CMOC buys stake in Rio Tinto gold, copper mine

Updated: 2013-07-30 08:11

By Zhong Nan (China Daily)

|

||||||||

|

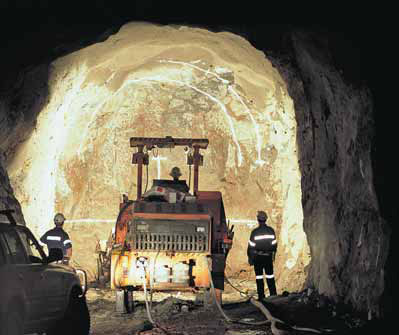

A mobile drill rig digs a tunnel at the Northparkes copper and gold mine owned by Rio Tinto Group in Australia. The group has reached a binding agreement to sell its 80 percent stake in Northparkes to China Molybdenum Co Ltd. Provided to China Daily |

The $820m deal is expected to be completed by the end of this year

Rio Tinto Group has reached a binding agreement to sell its 80 percent stake in Northparkes, a copper and gold mine in Australia's New South Wales, to China Molybdenum Co Ltd for $820 million.

The Chinese company is the world's fourth-largest molybdenum and second-largest tungsten concentrate producer.

"The sale of Northparkes represents great value for our shareholders and demonstrates our continued focus and discipline in the way we allocate capital across the group," said Chris Lynch, Rio Tinto's chief financial officer, in a statement on Monday.

Lynch said that Northparkes is a successful business but is not of sufficient size to be a good fit with Rio Tinto's strategy. The Anglo-Australian mining giant will continue to manage Northparkes as to safety and environmental standards during the transition to the new Chinese owner. The deal is expected to be completed by the end of 2013.

CMOC is primarily engaged in the mining and processing, smelting, downstream processing, trading and research and development of molybdenum, tungsten and other metals.

The Chinese company's last asset purchase was in 2008, when it paid $45 million for three gold mines in China.

"The agreed sale of Northparkes follows our recently completed divestment of the Eagle nickel project in the United States, while the Palabora sale is now unconditional and expected to close on July 31," Lynch said.

The sale is subject to Rio Tinto's joint venture partners, Sumitomo Metal Mining and Sumitomo Corp Mineral Resources, waiving or failing to exercise their pre-emption rights under the terms of the Northparkes joint venture agreement.

Ding Rijia, a professor at the China University of Mining and Technology in Beijing, said that because falling global commodity prices had started to squeeze the revenues of the world's mining sector, giant mining corporations such as Rio Tinto, BHP Billiton Ltd and European Goldfields Ltd were aiming to improve the operational efficiency of existing projects and reduce costs through the disposal of non-core assets.

"This transaction could be another major purchase by a Chinese company of an overseas mining asset this year. CMOC will be able to control an operation that provided 43,100 metric tons of mined copper for Rio Tinto in 2012, as well as an underground training facility," Ding said.

The sale is also conditional upon customary regulatory approvals and the approval of CMOC shareholders.

Rio Tinto has received binding commitments from the two major CMOC shareholders, which together own 69 percent of CMOC's shares, to support this transaction, which is sufficient for the relevant shareholder resolutions to be passed.

Lin Boqiang, director of the China Center for Energy Economic Research at Xiamen University in Fujian province, said the deal price is better than industrial analysts had forecast but was near the level Rio Tinto had been holding out for.

The 80 percent stake in Northparkes is one of several assets Rio Tinto has put up for sale as it aims to focus on its biggest, most profitable mines.

China has been active in buying foreign mining assets in recent years. The purchases have been driven by the long-term need for resource security and by relatively low values for foreign mining assets since the end of 2009, a result of weak global economic conditions.

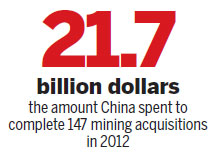

In 2012, the country spent $21.7 billion to complete 147 mining acquisitions, ranking it the world's biggest buyer of mining assets. At a total cost of $7.1 billion, Chinese companies have announced 67 mining transactions so far this year, according to the China Chamber of International Commerce in Beijing.

"However, Chinese companies must be acutely aware that the majority of overseas mergers and acquisitions of mining assets are completed in the international capital markets and foreign mining companies' stock prices won't fall within a short period," Lin said. "This indicates that Chinese buyers may have to spend more to complete the acquisition of these shares."

Lin said based on current global market demand, M&A in the mining industry will continue to soar in the second half of this year. Countries such as China and India will continue to buy or invest in gold, coal, copper, iron ore and other mineral assets throughout the world.

zhongnan@chinadaily.com.cn

(China Daily USA 07/30/2013 page16)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China-US talks yield 'incremental progress'

Spain investigators: Train driver was on phone

Apple faces more staff abuse charges

Spending surge for renewables

Beijing and Canberra to resume trade talks

Top leader vows to meet growth target

2,290 disciplined for extravagance

Japan diplomat seeks to mend ties

US Weekly

|

|