Yuan influence on the rise worldwide

Updated: 2013-07-22 08:19

By Wang Xiaotian in Beijing and Singapore, and Li Xiang in Paris (China Daily)

|

||||||||

More nations turn to Chinese currency for investment and trade settlement

Although the money markets have gone into a tizzy recently, there have been some unrelated developments that clearly underscore the growing global influence of China's currency, the yuan also known as renminbi.

Indications that the yuan is well on its way to becoming an "international" currency heightened after important currency trading centers such as Paris, Luxembourg, Frankfurt, Sydney and Dubai expressed interest in becoming offshore yuan-trading centers. Major money markets, including Hong Kong, Taipei, Singapore and London, are already part of the lucrative offshore yuan-trading club.

"There is no doubt that the renminbi is gaining international recognition and that there is demand for it outside the Chinese mainland," says Ravi Menon, managing director of the Monetary Authority of Singapore.

"The expansion of offshore renminbi-funding centers as well as the setting up of swap lines between the People's Bank of China and various central banks, including the latest agreement with the UK, bear evidence to this."

He says a stable and thriving Chinese economy is the best foundation on which to further the use of the yuan globally.

Zhang Lei, general manager of the global payment and clearing division at Bank of China, says: "The internationalization of the yuan has entered a critical period as yuan usage is strengthening in regions outside the Asia-Pacific."

Although there are several contenders, the European cities have the best credentials for bagging yuan deals, he says.

Growing interest

The Frankfurt-based European Central Bank is likely to enter into a swap agreement with the People's Bank of China for as much as 800 billion yuan ($130 billion), Bloomberg reported earlier this month, citing prominent lobby group Frankfurt Main Finance.

The deal, four times the 200-billion-yuan agreement signed in June between the Bank of England and PBOC, is expected to give central banks from the eurozone access to yuan funds.

"One of the major themes of the current negotiation is whether it should be mandatory for all members of the eurozone or it is only on a volunteer basis," says Philippe Mongars, deputy director of the market operation department at the Bank of France.

French President Francois Hollande said earlier that the Bank of France and the PBOC will soon reach a deal over a currency swap agreement within the framework of the ECB.

Nearly 10 percent of the commercial transactions between China and France are currently settled in yuan. Banking deposits in yuan in Paris have amounted to about 10 billion, the second largest pool of such deposits in Europe, according to Paris Europlace, a professional association that supports the French financial industry and promotes Paris as an international financial center.

Zhang, however, feels the eagerness and readiness of Luxemburg is more obvious because it appointed BOC as the first yuan-clearing bank in the country as early as July.

Luxemburg, the world's eighth largest financial investment center and Europe's biggest fund management center, had secured yuan deposits of 20 billion yuan by January, the highest in the eurozone. Yuan loans extended in Luxemburg reached 30 billion, while local fund industries manage yuan assets of 200 billion.

The largest offshore yuan center, Hong Kong, which accounts for 70 percent of overseas yuan deposits, held deposits of 698.5 billion yuan by May, according to data released by Hong Kong Monetary Authority.

"In financial terms, Luxembourg is even more important than Paris or London," says Nicolas Mackel, chief executive of Luxembourg for Finance, an agency that promotes Luxembourg as an international financial center. "We consider ourselves as a European hub especially in financial services. We don't do trading financing in that sense. But there are other services relating to renminbi that we could focus on."

More than half of Chinese investment in Europe gets structured through Luxembourg. The increasing presence of Chinese banks will also give his country an edge, Mackel says.

Luxembourg is already the European headquarters of BOC and Industrial and Commercial Bank of China.

China's Construction Bank, the second-largest Chinese lender, will soon open its European headquarters there.

Joachim Nagel, member of the executive board of the Deutsche Bundesbank, says the strong trading position between Germany and China has generated enough momentum for setting up an offshore yuan-trading center in Frankfurt.

"I believe the renminbi will develop into a global reserve currency. There is intense competition in the financial world for being a part of the renminbi trading system," says Nagel.

He says the biggest challenge for contenders such as Germany would be to initially maintain a certain amount of liquidity in Frankfurt. Major multinational companies and banks could be the "ice breaker" by bringing in the desired volumes through yuan trading.

"The renminbi is a big currency and will play a bigger role in the future in the international market. I think the market is big enough to have multiple yuan-trading centers in Europe," Nagel says.

Mongars, of the Bank of France, feels that there would not be too much competition among the major European financial centers, because the currency swap deal will serve as a back-up facility when there is a serious liquidity shortage of the yuan in the eurozone, and also negates the need for an alternative funding source.

Wim Raymaekers, head of the banking market at the Society for Worldwide Interbank Financial Telecommunication, says financial institutions in the UK, France and Germany are increasingly adopting the yuan to support trade settlement by their corporate customers.

Outside Europe, Dubai is likely to become another major offshore yuan-trading center after Taipei as it refocuses on its roles as a regional hub for trading, logistics and tourism, says a recent report published by Standard Chartered Bank.

Financial institutions in Dubai have been actively participating in yuan deals, facilitated by the 35-billion-yuan currency swap agreement signed last year between China and the United Arab Emirates. The Dubai International Financial Centre has already introduced a payment system to allow clearing and settlement in the yuan.

Peter Sun, managing director for transaction banking, Africa, at Standard Chartered, says the chances of establishing an offshore yuan center in Africa are also high. Mauritius, with a free flow of dollars and trading with other African countries, is becoming a new regional treasury center, and companies in Africa are moving there from the traditional locations such as London and Dubai, he says.

Menon, of the monetary Authority of Singapore, says: "As the use of the renminbi expands over time in the region and beyond, there will be room for more than one offshore renminbi center. Each will have its own niche and strength."

They will also play complementary roles in developing the offshore yuan market, Menon adds.

For instance, "offshore renminbi liquidity in Singapore should be fungible with renminbi liquidity in other offshore centers. This will help ensure that surplus liquidity in one center can be channeled to meet the demands in another, thereby improving the efficiency of the overall renminbi market," he says.

Guo Tianyong, a professor at the Central University of Finance and Economics in China, says: "Major cities around the world have become increasingly vocal on opportunities from yuan business in the past few months. The recognition and acceptance of the yuan is very encouraging if we realize that internationalization of the currency is just a three-year baby."

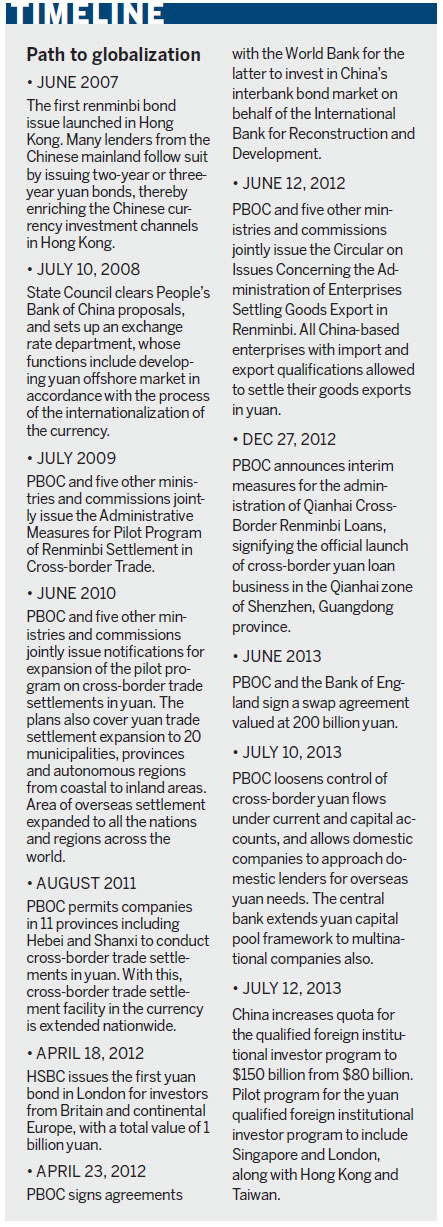

In 2010, Beijing launched its ambitious project to float the yuan globally by allowing companies worldwide to settle their international trade in the Chinese currency.

Despite the increase of yuan centers worldwide, the dominance of Hong Kong won't be threatened, as the biggest proportion of yuan flows are still conducted through the special administrative region of China, says Piyush Gupta, chief executive officer of DBS Bank Ltd, Singapore's largest commercial bank.

George Chin, a professor at York University in Toronto, says central banks, governments and private investors are seeking alternative foreign exchange reserves and investment options. For traders, there are real cost efficiencies to be gained by shifting to yuan settlement.

Raymaekers says the internationalization of the yuan will continue to increase in the near future, albeit with some volatility.

"Based on payment transactions going over SWIFT in June 2013, we see that the yuan again rose up the ranks versus other global currencies and may actually join the list of top 10 currencies soon."

The Chinese currency is ranked 13th globally among world payment currencies, up from 20th in January 2012.

Asian advantage

An index compiled by Standard Chartered that tracks the progress of the yuan business breached 1,000 points for the first time in May.

The index, which started on Dec 31, 2010, at 100 points, tracks yuan activity in Hong Kong, Singapore and London.

The lender, however, indicated that overseas activities of the Chinese currency might soften in the second half, because yuan current account inflows into offshore markets ease because of the pauses in onshore yuan appreciation.

According to a survey conducted by BOC in June, nearly 80 percent of its 3,000 clients said they use the yuan because they have trade relations with the Chinese mainland and would like to settle transactions in the currency, while most of the overseas clients ranked stability of the yuan exchange rate as the top factor in choosing to use the Chinese currency.

"Hong Kong and Singapore have yuan clearing banks and are key centers for fostering yuan-based trade settlement and investment services," says Chin of York University.

Taiwan is also catching up fast. In February, Taipei became the fourth-largest offshore center for yuan settlement, behind Hong Kong, London and Singapore, up from seventh place in August 2012.

Yuan payments also accounted for 12 percent of Taiwan's bilateral trade with the Chinese mainland in March 2013.

"Taiwan's offshore market is developing quickly. Deposits are already at 66 billion yuan and we expect them to rise to 100 to 150 billion yuan by year-end," says the Standard Chartered Bank report.

There are, however, limits to how far the yuan can be internationalized through offshore channels, or via limited offshore-onshore options, Chin says. "China should not be hasty in appointing clearing banks in offshore sites."

The BOC survey also showed that 90 percent of the total yuan settlements were related to companies located on the mainland, or firms with a mainland background.

"That means only 10 percent of the yuan settlements happen between the overseas third parties, among which most are companies from Hong Kong and Macao," says Cheng Jun, general manager of the Corporate Banking Unit at BOC.

Mark Boleat, policy chairman of the City of London Corp, which oversees the running of London's business district, says that opening up the capital account and making the yuan fully convertible is a must for a prosperous offshore market. He says the quotas for the yuan qualified foreign institutional investor program (RQFII) need to be further extended to promote offshore-onshore circulation of the currency.

China on July 12 announced an expansion in the quota for QFIIs to $150 billion from $80 billion. It said the pilot program for RQFII will now include Singapore and London, with Hong Kong and Taipei already having joined the plan. The RQFII quota was set at 270 billion yuan in November last year.

The PBOC also announced on July 10 a set of measures to loosen controls on cross-border yuan flows under both the current and capital accounts. According to the new rules, domestic firms can apply to domestic banks to disburse the yuan overseas, while multinational companies can utilize a yuan capital pool framework to do the same.

Zhang Weiwu, general manager of the Industrial and Commercial Bank of China's Singapore branch, says the fact that the yuan is not yet fully convertible determines that apart from the naturally breeding market demand, banks' product innovation and guidance to the clients will play a substantial role in promoting wider acceptance of the currency. Foreign banks also have an edge as they have a strong local customer base in offshore markets, rich trading expertise and experience.

"In addition, they can contribute more to the innovation of the yuan-investment products," says Fang Wenjian, CEO of Bank of China (UK) Ltd.

The role of Chinese banks and that of international financial institutions will be more complementary than competitive, Fang says.

Zhang Chunyan in London and Zhang Yuwei in New York contributed to this story.

Contact the writers through wangxiaotian@chinadaily.com.cn

(China Daily USA 07/17/2013 page13)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Knife attack injures 4 in Beijing

Yuan gains 34% against USD in past 8 years

Live Report: 47 dead, 296 injured in earthquake

Hard landing of China economy no topic at G20

US Navy drops bombs on Australia's reef

Woman jailed in Dubai after reporting rape

Guangdong to probe airport bomber's allegations

Police meets GSK representative after scandal

US Weekly

|

|