The real cost of healthcare

Updated: 2013-08-01 08:00

By Liu Jie (China Daily)

|

||||||||

|

China's pharmaceutical sales amounted to 600 billion yuan ($97.7 billion) last year, with average annual growth exceeding 20 percent over the last five years, compared with 0.3 percent in developed markets, according to IMS Health Inc. Provided to China Daily |

Investigations are under way into the drug industry amid reforms

A series of investigations into allegedly corrupt practices by multinational drugmakers and the high cost of medicine in China have aroused concern among international companies on how to do business in the nation amid an overhaul of the market.

Putting an end to unethical business behavior and discovering what the fundamental reasons are for high pharmaceutical prices in China and who, if anyone, should be punished have created controversy among experts and insiders.

Business rules

The Chinese government initiated an anti-corruption campaign in the medical sector in early July following an investigation into the United Kingdom's GlaxoSmithKline Plc that suggested the company was involved in bribery and fixing the price of drugs.

So far, local industry and trade officials or police have visited the Chinese offices of the Belgium-based drugmaker UCB SA, the UK's AstraZeneca Plc and the Japanese pharmaceutical company Astellas Pharma Inc.

Insiders believe the investigations currently targeted at foreign pharmaceutical companies in China will be further expanded.

"It demonstrates the central government's determination to sort out the sector in which commercial bribery is commonplace and lower unreasonable drug costs caused by corruption," said Li Ling, professor of the China Center for Economic Research at Peking University.

GSK, UCB and AstraZeneca all said they fully support the Chinese government's anti-corruption drive and will fully cooperate with the investigation.

The anti-corruption probe will probably hurt GSK's sales in China, said Andrew Witty, the company's chief executive officer, in a statement on Wednesday, adding: "It's too early to say what the impact will be."

"In general, multinational drugmakers' profits in China may decline because companies are likely to cut prices of some products to show goodwill to the government and the public. An overhaul in the distribution and purchasing channels is expected," said Guo Fanli, an analyst with China Investment Consulting Co Ltd.

Meanwhile, some multinational drugmakers are asking, "Why us?"

"We know we are not innocent. It is a common practice in this sector in China. Why are Chinese companies not being included in the crackdown?" asked a sales manager at Roche AG China, who declined to be identified.

A senior executive with one of the top 10 international drugmakers in China, who asked to remain anonymous, said that it is a real dilemma. "We have ambitious investment plans in China, but now we have to be very cautious," he said. "We treasure the opportunities here, but there must be fair treatment."

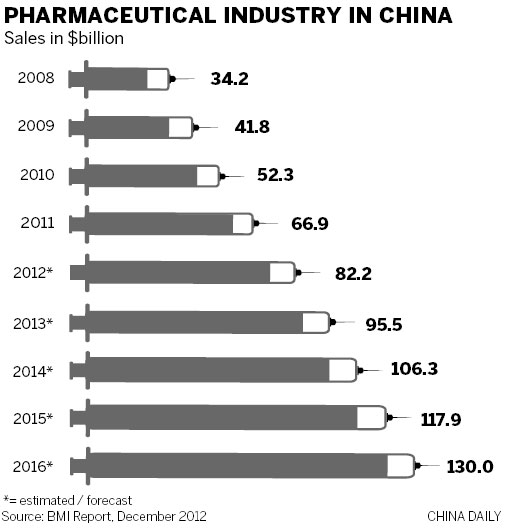

Statistics from international healthcare market research company IMS Health Inc show that China's pharmaceutical sales amounted to 600 billion yuan ($97.7 billion) last year, with average annual growth exceeding 20 percent over the last five years, compared with 0.3 percent in developed markets, such as the United States and Europe.

Multinational drugmakers have been enjoying double-digit growth in China for more than a decade, while their performance in developed economies was flat or even fell following the global financial crisis in 2008.

"The transnationals cannot give up the market. They have enjoyed preferential treatment for many years. Now they have to rethink their strategies because the market is becoming sophisticated," said Liu Junhai, director of the Commerce Law Research Institute at Renmin University.

Responding to the probe into GSK, Shen Danyang, spokesman for China's Ministry of Commerce, said in mid-July that China has not changed and will not change its active policies on the introduction of foreign capital. Investigations in line with the law are further witness to the Chinese government's determination to improve and optimize the investment environment and create fair and equal competition opportunities for investors from various countries and regions.

By the end of last year, China had become the world's No 1 foreign direct investment destination for 20 consecutive years, said the ministry.

The anti-corruption probe in the medical sector might be regarded as one of several examples indicating the Chinese government will regulate and standardize multinational companies' business practices.

Other cases include an antitrust probe into Sweden's food processing and packaging giant Tetra Pak International SA and a monopoly pricing investigation over infant formula by Switzerland-based Nestle SA's Wyeth, Mead Johnson Nutrition Co and Abbott Laboratories, which were all launched in July.

China also fined six overseas liquid crystal display makers, including Samsung Group, a record $56 million for price fixing.

"The moves sent a signal to multinational companies that China is regulating its business environment to provide fair competition and cracking down on all kinds of malpractices," said Liu.

Further reform

The nation is undergoing a huge medical reform to provide universal care for its 1.3 billion population. Both President Xi Jinping and Premier Li Keqiang reiterated during government conferences and meetings that affordable healthcare is a key part of the Party's and the government's agenda. To achieve overall medical care coverage, cutting medicine prices to reduce medical costs is a core issue.

China's graft-to-collusion crackdown and pricing investigation in the medical sector cover not only foreign companies but also Chinese businesses, Guo said.

In early July, the National Development and Reform Commission asked 60 drugmakers, including 27 foreign multinationals - among them Boehringer-Ingelheim Pharmaceuticals Inc, GSK, Baxter Inc and MSD - as well as domestic companies, including more than 10 listed drugmakers, to submit their cost and pricing files for review.

The commission said it was a routine cost and price data collection task and has been practiced on a random basis for many years.

"But this year it's different. The commission is taking real action," said the vice-president of a Shanghai-listed Chinese biopharmaceutical company, speaking anonymously. He is responsible for the daily operations of a Jiangsu-based drugmaker.

The commission, China's economic planner and price supervisor, has urged and forced drugmakers to cut prices of prescribed medicines several times, without noticeable results.

"The government is putting pressure on drugmakers to lower prices. Foreign companies should be the first to bear the brunt because many of their medicines are self-developed and have higher prices compared with Chinese companies," said Li.

Many multinational drugmakers claim research and development costs - usually taking 10 years and costing $1 billion for the development of a new medicine - should be taken into account when setting prices. Appropriate returns enable them to continue investing in their current portfolio of medicines and the next generation of breakthrough innovations, they said.

"However, many medicines have or are about to lose their patents, so the excuse is not strong enough to support higher prices," said the vice-president of the Shanghai-listed Chinese company.

Anti-corruption efforts and pressure to cut prices cannot solve fundamental problems unless China deepens its medical reforms and changes the way its medical industry operates, said Guo.

The sales manager at Roche said bribing people who are responsible for bidding for products on China's essential drug list and national reimbursement drug list, drug pricing and hospital purchasing and offering kickbacks to doctors to prescribe a particular drug have increased medical costs.

It is a widely known secret in China's medical sector. Both multinational and domestic companies indulge in the practice.

"We are not the fundamental cause (of the high prices). Is it fair to label these people as immoral and punish them?" he asked.

The National Health and Family Planning Commission and the National Development and Reform Commission pledged to set up a new medical care system to replace the current one in which hospitals mainly depend on medicine sales to pay for operational costs and development.

Separating medical care services and drug sales is essential. It will result in the separation of service providers, and medicine purchasers and drugmakers, thereby avoiding any risk of collusion and disconnecting interests between parties.

Liu from Renmin University of China said the reform commission has the last say on pricing, but being the price supervisor has its own problems.

"Anti-corruption efforts should be strengthened at the government level. Administration and executive responsibilities should be clearly identified among various government bodies," he added.

The Chinese government reiterated its determination to fight graft and severely punished some guilty officials this year.

"The market is turning more and more transparent and becoming standardized. I believe it's a good thing for multinational companies in China," said Liu.

liujie@chinadaily.com.cn

(China Daily USA 08/01/2013 page16)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

7.5% GDP growth 'in reach' this year

Surveillance plan files declassified

Xi vows to protect maritime interests

Snowden's father thankful to Putin

UN to probe alleged Syria chemical attacks

Saudi blogger faces lashes for 'insulting Islam'

Memorial a tribute to WWII 'comfort women'

Hollywood unpaid for movies

US Weekly

|

|