Iron ore surplus seen shuttering China mines

Updated: 2014-05-08 06:42

By Bloomberg News in Singapore (China Daily USA)

|

||||||||

New, cheap supplies from Australia, Brazil pushing global prices down

Surging global supplies of seaborne iron ore will challenge Chinese producers of the raw material for steel, probably forcing some higher-cost capacity in the country to close, according to BHP Billiton Ltd.

The gain in global production is being led by Australia and Brazil and their new, low-cost output will displace marginal suppliers in China, Michiel Hovers, vice-president of iron ore marketing at BHP, told an industry conference on Wednesday.

Vale SA, the world's biggest iron ore producer, plans to raise output by almost 50 percent by 2018, Claudio Alves, global director of marketing and sales, told the gathering in Singapore.

The biggest producers, including Vale, BHP, Rio Tinto Group and Fortescue Metals Group Ltd, have invested billions of dollars to expand output, betting on sustained growth in demand from China, the biggest buyer. Iron ore fell into a bear market in March amid forecasts for a global glut.

Fortescue wouldn't cut output even if prices extend declines as its costs are low, Zhuang Binjun, business development manager, said.

"Seaborne supply growth will come largely from Australia and Brazil," said Hovers. "This new supply will be low-cost seaborne and displace marginal supply from high-cost domestic Chinese producers and other lower-quality iron ore imports into China."

Slumping prices

Ore with 62 percent content delivered to Tianjin has fallen 21 percent so far this year to $106 a ton as of Tuesday, according to data from The Steel Index Ltd. The benchmark fell to $104.70 on March 10, the lowest level since 2012. While prices may be firmer over three months, there may be a drop below $100 over six months, toward $90, on the new supplies, Kamal Naqvi, global head of metals at Credit Suisse Group AG, told the conference.

If prices drop to $100, output in China may be hurt as domestic mines with high production costs are forced to cut output or close, according to the Bureau of Resources and Energy Economics, Australia's government forecaster. By comparison, Rio Tinto can be profitable above A $39 ($36), BHP's breakeven is A $41 ($38), and Fortescue's is A $56, UBS AG estimated.

Global seaborne supplies will increase 126 million tons to 1.38 billion tons this year, Morgan Stanley estimated in a May 5 report. That will increase the worldwide surplus to 79 million tons in 2014 from 1 million last year, the bank forecast.

"What's happening now is the major iron ore producers are bringing considerable new capacity," Alves said in an interview, forecasting a rise of about 120 million tons this year and a further 100 million tons in 2015. "Most of the tonnage is very competitive," he said.

Vale's expansion

Production at the Rio de Janeiro-based company will rise to about 453 million tons in 2018 compared with 306 million tons last year, Alves told the conference. Vale's average cost of production in Brazil is $21 to $22 a ton, he said.

"It takes time to absorb all this pickup in iron ore supply," said Alves, forecasting China's imports will be more than 900 million tons this year from 820 million tons. "It will make some pressure in terms of price, create some volatility."

The Tianjin benchmark fell for a fifth month in April, the longest losing run since August 2012, as growth in China slowed and seaborne supplies rose. The price will drop to $100 in the fourth quarter, according to Goldman Sachs Group Inc.

|

Imported iron ore is unloaded from a vessel in Nantong, Jiangsu province. Xu Congjun / For China Daily |

(China Daily USA 05/08/2014 page13)

Forum trends: Made in China - cheap and inferior?

Forum trends: Made in China - cheap and inferior?

Chinese artists are part of NY philanthropists' event

Chinese artists are part of NY philanthropists' event

When a man loves an extremely tall woman

When a man loves an extremely tall woman

Chinese enrollments increase for US MBA programs

Chinese enrollments increase for US MBA programs

World Smile Day special: Grinning animals

World Smile Day special: Grinning animals

Thai PM Yingluck bids farewell

Thai PM Yingluck bids farewell

Biggest IPO ever?

Biggest IPO ever?

Prima ballerina Tan still soars

Prima ballerina Tan still soars

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Thailand's new PM seen capable of compromises

China urges Japan to maintain regional peace

Rig is drilling in our waters, Beijing says

Woman detained for leaking secrets

Alibaba joins Amazon's rival

Young Chinese student in spotlight

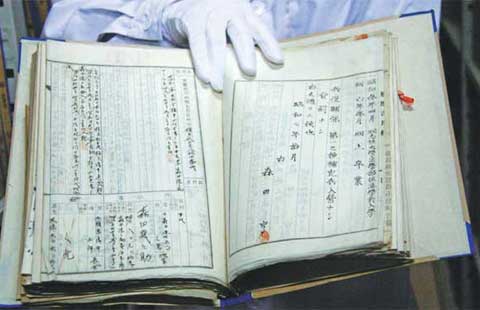

Swiss banks' move 'to aid graft fight'

Key Sino-Nigerian deals signed

US Weekly

|

|