China is reaching its tipping point

Updated: 2013-10-21 07:06

By Alfred Romann in Hong Kong (China Daily USA)

|

||||||||

Big change is coming to the nation's way of doing business this century

The weekend of Sept 21 was a busy one in Qingdao, in China's eastern Shandong province. The seaside town known for its beaches, beer and fish hosted some of the most famous actors in the world.

Leonardo DiCaprio and Nicole Kidman were there. So were Ewan McGregor, John Travolta, Zhang Ziyi, Jet Li and Tony Leung. They were mostly for decoration. The star of the show was really Wang Jianlin, who has become the richest man in China thanks to his Dalian Wanda group, a real estate and entertainment conglomerate.

Wang brought these celebrities to the party to announce an $8 billion mega studio and theme park in this city. If it comes to pass, the tentatively named Qingdao Oriental Movie Metropolis and its 100 film studios and theme park will add significantly to the service column in China's GDP calculation.

The government is keen to expand the service sector in the economy because it would mean less reliance on manufacturing for growth. At the same time, more expenditure on this sector would signal that the Chinese have stepped up to the plate.

"The service sector is not mature compared with the industrial sector," says Zhao Hong, a researcher at the East Asian Institute of the National University of Singapore. "It is still small but has potential because China is adjusting its economic structure."

This year could be a turning point in the development of the Chinese economy. For the first time in recent history, the service sector could overtake industry in its contribution to the economy. In 2012, services accounted for 44.6 percent of China's GDP while industry was responsible for 45.3 percent. Numbers for 2013 are not out yet, but services have been growing faster than industrial production.

GDP is made up of the value of all goods and services produced in an economy. In simple terms, it is measured by adding consumption, investment, government purchases and net exports. The consumption category is further divided into goods and services.

Services include products such as insurance, healthcare and tourism. A typical tourist on a trip during the holiday week at the beginning of October could have bought airline or train tickets and hotel rooms - all services.

About a week after Wang Jianlin's party in Qingdao, on Sept 29, the Shanghai free trade zone (FTZ) was officially launched in much more subdued fashion. In an area of 28 square kilometers, the government plans to allow for full convertibility of the yuan, freer flow of capital, and banks that qualify will be allowed to do offshore business.

Companies will be allowed to import goods directly into the zone before going through customs. In theory, both domestic and foreign companies will be allowed to invest in banks, shipping companies, entertainment services, schools, health and insurers that operate in the zone, even if there are more than 1,000 areas that still remain off-limits to investors. As in Qingdao, the FTZ could add to the services column.

More than signifying a continuous rebound in economic activity, increasing non-manufacturing activity underscores the government's efforts to change the structure of the country's economy.

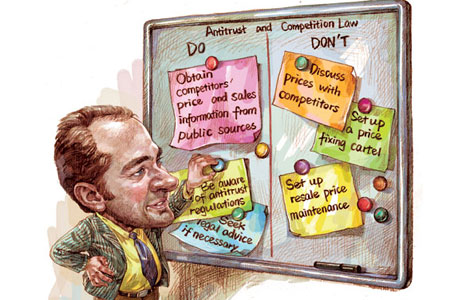

For the time being, some parts of the service sector is yet to be fully open to non-State investors.

Foreign players that can invest with ease in most industrial sectors have a more difficult time investing in services such as banking, accounting or legal services. The new and much awaited Shanghai FTZ could mark the beginning of wider opening of the service sector to international competition, but there have been few details of what exactly the zone will do.

"The government is aware that they need to reform. They are losing capacity in the traditional industries," says Stuart Allsopp, head of Asia country risk and financial markets at Business Monitor International. The FTZ is a move in the right direction, he believes, even if details remain sketchy. For example, foreigners will be able to invest in things such as schools.

The current 12th Five-Year Plan (2011-2015) calls for services to contribute about 47 percent of GDP by the end of the period in 2015. That would represent a small gain of about 2 percent from current levels, but would cement services as the biggest single contributor to the country's GDP.

Zhao believes this target is very reachable. Within three to five years, he says, services could account for as much as 50 percent of the economy.

China's GDP in 2012 (at current rates) was $8.23 trillion. Services accounted for just under 45 percent of that, a little less than $3.7 trillion, according to official figures.

Measuring GDP can be a difficult thing, and determining what a service is and what a good is requires a myriad of small decisions. Allsopp prefers to look at private consumption, which accounts for about 30 percent of GDP, much less than the services tab.

"We think the private consumption data is probably more accurate," Allsopp says. "The service sector is quite underdeveloped. It's not that it is not growing but, relative to the broader economy, it is slowing."

A few days after the launch of the FTZ, the Chinese mainland went on holiday for a week to mark national day. This holiday during the first week of October likely helped the services portion of the economy continue to grow after reaching a six-month peak in September. As it turns out, the number of tourists hit a record.

There were so many tourists that much of the feedback was negative, with many complaining that the more popular sites around the country were overcrowded, hotels were full and restaurants operating beyond capacity.

Despite the growth and the emergence of services as the largest single contributor to the country's GDP, the sector remains relatively underdeveloped in China, which has long focused on manufacturing as an engine of growth.

Premier Li Keqiang has been vocal in advocating the growth of services. Speaking in May, he said that increasing the availability and quality of the country's service industries "will help unleash huge potential in domestic demand and thus offer firm support for stable economic growth and structural optimization".

He continued: "China will further open up the service industry and pilot free trade experimental zones to tap development."

The most recent numbers suggest services could be key for China to reach its growth targets.

The service sector in China grew faster in September than it has in the past six months, even as growth in other areas remains slack because of weak demand both at home and abroad.

The official Purchasing Managers' Index (PMI) for the non-manufacturing sector rose to 55.4 in September from 53.9 in August, the highest reading since March. A number above 50 represents growth.

"The index reflected strong growth in consumption services represented by retail thanks to the holiday factor in September," said Cai Jin, vice-chairman of the China Federation of Logistics and Purchasing, which compiles the numbers along with the National Bureau of Statistics. "It also showed that the restructuring policies had boosted demand in the service sector."

The HSBC/Markit Services PMI, which came out on Oct 8, painted a slightly different picture, coming in at 52.4 for September compared with 52.8 in August as both manufacturers and service providers raised their prices in response to higher costs.

The service sector continues to grow, but the growth is increasingly subdued.

"Combined with the gradual improvement of the manufacturing PMI, the Chinese economy is still on the way to modest recovery. But a more consolidated and sustainable recovery requires structural reforms," said Qu Hongbin, chief economist for China and co-head of Asian economic research at HSBC.

For China Business Weekly

|

Nicole Kidman greets fans at the opening ceremony of the Oriental Movie Metropolis in Qingdao, Shandong province, on Sept 22. The Chinese government is keen to expand the service sector and reduce reliance on manufacturing for economic growth. AFP |

(China Daily USA 10/21/2013 page14)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China has to brace for next dollar drama

Life of Pi artwork on display

Canada welcomes China to invest

No criminal charges in Asiana crash death: DA

US deal key to nabbing fugitives

Trending news across China

Seattle high-tech summit talks 'green'

JPMorgan reaches $13b deal

US Weekly

|

|