Shale gas faces a bumpy road en route to boom

Updated: 2014-02-13 08:27

By Du Juan (China Daily USA)

|

||||||||

China's shale gas industry could soon be entering its boom years.

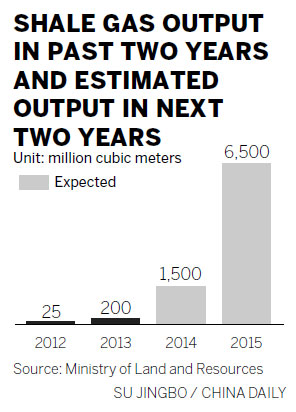

Thanks to the top two oil and gas giants - China National Petroleum Corp and Sinopec Group - the nation's shale gas output soared from 25 million cubic meters in 2012 to more than 200 million last year.

Late last month, the National Energy Administration announced that Chinese shale gas production will reach 1.5 billion cubic meters this year.

Peng Qiming, director of the geological exploration department at the Ministry of Land and Resources, said at a January news conference that China has made many breakthroughs in the unconventional oil and gas exploration sector in the past 12 months.

At the Chongqing Fuling shale gas block last year, Sinopec averaged single well output of 150,000 cubic meters a day. The company is expected to achieve annual production of 1 billion cubic meters by the end of 2014.

China's biggest oil and gas developer CNPC boasts a total commercialized shale gas output of 70 million cubic meters, primarily from three blocks: Changning-Weiyuan block in Sichuan province, Zhaotong block in Yunnan and the Fushun-Yongchuan block that was jointly developed with Royal Dutch Shell Plc in Sichuan.

And an expert from the ministry, who declined to be named, said domestic shale gas capacity will increase rapidly based on the current development level Chinese companies have achieved.

But other analysts are not as optimistic about its future.

"It is not a tough goal to accomplish," said Wang Xiaokun, a natural gas analyst at domestic commodities consultancy Sublime China Information Group Co Ltd.

She predicted that China will consume 170 billion cubic meters of natural gas this year.

"In addition, even if the country achieves the target, it doesn't mean all the production can be utilized for society because it requires mature pipeline infrastructure and other supporting facilities," said Wang.

Besides a low utilization rate, there are also problems in upstream exploration.

Wang said Sinopec's technology for the Chongqing Fuling block cannot be easily employed in other blocks.

"The biggest obstacle is we have not found a method that fits most shale gas blocks in China yet," she said.

Challenges ahead

China's geological conditions are far different from those in the United States, the world's biggest shale gas producer.

In China, most shale gas blocks are in mountainous regions, making it difficult to bring in the huge fracturing equipment needed to extract the gas.

Groundwater exploitation and contamination are other major concerns.

Lin Boqiang, director of the China Center for Energy Economic Research at Xiamen University, said shale gas exploration needs lots of fresh water, and current technology hasn't completely solved this problem.

Wang said fresh water can't be cleared for residential consumption after being used in shale gas extraction and that removing fluids from reservoirs also can cause surface subsidence.

"These factors are all limitations for China's shale gas development, which can explain why many companies are reluctant to take real action in blocks they won from the bidding," she said.

China held a second round of shale gas block bidding in October 2012 and announced the winners in January 2013.

Up to 16 companies, two of them private, won bids for 19 shale gas blocks, covering about 20,000 square kilometers during the second round.

To avoid tying up the land, the ministry asked the bid-winners to guarantee a total investment of about 13 billion yuan ($2.1 billion) on shale gas exploration for the 19 blocks within three years; otherwise, it can take the blocks back.

But many companies still have not made any big moves, said Wang, who declined to release specifics on the companies, saying "it's hard to determine whether they have taken action or not".

"The average cost of drilling a well is about 100 million yuan, which still cannot guarantee any shale gas will be found," she said. "The high cost and risk inherent in shale gas exploration are major reasons for Chinese companies' inaction."

Although a third round of shale gas block bidding was rumored to be taking place in either March or April of this year, the Ministry of Land and Resources, the country's land watchdog, could not confirm it.

Bidding was supposed to be held late last year. Wang said the delay was partially due to companies' reluctance.

China's shale gas boom has been bringing business opportunities to some machinery manufacturers.

Yantai Jereh Oilfield Services Group Co Ltd, a private company listed on the Shenzhen Stock Exchange, has been working on tailoring fracturing equipment to fit China's geological contours.

As the only Chinese firm to supply shale gas equipment to North American companies, Jereh has been developing machines in recent years specifically for Chinese projects, hoping for a boom in the sector.

The company said it had successfully tested the extraction equipment last October.

Cui Rizhe, director of the company's technology center, said the machines can be used in areas with poor roads and uneven land for long periods.

dujuan@chinadaily.com.cn

|

Yangbajing geothermal field in Tibet is famous for its rich geothermal resources. Tao Xiyi / Xinhua |

(China Daily USA 02/13/2014 page15)

Deadly ice and snow storm slams US South

Deadly ice and snow storm slams US South

Starlings to spend the winter in Israel

Starlings to spend the winter in Israel

Highlights of Singapore Airshow

Highlights of Singapore Airshow

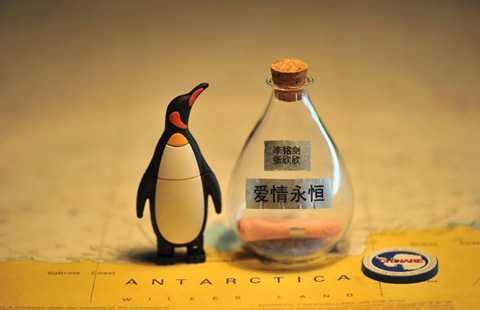

Sailors of Xuelong release 'love drift bottles'

Sailors of Xuelong release 'love drift bottles'

Free 3D painting show for Lantern Festival

Free 3D painting show for Lantern Festival

China takes first Sochi medal on short track

China takes first Sochi medal on short track

Guangdong set to slam underground prostitution

Guangdong set to slam underground prostitution

Giraffe shot and dismembered in Copenhagen Zoo

Giraffe shot and dismembered in Copenhagen Zoo

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese consume too much food from animals

Obama to visit four Asian countries in April

Jade rabbit comes back to life

Embassy in talks over arrest

Beijing low on list of green cities

No casualties reported in Xinjiang quake

Abe's view on history rapped

Prostitution crackdown expands in Guangdong

US Weekly

|

|