The startup games in Silicon Valley

Updated: 2013-12-20 11:50

By Qidong Zhang (China Daily USA)

|

||||||||

|

A Chinese delegation from SIAS International University visited Plug and Play Inc to study its Silicon Valley incubation model on Dec 13. Qidong Zhang / China Daily |

Silicon Valley in California is where dreams can become a reality or go nowhere, and a growing number of Chinese and Chinese Americans are overseeing angel funds, incubators and accelerators to help make those dreams come true, reports Qidong Zhang from San Francisco.

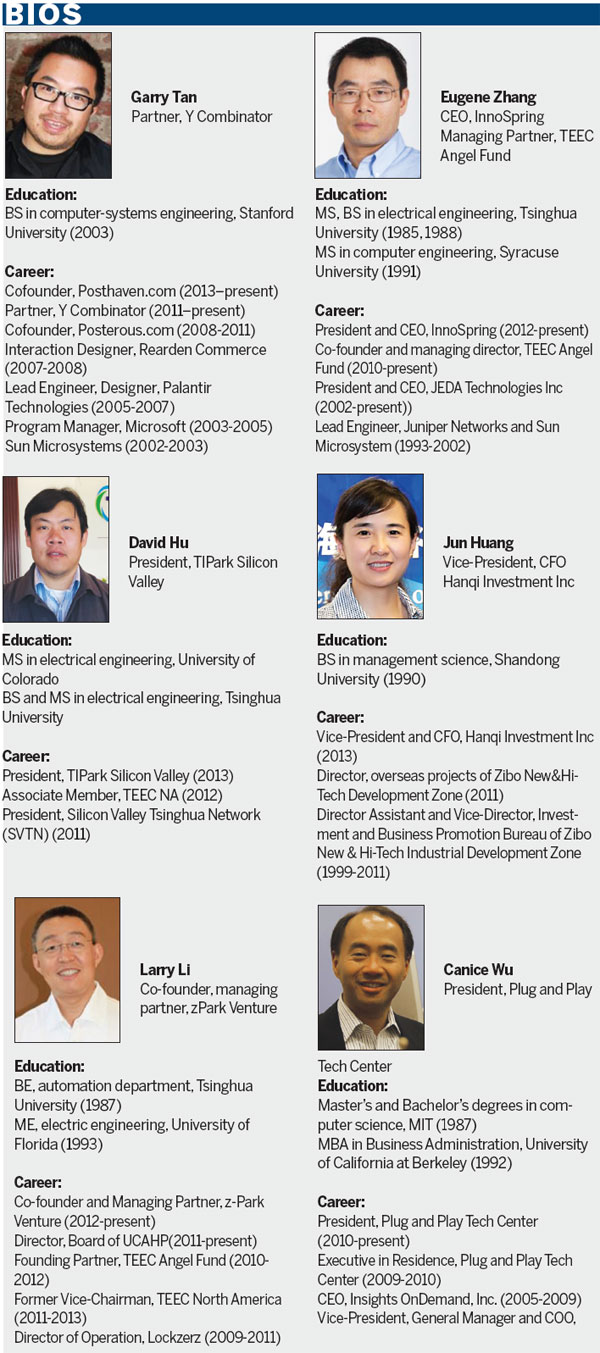

Eugene Zhang launched Silicon Valley's first US-China tech incubator, Innospring, in April 2012. Larry Li came to the US from China in 1990. Now he's an angel investor who co-founded zPark Venture.

David Hu is president of TIPark Silicon Valley, an incubator. CFO and Vice-President Jun Huang works at an incubator and has established partnerships between Silicon Valley companies and Chinese companies.

Canice Wu is president of Plug and Play, a start up accelerator that has invested in more than 1,200 startups since 2006. And Garry Tan is one of the eight partners of Y Combinator, one of the most successful tech accelerators.

They are among the Chinese and Chinese Americans whose companies are in the world of startups in Silicon Valley as angels, incubators and accelerators.

Junming Wang, science and technology counselor of the Consulate General of China in San Francisco, said in a recent speech to the local business community, that US-China innovation is truly re8 ected on incubation and acceleration activities in Silicon Valley. "It not only drives the local and US economy, but also bridges the entrepreneurship between the two countries," he said.

Innospring

Eugene Zhang's InnoSpring is trying to do just that. With $10 million in seed money from VC firm Kleiner Perkins Caufield and Byers, Northern Light, GSR Ventures, China Broadband Capital and TEEC Angel Fund, Innospring aims to utilize its US-China resources to connect both countries and help startups navigate the local market.

"What we want to do is to bridge the gap in science and technology innovation between the US and China, and help startups to go global early," said Zhang.

InnoSpring, a partnership between Tsinghua University Science Park (TusPark), Shui On Group, Northern Light Venture Capital and Silicon Valley Bank, has incubated more than 100 startups at its 13,500 square-foot center in Santa Clara, and is now known as a "must-visit" stop for Chinese delegations coming to Silicon Valley.

An electrical engineering major from Tsinghua University, Zhang, 50, held leadership positions at Sun Microsystems Inc and Juniper Networks Inc in the 1990s. He made what he calls his "first barrel of gold" co-writing a semiconductor software tool called VERA about 20 years ago.

Zhang said startups in enterprise software and systems and big data-driven applications in many areas including biotech will be Innospring's primary focus in startup selection.

"I anticipate a lot of revolutionary changes in some areas of technology like human to machine and machine to machine, as well as business model changes such as in enterprise software," he said. "Corporate management will be fundamentally changed with Cloud and mobile technology coming into the picture. Environment related technologies will also have a heavy impact on innovation in the near future."

zPark Venture

In July, Larry Li, a 1982 graduate of Tsinghua University's automation department, a professional engineer for Fortune 500 companies, and a veteran of working with startups, teamed up with a couple of investors and started zPark Venture. The multimilliondollar angel fund aims to help startup teams build ventures for incubation and eventually venture-capital investment.

Li has since organized a group of angel investors who are industry executives and innovation leaders in social media, semiconductor, IT and bio-tech.

"Now we have more than 10 partners, 20 advisers. Since last July we have invested in 17 startups, probably the number will hit over 20 by end of this year," he said.

Li said zPark Venture's angel fund coordinates with other incubators to work together in areas including mobile, games, Internet, security, big data, IT and healthcare. Key prospects, said Li, are software startups, or hardware plus software startups. "If they have users, that's definitely a plus."

Li believes having oJ ces in Silicon Valley and Beijing gives zPark a strong advantage in helping early-stage startups succeed.

"Our team of cross border investors and advisers brings investment credibility and global vision to the platform, which helps today's innovative entrepreneurs," he said.

Still at an early stage, Li said the angel fund aims to bring more value to start-ups sometimes before they are incubated, and takes 1 percent to 5 percent of the company's equity.

"We build up a track record and help startups wrap up quickly before they are incubated. Many of them doubled their value in six months," said Li.

TIPark Silicon

One of the largest high-tech incubation centers in Silicon Valley is TIPark Silicon Valley. Its nearly 50,000 square-foot office location was purchased early this year. TIPark Silicon Valley, a joint investment of THTI Holdings Co Ltd, and Haidian district, focuses on US-China startups. David Hu, president of TIPark Silicon Valley, is an IT professional in his mid-30s.

"Since we have a strong China background, we focus on both start-ups in the Silicon Valley and Chinese enterprises coming to America and enhance their needs," he said . "Our advantage over others is that we are well connected to both Silicon Valley and Haidian District, which are the most dynamic innovation cradles in the US and China."

Hu and his team have evaluated approximately 30 startups since October; many of them in clean energy, mobile app, gaming and cloud technology.

Coordinating with angel fund investors, Hu aims to customize his program and find what is the best way to incubate startups. For an equity return of 5 percent to 6 percent, Hu also plans to coordinate with angel-fund investors.

"Some startups want to go to China directly, some want to be incubated here and see what happens locally. It all depends on what kind of strategy and funding they receive when they come out of our program," he said.

With four people on his team and a $10 million fund, Hu is also cautious.

"We are in the learning process of incubation, and it is also an evolving process for us," he said.

Hanqi

In June, Hanqi Investment Inc purchased a 105,000 square-foot building in Burlingame, California, adjacent to the San Francisco Bay and San Francisco International Airport. The $24 million purchase was mainly made by Zibo National New and High Tech Industrial Development Zone, along with six companies at Zibo New and High Tech Industrial Development Zone and Hanhai Investment Management Group.

While approximately 8,000 square-feet of co-working space is undergoing remodeling, CFO and Vice-President Jun Huang has launched programs to fill that space for the incubator, including services for resident companies.

Hanqi has established partnerships between Silicon Valley companies and Chinese companies and recruited nine startup companies for service programs.

"Our advantage is to be able to provide a direct channel for Silicon Valley startups that are interested in launching in Zibo, Shandong province, where the entrepreneurship environment is superb," Huang said. "Through this overseas technology incubator, we are also able to bring back overseas talents, licensing advanced technology and projects, facilitating Chinese companies to enter overseas markets, and achieving our goals of innovating overseas, accelerating in China," said Huang.

She said the incubator administrative committee of Zibo National New and High Tech Industrial Development Zone provides approximately $200,000 in funding for innovation and entrepreneurship, a rent subsidy for 1,000 square-feet research and development for five years and technical-service platforms (labs).

"The life-science park is established because we believe there is substantial need for the two countries in life-science innovation. The platform here will provide local startups a most eM ective incubation from US to Shandong province directly," Huang said.

Plug and Play

To distinguish an accelerator from an incubator, Canice Wu, president of Plug and Play - a startup accelerator based in Sunnyvale, California - says his company "enhances graduates from incubators" and brings them to the commercial market.

Since its establishment in 2006, the company has invested in more than 1,200 startups, with an average investment of $25,000 to $100,000. With more than 300 resident startups, a network of 180 venture capitalists and extensive relationships with Fortune 500 corporations, Plug and Play is one of the most sought after ecosystems in Silicon Valley.

"We work with engineering and business schools in various colleges to identify entrepreneurs and startups from college students. The summer and winter camps run 10 weeks each," Wu said. "We also run an international acceleration program, a three-month program four times a year. People call it Silicon Valley boot camp because this is where global entrepreneurs meet up with CEOs, mentors and investors who literally transform their ideas into opportunity."

Experienced in developing a business from concept to becoming a market leader, Wu founded Insights OnDemand and developed Siebel's vertical-industry business unit for financial services from scratch to more than $300 million in revenue in five years.

Wu said that Chinese Fortune 500 companies are interested in his company's B2B (business to business) accelerator-investment program that concentrates on enterprise, big data and cloud startups.

"Baidu, Huawei, TCL, Lenovo are our corporate partners who would acquire or invest in startups in those areas based on needs of their business portfolio," he said.

"We are very much a global accelerator; we have very strong connections in not only the VC (venture capital) community in Silicon Valley, but also global corporate community," he said.

Y Combinator

With more than 560 startups launched since 2005, Y Combinator (YC) stands out as a seed accelerator. It provides seed money, advice and connects qualified startups at two of its three-month programs per year, taking an average of about 7 percent of the startup's equity.

Partner Garry Tan said YC invests about $2 million a year, an average of $20,000 per startup.

"We receive about 5,000 to 6,000 applications every year, alumni members who graduated from the YC incubation program are the first tier to review the applications," said Tan.

Two batches of application are received every year for the January to March and the June to August programs. "We look at a business, and value its articulateness. We see how the founders explain a complex concept, and observe the team's interaction. People mostly don't change their personalities, it's important to speculate how the team reacts when they confront challenges," said Tan.

"We pick winners based on how big the idea is, and how good the idea is. The team is most important when you pick a company. We look for scrappiness, too, and see if the team will still be passionate if they face a challenge or trouble."

Dropbox was one of the star seed-startups invested in by YC in 2008. It now has 200 million users, 4 million business users, and, according to an announcement made by its co-founder Drew Houston in November, 97 percent of the Fortune 500 companies are using Dropbox. "What we do is to focus on startups which make software and have a market to sell to, and Dropbox fits exactly into that model," said Tan.

The YC "graduate", according to Tan, receives an average of $1 million dollars after its acceleration program, which makes the company the king of accelerators in the US and a dream pitch for startup founders.

A first generation immigrant himself with his father from Singapore and mother from Burma, Tan, a Stanford computer-science graduate, has been a successful entrepreneur. A cofounder of Posterous, he cofounded financial analysis platform Palantir Technology and was previously a program manager at MicrosoF Windows Mobile.

Tan has big dreams for YC:

"We fund 100 companies every year. How much better a world would be if we could fund 1,000 a year? We are not sure how to scale YC yet, but we are thinking every day about how to make it great and better."

Contact the writer at kellyzhang@chinadailyusa.com

(China Daily USA 12/20/2013 page19)

Oil spill from Qingdao blast kills sea life

Oil spill from Qingdao blast kills sea life

Ice storm hits Toronto

Ice storm hits Toronto

A man and a child jump off Manhattan building

A man and a child jump off Manhattan building

Male nurses in demand as caregivers for elderly

Male nurses in demand as caregivers for elderly

Moving beyond language skills

Moving beyond language skills

Khodorkovsky says he will not enter Russian politics

Khodorkovsky says he will not enter Russian politics

Debris of Bolivian satellite falls on E China

Debris of Bolivian satellite falls on E China

Migrating cranes at Israel's Hula Lake

Migrating cranes at Israel's Hula Lake

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China reviews bill to ease one-child policy

Apple inks iPhone deal with China Mobile

Committee of 100 seeks to tackle 'sensitive' images about China

China's IPR courts 'would be helpful'

GM corn rejection no to hurt market

Liaoning's combat capability tested

Sotheby's denies $8m work is fake

Castro urges US to respect differences with Cuba

US Weekly

|

|