Full throttle ahead

Updated: 2014-09-29 06:57

By Krishna Kumar Vr in New Delhi(China Daily USA)

|

||||||||

Billionaire entrepreneur believes diversification can unlock new avenues for sustained, long-term growth

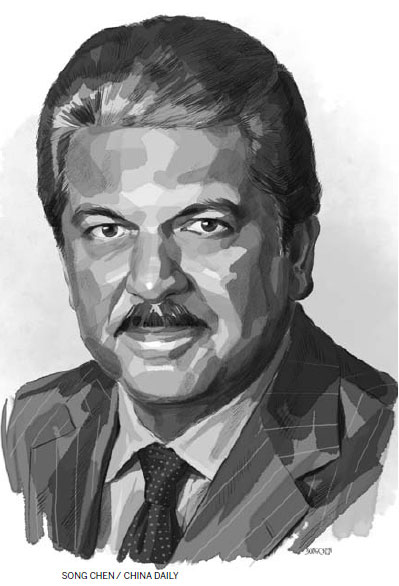

During his teens, Anand Mahindra's consuming passion for filmmaking took him to Harvard in the early 1970s to major in film on a full scholarship. He graduated from the esteemed US institution in 1977 with high honors.

But he never became a moviemaker. Instead, he turned out to be a globally respected businessman. Today, he heads a $16.5 billion multinational group, Mahindra & Mahindra (M&M), which has more than 180,000 employees in over 100 countries across the globe.

"I still have an abiding passion for watching good cinema. I have also invested personally in a film production company," says Mahindra, chairman and managing director of M&M.

His media and entertainment company, Mumbai Mantra Media, has committed to provide a platform for independent voices in world cinema and the emerging generation of filmmakers. The company has established a global filmmaking award and a screenwriters' lab in India, the Mahindra Global Filmmaking Award.

Mahindra's commitment toward society goes beyond the silver screen, and he is modest about his achievements. He describes himself as an "accidental entrepreneur" who simply joined the family business rather than starting up his own company.

After securing a management degree from Harvard Business School in 1981, he returned to India and joined the Mahindra Ugine Steel Company, a subsidiary of the M&M Group listed on Bombay Stock Exchange, as an executive assistant to the finance director.

After eight years of working in his grandfather's business, in 1989 he was appointed president and deputy managing director of the company. During his time at MUSCO, he initiated the group's diversification into the new business areas of real estate development and hospitality management. In 1991 he was brought from MUSCO and appointed as deputy managing director of M&M.

Initially, he had a tough time in the office. Striking workers from a factory in Mumbai had even surrounded him in his plant at one point when Mahindra, then 36, had said that there would be no bonus unless workers stepped up productivity. His ordeal only lasted for a few hours, however, until the workers calmed down.

Subsequently, he initiated a comprehensive change program in the company to turn it into an efficient and aggressive competitor in the new liberalized economic environment in India. Now, M&M is present across the entire automotive spectrum - two-wheelers, commercial vehicles, SUVs and sedans.

In addition, the group has diversified into a wide range of other sectors, including aerospace, agribusiness, energy, farm equipment, finance, information technology, hospitality, logistics, real estate and retail.

"Because of our long-term view, we have never shied away from making investments, even during down cycles," Mahindra says. "For instance, we invested in a world-class automotive manufacturing plant when the economy wasn't in the best of health. This long-term focus has helped us tide over the rough times. It also helps us to diversify."

His leadership also took the company to foreign markets, including China.

In 2005, M&M formed its first Indo-Chinese joint venture with Jiangling Motors, one of China's biggest commercial vehicle manufacturers.

"China is one of the largest tractor markets in the world," he says. "We see China as our second home market and we are working towards creating our biggest tractor base in the country."

The venture, Mahindra (China) Tractor Company, helped M&M create a global footprint, opening export avenues to support its US operations. It also created the possibility of introducing low-cost products in the India market from China.

In 2009, M&M formed another joint venture, with the Yueda Group of China, a major player in automobiles and tractors, mining, infrastructure and real estate.

"Our experience so far has been rewarding. We share an excellent rapport with the local government as well as our JV (joint venture) partners. We will continue to evaluate further opportunities as and when they arise," he says.

An ardent admirer of China's dazzling economic prowess, Mahindra believes that there is certainly much that India can learn from its neighbor.

"China always thinks big, and that is something we must learn to do. China's public investment programs and the timely execution of massive infrastructure projects have deep lessons not just for India, but for the whole world," he says.

Mahindra is of the view that for India's economy to expand rapidly and sustainably, it needs to engender cooperative competition between different regions as China has done.

"Certain provinces on China's eastern seaboard have raced ahead of their compatriots inland, and are benchmarks for the rest of the country," he says. "We, too, need to encourage our states and regions to improve on their performance and measure themselves against states and regions that are outperforming."

But Mahindra believes that his country has to evolve a uniquely Indian model of growth, by taking into account prevailing socioeconomic conditions and a vastly different environment. Stressing the importance of cordial relations between China and India, the business magnate opines: "It is not only critical for Asia but also for the world."

"Both countries have matured and are now viewing their relationship more and more in terms of their economic interests. At one time India and China accounted for over 50 percent of global GDP," he says.

With a great appetite for global business, for the past few years, M&M has been making million-dollar acquisitions across the globe. Its largest outbound deal involved buying a 70 percent stake in South Korea's Ssangyong Motor Company.

"We hope our Ssanyong products will enable us to gain a share of the growing SUV market," he says.

Other strategic acquisitions include the purchase of Punjab Tractors, which doubled the company's share of the tractor market, and Kinetic Motor's two-wheeler business. He also led the purchase of a 55.2 percent stake in Reva Electric Company due to his interest in producing electric vehicles.

Last year, the automotive component businesses signed a global alliance agreement with CIE Automotive, a Spanish company that is one of the main suppliers of components for the automobile sector in Europe, Brazil, North America and China. The agreement led to the formation of a global automotive component supply network, which has combined annual sales of approximately $3 billion.

"It will give our components business a quantum jump in scale," he says.

Mahindra also spearheaded the group's entry into aviation, as the group has acquired aerospace companies including Plexion Technologies (India), Engines Engineering (Italy) and GippsAero (Australia).

But Mahindra is not just an aggressive globe-trotting purchaser. He understands the value of human resources, which are vital for any organization to grow. He is a firm believer in empowering people and giving them free rein to develop their ideas into a feasible business plan.

"Of course, people's empowerment requires significant risk-taking, but we need to change the way we think about people. We need to look beyond hierarchy," he says.

He believes education is vital to creating top-class human resources, and it has always been on the top of his agenda. In 1996 Mahindra founded Nanhi Kali, which supports the education of underprivileged young girls.

"Driving positive change is inseparable from the brand and that is what we try to do through our philosophy," he sums up.

(China Daily USA 09/29/2014 page15)

Brazilian eyes

Brazilian eyes

National Day Celebration

National Day Celebration

Splendid China

Splendid China

Police: Ferguson officer shot; 2 suspects wanted

Police: Ferguson officer shot; 2 suspects wanted

Beijing welcomes its vintage tour bus

Beijing welcomes its vintage tour bus

Mo Yan awarded highest honor of oldest Bulgarian university

Mo Yan awarded highest honor of oldest Bulgarian university

Hundred Flowers Award ceremony opens in Lanzhou

Hundred Flowers Award ceremony opens in Lanzhou

Luxurious new Boeing 777 delivered to China Eastern

Luxurious new Boeing 777 delivered to China Eastern

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

15 people, mostly teens, shot at Miami nightclub

Currency swap potential boon to Argentia

Sino-Venezuela ties at 'highest level'

FM makes official visit to Mexico

Brazil, China exchanges ink deal

VCs gather in Silicon Valley

Police: Ferguson officer shot; 2 suspects wanted

Central govt opposes illegal activities in HK

US Weekly

|

|