probably segments where the financial sector is more interlinked with the global financial flows and where the banks might be linked. But there may be parts of the Chinese banking system that would not favor this much loosening of capital controls.

"We're not clear who the winners and losers are in this process," he said.

For the US, Chin said, the key question is "Can the US afford to continue running these current account deficits which seem to be part of the equation of having an international currency?"

The balance of trade is "in favor of the trading partner - the trading partner that is willing to use the currency of the US," Chin said. "But if the US gets serious about taking on its deficits and its debt, the real question is, unless there is a major spike in US competiveness in trading, can the US continue to bear the costs of providing this global currency?

"When it does make sense for the US to no longer try to pay this absolute role?" he asked. "More research needs to be done on this."

michaelbarris@chinadailyusa.com

(China Daily USA 07/19/2013 page10)

Detroit files biggest ever US municipal bankruptcy

Detroit files biggest ever US municipal bankruptcy

Plane crash victims' parents seek answers

Plane crash victims' parents seek answers

'Improving' Mandela marks 95th birthday

'Improving' Mandela marks 95th birthday

Qingdao eatery finds use for pesky seaweed

Qingdao eatery finds use for pesky seaweed

From university campus to boot camp

From university campus to boot camp

FIFA head: World Cup in Brazil could be mistake

FIFA head: World Cup in Brazil could be mistake

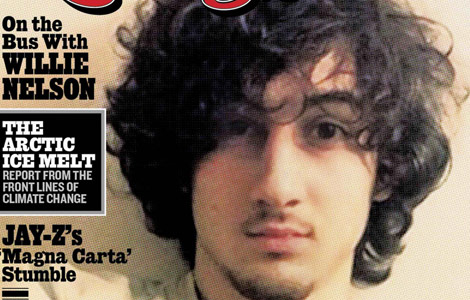

Bomber as rock star? Rolling Stone cover outrage

Bomber as rock star? Rolling Stone cover outrage

German band performs with 3D stage set

German band performs with 3D stage set

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China's government spends less in 2012

Obama weighs canceling Moscow talks with Putin

Pentagon to field 4,000-person cyber squad

NSA implements new security measures

Detroit files biggest ever US municipal bankruptcy

US ready to talk if DPRK 'genuine'

China's Sansha city dock begins operating

Yuan: Collateral types to expand

US Weekly

|

|