China advised to curb credit growth

Updated: 2014-04-14 11:09

By Michael Barris in New York (China Daily USA)

|

||||||||

IMF says reining in borrowing is important for long-term stability

China should move to rein in a record expansion of lending that endangers the financial system, even if growth slows, an International Monetary Fund official said.

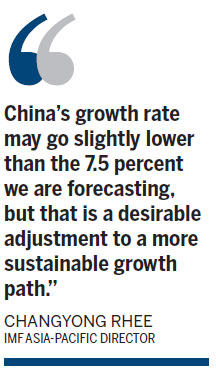

"China's growth rate may go slightly lower than the 7.5 percent we are forecasting, but that is a desirable adjustment to a more sustainable growth path," IMF Asia-Pacific director Changyong Rhee told reporters on Friday.

"I think the (Chinese) government understands this problem very well," Rhee said in a briefing during IMF meetings in Washington. He called Chinese Premier Li Keqiang's stated support for China's employing a "strong stimulus plan" to cope with short-term credit-market volatility "the right stance."

The IMF sees China's economy growing 7.5 percent this year, slowing from last year's 7.7 percent rate as growth in the Asia-Pacific region generally dips. Rhee called reining in credit growth, especially outside the banking sector, a "very important task to secure (China's) long-term stability".

His comments reiterated the message in an IMF report this week that China risks a financial crisis that could cripple the world's second-largest economy and wreak global economic havoc without stronger oversight of its lending practices. Although the Global Financial Stability report said Chinese officials are moving too slowly to manage loose lending, the report cautioned against quick steps that could trigger financial panic.

Rhee downplayed concern about the scale of borrowing by China's local governments, pointing out that most of the debt is in local currency. "There is room for the Chinese government to react," he told the briefing. "But that's why it is important to rein in the credit pension by local government" to ensure stability.

China's willingness to assist debt-saddled financial institutions has encouraged borrowers to take on even more debt, observers have said.

IMF Asia-Pacific Deputy Director Markus Rodlawer told the briefing that China sees, correctly, that removing all the debt at once won't work because "you open the floodgates to more borrowing".

IMF supports "not removing in one stroke all the debt from the government's books", Rodlawer said. "The key is to reorganize the flow in a way that's much more rational."

Rhee said the IMF projects Asian economic growth edging up to 5.4 percent this year and 5.5 percent in 2015 from 5.2 last year. The outlook for China's GDP growth is based on an assumption that China will gradually rein in rapid credit growth and make progress in implementing their reform blueprint so as to put the economy on a more balanced and sustainable growth path", according to the IMF report. The IMF's estimates are unchanged from its January forecasts.

IMF financial counselor Jos Vials has said Beijing needs to ensure that lending rates more accurately reflect risks. One way to do that would be to raise borrowing costs, he said.

Rhee said the panic that gripped emerging economies last year after the US Federal Reserve announced it would reduce its bond-buying economic stimulus program appears to be over. "Emerging economies in Asia are doing better than developed economies in the region," due to moves aimed at strengthening macroeconomic and institutional frameworks after the quantitative-easing turmoil, the official said.

Asia, however, must strive to implement financial reform to be able to withstand global upheaval, Rhee said. "This is not a time for complacency in Asia. It is time in Asia for vigilance and reform. Without reform, Asia becomes slightly more vulnerable."

In remarks delivered at the IMF meetings Friday, Secretary Jacob J. Lew held out China's "forward-looking" reforms as a model for other nations to emulate. The November meetings of the Chinese Communist Party leadership proposed changes that "hold promise for a shift to a more balanced economy that delivers higher living standards" and "continued economic stability and growth", Lew said.

Exchange rates must rise further to allow consumption, rather than investment, to drive domestic demand and insure a sustainable economy, he said.

michaelbarris@chinadailyusa.com

|

Financial leaders join other International Monetary and Financial Committee (IMFC) finance ministers, bank governors and other ministers from around the world for a family photo during the IMF and World Bank's 2014 Annual Spring Meetings in Washington on Saturday. Mike Theiler / Reuters |

(China Daily USA 04/14/2014 page1)

DPRK opens race to foreigners

DPRK opens race to foreigners

Death toll from Chile forest fire rises to 16

Death toll from Chile forest fire rises to 16

Duchess receives Maori welcome

Duchess receives Maori welcome

Christie's to auction dazzling diamonds

Christie's to auction dazzling diamonds

Women's missile unit joins China's army

Women's missile unit joins China's army

Coldest marathon: a song of ice and fire

Coldest marathon: a song of ice and fire

Prince William, Kate unveil portrait of Queen Elizabeth

Prince William, Kate unveil portrait of Queen Elizabeth

Hagel gets recipe of goodwill

Hagel gets recipe of goodwill

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Experts discuss about custody of black box

Foreign investment law to be revised

China protests Shindo's shrine visit

China's financial reforms 'not tough one'

Boao Forum focuses on 'growth drivers' for Asia

Texas firm offers costly air purifier

NBA to play games in China

'Shared responsibility' emphasized

US Weekly

|

|