Grim picture for pocket cameras

Updated: 2013-08-23 07:48

By Gao Yuan (China Daily)

|

||||||||

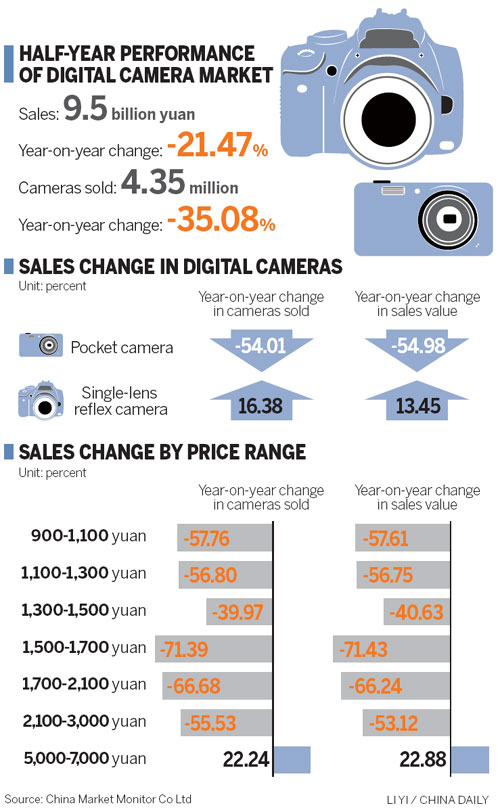

First-half digital camera sales in China plunged by more than one-third, the sharpest fall-off ever, as people increasingly turned to smartphones equipped with high-definition cameras, analysts said.

Fewer than 4.4 million digital cameras were sold during the first six months, a slump of 35.08 percent year-on-year, according to industry watcher China Market Monitor Co Ltd.

Industry revenue fell more than 20 percent to 9.5 billion yuan ($1.6 billion), it added.

"The downtrend in the digital camera market is unstoppable," said Zuo Yanque, brand director of CMM.

Zuo said lower-end cameras can't stand up to smartphones, which come with powerful photography tools that can essentially replace digital cameras.

"There is no need to bring along a camera if your mobile phone can take pictures of similar quality," he said.

Smartphones' strong social-media functions, which allow their users to access micro blogs and share online content instantly, give those devices yet another edge.

CMM's researchers found that sales of low- and middle-range cameras, priced below 3,000 yuan, declined the most.

"Sales of digital cameras are poised to decline by 20 percent to 30 percent annually in the coming years," said Zuo.

In contrast, smartphone shipments in China are set to witness a "sharp increase" in 2013, powered by constant hardware updates and an expanding user base, according to United States-based consultancy IDC.

Mainland smartphone shipments are on track to exceed 460 million by 2017, with a market scale of 740.5 billion yuan.

China's first-quarter smartphone shipments totaled 78 million units, up nearly 120 percent from a year earlier, said IDC.

"I use my iPhone to take photos because it's more convenient and easy to share online," said Nie Miao, a landscape architect living in Chengdu, Sichuan province.

He said he isn't interested in buying a pocket camera himself, but he does plan to purchase a pair of new lenses for his father, who owns an 8,000-yuan single-lens reflex camera.

"A single-lens reflex camera is a must for the modern Chinese family, but cheap pocket cameras are just teens' toys," Nie said.

As overall sales stagnate, camera producers are looking at the high-end market.

High-end models costing about 7,000 yuan enjoyed an impressive 22 percent jump in first-half sales, said CMM. It said that single-lens reflex cameras, a major high-end camera category, accounted for a little more than 17 percent of the sales.

"Looking forward, digital camera giants are likely to set their sights on enterprise-level markets such as the medical industry to offset the decline in the consumer sector," said Zuo.

China's digital camera market was dominated by overseas brands. Top vendors included Canon Inc, Sony Corp and Nikon Corp, as well as South Korean Samsung Electronics Co Ltd.

Samsung said it is focusing on miniature single-lens reflex cameras, an entry-level product in the high-end market.

Canon, which declined to comment specifically on the CMM report, said it plans to lift China sales to $10 billion by the end of 2017, fueled by strong demand for top-end single-lens reflex cameras.

Ren Pengfei contributed to this story.

gaoyuan@chinadaily.com.cn

(China Daily USA 08/23/2013 page17)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

McCain comments about Diaoyu draw fire

Chinese scientists asked to improve toilet

Bo Xilai denies bribery charges

Experts say police need guns on patrol

Nasdaq resumes stock trading

German mitten crabs not 'qualified for import'

Chinese netizens debate upping retirement age

Egypt's Mubarak leaves prison

US Weekly

|

|