Weaker manufacturing PMI may signal policy changes

Updated: 2014-03-25 07:16

By Jiang Xueqing (China Daily USA)

|

||||||||

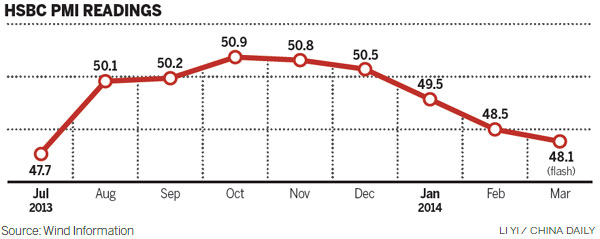

The HSBC China flash manufacturing PMI fell to an eight-month low in March, deepening concern that the Chinese economy might not meet its 7.5 percent growth target in 2014.

The preliminary Purchasing Managers' Index from HSBC Holdings Plc dropped to 48.1 from 48.5 in February.

Contrary to expectations of a mild rebound as activity normalized after seasonal distortions, China's growth momentum continued to slow following the Lunar New Year.

First-quarter GDP growth is likely to fall below the annual growth target of 7.5 percent, according to an HSBC report released on Monday.

The report found that domestic demand has weakened at a pace similar to that seen in the middle of last year, which is likely due to slowing investment growth, a softer property market and continued efforts to eliminate excess industrial capacity.

"With no signs suggesting meaningful improvement in domestic demand, the ongoing softening momentum will test Beijing's bottom line for growth of about 7 percent in coming months and could threaten labor market stability," the report said.

Qu Hongbin and Sun Junwei, economists at HSBC, emphasized that they expect Chinese authorities to launch a series of policy measures to stabilize growth sooner rather than later. Likely options include lowering entry barriers to encourage private investment, targeting spending on subways, clean air and public housing, and guiding lending rates lower.

Zhou Mingjian, director of the research institute of Golden Sun Securities Co Ltd, said the downturn trend reveals problems in China's resource allocations.

He noted that a huge amount of resources were allocated to real estate projects and local government financing platforms in the past few years, due to government-led economic intervention. Some investments brought only a small return and led to overcapacity in sectors like steel and cement.

"We can't reverse the situation overnight. The Chinese economy will inevitably slow down during its restructuring," Zhou said.

He expects that in order to prevent social conflicts, the government will try to halt an economic downturn by increasing investment, especially in domestic infrastructure projects.

As a result, fixed-asset investment growth may surpass 18 percent and even hit 20 percent in 2014, in his estimation.

Li Wei, China economist at Standard Chartered Bank, said China is still transforming from an industry-based economy to a service-driven one. In the process, its industries will undergo painful restructuring, and that will bring downward economic pressure.

"In the next two years, China's economic fluctuations are likely to become the norm. We'll see more interactions between economic growth and government policies," Li said.

The Chinese authorities already have taken measures to ensure stable economic growth by launching some projects in the country's 12th Five-Year Plan (2011-15).

Li predicted in the short term, the government will invest more in projects surrounding the service industry, emerging industries and infrastructure.

External economic conditions also will help lift the economy, he added.

"The Chinese economy will improve as the economies of the United States and the European Union recover in the second or third quarter," he said.

jiangxueqing@chinadaily.com.cn

(China Daily USA 03/25/2014 page13)

Xi and Obama talk about family and jokes

Xi and Obama talk about family and jokes

17 days of prayers and hope

17 days of prayers and hope

Prosperity poised to blossom

Prosperity poised to blossom

Chinese Consulate General in NY meets press

Chinese Consulate General in NY meets press

China Southern will launch Guangzhou-NY service

China Southern will launch Guangzhou-NY service

The world in photos: March 17-23

The world in photos: March 17-23

3 dead, 18 missing after Washington landslide

3 dead, 18 missing after Washington landslide

Obamas climb Great Wall after lunch of trout

Obamas climb Great Wall after lunch of trout

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Ukraine recalls troops in Crimea

Jet 'ended in ocean', China asks for all info

Xi calls for better ties with US

University 'bridges' US-China gap

Xi meets Obama in Netherlands

Huawei condemns NSA hacking

Obamas entourage wowed by China

Xi and Obama talk about jokes

US Weekly

|

|