Alipay to launch wallet app upgrade next month

Updated: 2013-10-17 07:12

By He Wei in Hangzhou (China Daily USA)

|

||||||||

Alibaba Group Holding Ltd's Alipay - China's largest e-payments company - will launch a new version of its wallet mobile app in November that will allow offline transactions via sound wave technology.

The upgrade, along with other new features, will consolidate its already solid position in the mobile payment market, enhance online-to-offline payment solutions and fend off rivals such as WeChat, industry observers said.

Alipay's Wallet 7.6 will enable the transfer of funds even when users don't have access to the Web, moving beyond barcode or QR code recognition, said Fan Zhiming, the president of Alibaba's small and micro financial services unit.

Sound wave payment technology uses the white noise generated by smartphones to transfer digital information to other Alipay Wallet-equipped devices in the vicinity, Fan said.

The mobile app will also allow inquiries and payments of public utility fees if users log on to their Alipay accounts, after the firm teamed up with the country's three telecom carriers and more than 10 banks to provide real-time information and online business processing.

The wallet-like experience allows people to electronically store and manage credit cards, gift cards and discount coupons. The improved digital wallet app also aims to facilitate the recharging process of campus cards, said Fan. The company plans to cover China's more than 2,100 universities and colleges by the middle of next year.

Alipay has shaken up the country's financial sector by partnering with more than 100 banks and financial institutions to allow inter-bank transactions free of charge. Cross-bank transfers often impose hefty service fees, sparking concern among bank customers.

Currently, some 200 banks and 400,000 e-commerce vendors or online units of brick-and-mortar stores accept Alipay as an online payment channel.

Data from Alipay suggests the company is also making a dent on the mobile front, as a striking 82 percent of all Alipay users inject money into their virtual accounts via portable devices.

An average of 25,000 customers use Alipay's wireless payment services every minute. Installations of the mobile app are 2.5 times higher than those on desktop computers, with the amount of transfers 1.5 times higher.

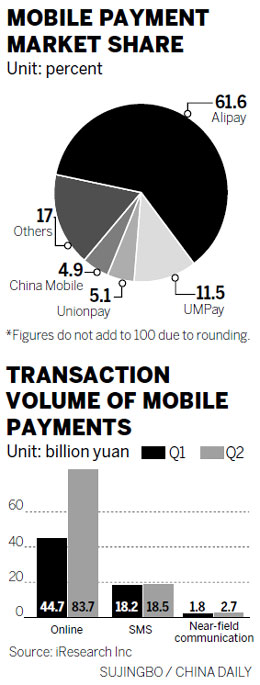

But even as the platform firmly accounts for three-quarters of the country's wireless payment market - according to consultancy iResearch Inc - more firepower is being given to Alipay's "going mobile" strategy as the firm is being challenged by Alibaba's archrivals such as Tencent Holdings Ltd.

In August, Tencent released the latest version of WeChat, a popular social networking mobile app, to include payment integration functions, empowering its more than 300 million users to make purchases on several e-commerce platforms.

Lu Zhenwang, an independent Internet analyst and the chief executive officer of Shanghai-based Wanqing Consultancy, said that WeChat's payment function is a "game changer", in that it largely combines online and offline businesses by using the phone rather than a personal computer.

Therefore, the introduction of sound wave technology by Alipay is largely a symbolic move that aims to differentiate itself from WeChat, which features barcode scanning, said Sun Hongchao, an IT columnist at NetEase Inc, a leading Internet portal in China.

"While it's becoming a trend that companies are joining the ranks of Internet businesses and rolling out solutions to allow customers to buy goods and services in shops using their smartphones, the variety of payment solutions being introduced is making consumers and merchants alike perplexed," said Sun.

He pointed out examples such as near-field communication, or NFC, technology, face-recognition software and proprietary hardware that plugs into devices, each falling into a different technological category. He called for a unified standard to allow a quicker and seamless adoption of online-to-offline payments.

hewei@chinadaily.com.cn

(China Daily USA 10/17/2013 page15)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US Congress ends debt impasse, Obama to sign bill

Facebook goes fishing in China

Michigan auto czar leading trade trip to China

Deal reached to avoid US default and open govt

Yuan gains the most in 20 years

Tibet avalanche claims 4

First interprovince subway route opens

US expert finds job 'rewarding'

US Weekly

|

|