News in review Friday, October 18 to Thursday, October 24

Updated: 2013-10-25 11:13

(China Daily USA)

|

||||||||

Friday - October 18

Asia Pacific pays executives highest base salaries

The highest base salaries in the world are being paid to executives in the Asia-Pacific region, driven in part by China's need to retain talent amid a severe management shortage, according to a survey by an executive-consultant industry group.

The annual base salary for senior-level executives in the Asia-Pacific region was $243,642 according to a recently released survey of 778 executives from around the world by the Association of Executive Search Consultants. By contrast, higher-ups in the Americas have an annual base pay of $229,261. The average base salary in the emerging markets of Europe, the Middle East and Africa was $212,066.

French bank says local debt not 'fatal' problem

China's local government debt is not a "fatal problem", French bank BNP Paribas SA said.

In the worst-case scenario, Chinese banks would suffer 1.87 trillion yuan ($306 billion) in losses, said Chi Lo, a senior strategist with BNP Paribas in Hong Kong. That would lower the banks' tier-1 capital adequacy ratios by 3.1 percentage points on average, but the ratios would still be at a high of 7.5 percent, 0.5 percentage point higher than the 7 percent level required by Basel III, which has yet to be implemented.

"Chinese banks are in a financial position so strong that even a systemic shock won't cause system breakdown," said Lo.

The National Audit Office started the latest round of audits of local government debt on Aug 1. Local media said audit work has already been completed and will be reported to the State Council - the country's cabinet - on Sunday. The results will be made public in November.

Monday - October 21

Fosun buying NY landmark building for $725m

In the latest high-profile US real-estate investment by a Chinese business, Fosun International - the investment firm controlled by billionaire Guo Guangchang - agreed to acquire New York banking landmark One Chase Manhattan Plaza for $725 million, the company said.

The 60-story, 2.2 million square-foot office tower on a 2.5-acre plaza is the former world headquarters of Chase Manhattan Bank and a signature piece of the city's financial district.

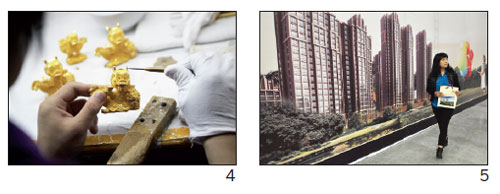

The purchase is the latest acquisition by Chinese property developers looking abroad to diversify amid a slowing economy in China and tight policy measures aimed at cooling an overheated housing market in the country. (Photo 1)

Illegal construction threatens Beijing's hutong

Beijing's historic hutong -narrow alleys that were traditionally lined with siheyuan courtyard residences - are in danger of disappearing because of illegal construction.

In 2000, Beijing still had 1,300 hutong, according to historian Zhang Wei. He estimates that since then, at least half of them have disappeared. He blames rapid urban development and unchecked illegal construction.

"Buildings have been built without permission by residents who want to improve their living conditions but don't want to move," he said.

The city launched a campaign to demolish illegal buildings, including hutong, in March.

Zhang said that to better protect the hutong, the government should offer more compensation to residents willing to move. (Photo 2)

Tuesday - October 22

US stock exchanges approve Alibaba's structure

Alibaba Group Holding Ltd has paved its way for a listing in the United States.

The New York Stock Exchange and the Nasdaq accepted the e-commerce company's special partnership structure, which would let its top executives nominate the majority of board members. The e-commerce giant's special corporate governance structure had derailed the company's initial public offering plan in Hong Kong.

"Apart from saying the two bourses have confirmed to accept Alibaba's partnership structure, we have nothing more to comment," said a company representative.

Despite the progress, the company has not made a timetable for the IPO and has neither chosen its listing venue nor the underwriter, the representative added. (Photo 3)

US ships sorghum to replace corn for animal feed

More than 60,000 metric tons of US sorghum designated for animal feed was unloaded last week at Port of Guangzhou, a leading port in South China, heralding a new era in US-China agricultural relations, the chairman of the United States Grains Council said.

Last week's shipment arrived as China's large private feed mills increasingly buy sorghum from the US after using up their import allocations for corn, the preferred animal-feed grain.

The mills have reached their import limit of 2.88 million tons of corn this year and are not expected to provide more corn until the end of the year when the government issues quotas for 2014.

Importing US-grown sorghum is appealing because domestic corn production is significantly more expensive.

|

Apple unveiled a thinner and lighter tablet computer called "iPad Air" and a new iPad mini in San Francisco on Tuesday. The iPad Air is equipped with a 9.7-inch retina display and weighs just 1 pound (0.45 kg). It will be available on the Chinese mainland on Nov 1, the same launch date as for the United States, but initially only Wi-Fi models will be available for Chinese buyers. Provided to China Daily |

Wednesday

- October 23China cuts US Treasury holdings to six-month low

China remains the largest foreign holder of US Treasury securities but its holdings in August dropped to a six-month low, according to the US Treasury Department.

China cut its holdings by $11.2 billion, bringing August's total to $1.27 trillion from July's $1.28 trillion, figures released Tuesday showed. That was a reversal from China's Treasuries boost in July, when it added $3.5 billion.

Japan trailed China as the second-largest Treasuries holder at $1.15 trillion, and continued to increase its holdings in August. Japan purchased an additional $13.7 billion.

Though Chinese holdings fell in August, analysts said it does not reflect major economic change.

NASA does a flip-flop on banning scientists

NASA has lifted its ban on Chinese astrophysics researchers attending a space telescope conference next month in California.

Allard Beutel, a spokesman for the US space agency, told the BBC that the ban on Chinese scientists, announced earlier this month, was prompted by new counter-espionage legislation restricting foreign nationals' access to NASA facilities. "The initial decision was based on a misinterpretation of the agency's policy regarding foreign nationals," Beutel was quoted as saying.

NASA officials earlier had said the restriction policy was based on legislation signed by President Barack Obama in 2011 that prohibits government funds from being used to host Chinese nationals at NASA facilities.

"We were able to clarify that interpretation and correct the decision, but it didn't happen until the federal government reopened last Thursday," the NASA spokesman said.

Thursday - October 24

Report: China could profit on US infrastructure

A report by the United States Chamber of Commerce says Chinese investors are "well-positioned" to profit from an $8 trillion US infrastructure boom. The US's aging and ailing infrastructure needs help and offers China the opportunity to help pay for them to be rebuilt while earning a profit.

China, with its large, growing pool of available capital, can benefit from "substantial new opportunities" created by the US's pressing need for its largest infrastructure expansion since the 1950s, according to the report released Wednesday.

Fuyao Glass to invest $420m in US, Russia

In a move to tap into high-end overseas markets, China's largest automobile glass manufacturer will invest $420 million to set up production bases in the United States and Russia.

Fuyao Glass said it will invest $200 million to build a safety glass plant in the US, and $220 million to establish a base to supply raw materials for its safety glass plant in the Russian market.

According to the company, Fuyao is the biggest auto-glass manufacturer in the world, but it hasn't become the main supplier for premium automakers such as Daimler AG's Mercedes-Benz, BMW AG and Bentley Motors Ltd.

The US - the second-largest auto market in the world - is becoming one of the company's most important overseas markets. General Motors Co is the company's biggest customer in the country.

|

A customer lies buried in a pile of pearls, jade and agate to experience an alternative health therapy to improve sleep quality at the China International Exhibition Center in Beijing on Oct 22. The exhibition showcased health and beauty products. Zou Hong / China Daily |

(China Daily USA 10/25/2013 page8)

Giant duck to exit after drawing the crowds

Giant duck to exit after drawing the crowds

Miss Universe 2013 to be held in Moscow

Miss Universe 2013 to be held in Moscow

Ministry to begin inspecting most heavily polluted regions

Ministry to begin inspecting most heavily polluted regions

Spy claims stir rebuke to Obama

Spy claims stir rebuke to Obama

Paint the world a picture

Paint the world a picture

World's first 1-liter car debuts in Beijing

World's first 1-liter car debuts in Beijing

Latin American clown convention

Latin American clown convention

Prince George baptized in London

Prince George baptized in London

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US will stage foreign investment summit

Chinatown restaurants learn how to get an 'A'

Snuff bottle 'gems' on display at Met

Beijing airport set to become world's busiest

US firms urge easier process for investment

China calls for strengthened EU ties

Spy claims stir rebuke to Obama

Traders in Yiwu cashing in on e-commerce shops

US Weekly

|

|