Export rebound in US 'no big threat'

Updated: 2013-08-22 11:09

By Yao Jing (China Daily)

|

||||||||

The resurgent competitiveness of US manufacturers appears to bolster that nation's position in the global export market and may reshape the world's trade map.

That is the view of a global consulting group. But experts said the strength of Chinese manufacturing exports is not necessarily being damaged despite the US' shrinking trade deficit on factory goods.

US exports have been growing more than seven times faster than the nation's gross domestic product since 2005. Exports are at their highest point in 50 years, according to a report by the Boston Consulting Group released on Wednesday.

The report suggests the US is steadily becoming one of the lowest-cost countries for manufacturing in the developed world, driven by the price of labor, natural gas and electricity.

BCG projects the US, as a result of its increasing competitiveness in manufacturing, will capture $70 billion to $115 billion in annual exports from other nations by the end of the decade.

By 2020, higher US exports, combined with production work that will likely be "reshored" from China, could create 2.5 million to 5 million US factory and service jobs associated with increased manufacturing, said the report.

Currently, China's once overwhelming production-cost advantage is eroding because of higher wages and other factors behind the slower economic growth.

However, it questions whether the reviving US manufacturing will dominate the manufacturing powerhouse China represents and change the China-US trade relationship in a short time.

The total China-US trade rose 5.6 percent to $244 billion in the first half of this year. China imports from the US amounted to $75.75 billion, up 15 percent from the same period in 2012, while China exports to the US were $168 billion, an increase of 1.8 percent, according to the Ministry of Commerce.

China's trade surplus with the US declined 7 percent in the period compared with the first half of 2012.

Nonetheless, for the past several years, the US trade deficit with China has been significantly larger than that of any other US trading partner or trading group, according to a report released by the US Congressional Research Service.

Major US exports to China include oilseeds and grains, waste and scrap, aerospace products and parts, as well as motor vehicles. Top US imports from China are computer equipment, communications equipment, miscellaneous manufactured commodities and apparel, according to the Congressional Research Service.

The US export surge will be felt across a wide range of US industries. The most profound impact will likely be on industrial groups that account for the bulk of global trade, such as transportation equipment, chemicals, machinery and computer and electronic products, BCG said.

When it comes to the emergence of a challenger for China exporters, experts said the backflow into US manufacturing is limited in several sectors. To further boost Chinese manufacturers, they have to continue improving their innovative capabilities to lower costs and build brands.

"The US transportation equipment, machinery, computer and electronic products are mainly exported to European countries and Japan, not China," said He Weiwen, co-director of the China-US/European Union Study Center at the China Association of International Trade.

"The US manufacturing industry has been recovering in recent years because of its economic improvement and the changes in the global industrial chain division. But it will not threaten China's exports in terms of labor intensive industry, such as textiles and furniture," said He.

As for communications equipment, some companies may move their manufacturing plants back to the US. "But this is only a part of Chinese exports to the US," said He.

Further, betting on the promising Chinese market, companies will choose to locate their plants in China and invest more in China, added He.

Wang Li, an expert at the Chinese Academy of International Trade and Economic Cooperation, a government think tank, said: "Although the trading figures between the two countries may fluctuate, there will be only a little change in the bilateral trading relationship. The declining China trade surplus with the US recently is mainly because of the appreciation of the yuan and the weaker dollar. Right now, the US is attracting foreign investment and manufacturing is consequently pulled up, but not many companies will rush back into the US now."

However, it is a fact that some companies used to expanding manufacturing in China are transferring to neighboring countries, such as Vietnam and Myanmar, to reduce their expenditure because China has lost the advantage of low production costs.

yaojing@chinadaily.com.cn

(China Daily USA 08/22/2013 page1)

Confronting 'Chinaphobia' challenge

Confronting 'Chinaphobia' challenge

Draft moots cut in homework

Draft moots cut in homework

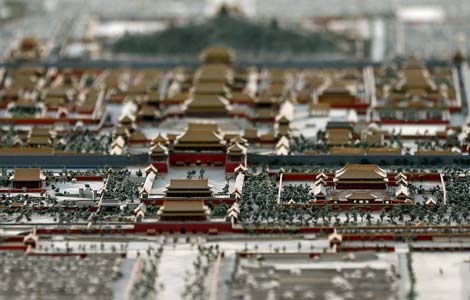

Model gives glimpse of old Beijing

Model gives glimpse of old Beijing

Chengdu visa-free policy to lure more tourists

Chengdu visa-free policy to lure more tourists

Manning gets 35 years in WikiLeaks trial

Manning gets 35 years in WikiLeaks trial

At least 37 killed in Malaysian bus crash

At least 37 killed in Malaysian bus crash

FM calls for closer Cambodia relations

FM calls for closer Cambodia relations Problems for rural kids in cities

Problems for rural kids in cities

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US senator McCain's comments draw fire

Chinese scientists asked to improve toilet

Experts say police need guns on patrol

German mitten crabs not 'qualified for import'

Chinese netizens debate upping retirement age

Bo Xilai denies charges of bribery

Nasdaq resumes stock trading

NZ committed to food security

US Weekly

|

|