Decentralization and supervision

Updated: 2013-11-05 07:23

By Venkat Raman (China Daily USA)

|

|||||||||

One of the most important developments in recent times in China has been the announcement of a change in the State Council's management of the economy and the society, which is widely expected to be the main focus of the upcoming Third Plenum of the 18th Communist Party of China Central Committee.

Likening decentralization and supervision to the wheels of a car, Premier Li Keqiang has argued that only with both decentralization and supervision can the car run smoothly. Li has also spoken about a more nuanced coordination between the government, market and society to engineer a new phase in the evolution of the socialist market economy.

But what is different about the latest round of decentralization measures? How will these measures be implemented to unleash fresh energy to the market? How will they impact on the relationship between the central and local governments? Will they have any significant effect on domestic and foreign investment in China? What should one make of Li's assertion that these measures are irreversible and only beginning of curtailing the powers of the State Council?

Ever since China embarked on reform and opening-up, it has seen various rounds of decentralization, centralization and recentralization motivated by economic and political factors.

The first major decentralization was widely known as "eating in separate kitchens", because it aimed to boost production by giving some provinces more leverage to cash in on the benefits of reforms. However, the debates between the so called "conservatives" and "reformers" in the 1980s and the weakening of the Chinese "State capacity" thesis by two eminent scholars, Wang Shaoguang and Hu Angang, forced China's central leadership to introduce recentralization measures. Thereafter there have been policy changes here and there, but the 1994 recentralization policies including the tax sharing reform led to a fundamental shift in relations between the central and local governments.

Local governments from provincial to sub-provincial levels had to contend with growing expenses and a drastic reduction in their share of the central government's revenues. This forced provincial governments to resort to unsustainable, uneconomic and at times illegal and corrupt ways of raising funds to meet their development needs.

What didn't help matters were the evaluation policies for officials, which prompted the leadership at various local levels to attract the attention of their political bosses by projecting a very attractive report card dominated by progress made in terms of economic development. These problems became more pronounced once former president Hu Jintao and former premier Wen Jiabao introduced the concepts of the Scientific Outlook on Development and building a harmonious society and made the leap from economic governance to social governance. This brought into the spotlight the dangerous practices, such as land grabbing to promote economic activity and debt-financing vehicles, of cash-strapped local governments.

In a set up where the banking sector was centrally controlled and monitored and most of the loans went to State-owned enterprises, investors at local level, both private and public, had to rely on shadow banking practices.

And once the 2008 sub-prime crisis hit China, the economy was faced with a new set of economic challenges. The subsequent fiscal stimulus package and shift in development strategy from the foreign direct investment model to boosting domestic consumption necessitated the introduction of a fresh round of decentralization to infuse new life into the Chinese economy.

In May, the State Council either removed the administrative approval requirements or delegated its power of administrative approval to lower-level authorities in respect of 117 items. These measures restricted approval authority of the National Development and Reform Commission.

Some of the crucial subjects that were removed from central approval list or delegated to local levels were related to sectors such as energy, rare earth mining and processing. In terms of business opportunities available for domestic and foreign investors, the new decentralization measures have made investments in projects such as oil, natural gas and petroleum projects, cold rolled steel projects, power projects procedurally less taxing and in the process more attractive.

The new rules have also led to the delegation of the State Administration for Industry and Commerce's powers to review and approve registration of resident representative offices for foreign companies and the verification of foreign companies to carry out manufacturing and operating activities in China to local bureaus for industry and commerce at the provincial level. The new measures have also done way with approvals from the Ministry of Commerce in cases where foreign companies entered into production sharing contracts with Chinese companies to exploit and develop oil, gas and coal-bed methane resources.

The new round of decentralization measures is also aimed at energizing the market by instilling new investor confidence in new industrialization, information, urbanization, and agricultural modernization, the so-called four modernizations.

But it has been observed that in China for many policies from top there is a counter policy at the local level. Therefore the central government will have to undertake political innovations and establish a new set of institutions to upgrade and facilitate supervision and management of the Chinese economy. The fact that these measures are bound to have a direct and indirect impact on the issues related to governance and social management make the task even more daunting.

The success of the latest decentralization measures will depend to great extent on the new leadership's ability to harmonize economic decentralization and political supervision.

The author is assistant professor at Indian Institute of Management, Kozhikode and adjunct fellow, Institute of Chinese Studies, Delhi.

(China Daily USA 11/05/2013 page12)

Kerry denies tensions between US, Saudi Arabia

Kerry denies tensions between US, Saudi Arabia

New York City Marathon

New York City Marathon

Not talking trash

Not talking trash

Training begins for weapons destruction

Training begins for weapons destruction

Police detain swimming star for driving SUV without license

Police detain swimming star for driving SUV without license

Nongfu Spring accuses Beijing Times of defamation

Nongfu Spring accuses Beijing Times of defamation

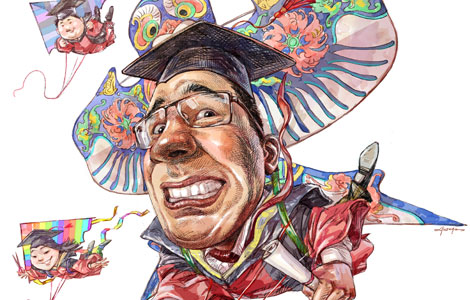

Movie director Feng leaves a lasting impression in Hollywood

Movie director Feng leaves a lasting impression in Hollywood

Egypt's Morsi arrives at court for trial

Egypt's Morsi arrives at court for trial

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

New York Chinese Film Festival kicks off today

DuPont expands Shanghai R&D center

Merkel says US ties must not be put at risk

Biden headed to East Asia

White House dismisses Snowden's clemency plea

New warning on overcapacity

Mobile games go boom in China

Xi calls for targeted policies to fight poverty

US Weekly

|

|