China needs a semiconductor industry

Updated: 2014-10-07 13:10

By Handel Jones(China Daily USA)

|

||||||||

The global semiconductor market will be nearly $444 billion in 2020, compared to $299 billion in 2013. Within the high-technology ecosystem, the semiconductor industry offers many benefits to China.

A key competitive advantage of Apple's smartphones has been its development and use of leadership semiconductor products such as the A7 and A8 application processors. The US has many areas of strength in new electronics technology because the country has several strong semiconductor companies.

Japan has allowed its semiconductor companies to weaken, and as a result, the electronics industry in Japan has weakened.

With the migration to 20nm, 14nm and 10nm, semiconductor vendors will take over more of the system value, which increases the importance of semiconductors within electronics equipment.

A large employment base can be built within the semiconductor industry. Semiconductor companies also have a large headcount in R&D, which provides employment to highly skilled and experienced engineers.

A large ecosystem is also built around semiconductor vendors, including EDA companies, tooling vendors and IP companies. The headcount within these support companies can be higher than within semiconductor companies.

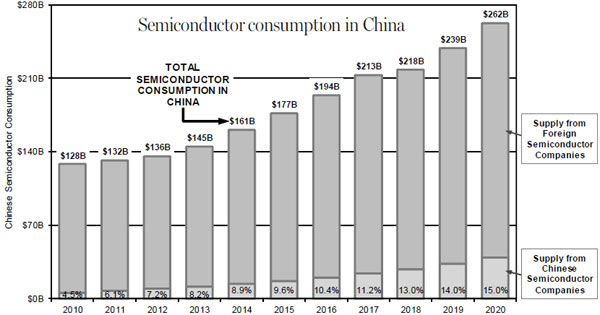

China also consumes a high percentage of imported semiconductors, yet, if market forces are allowed to continue, foreign companies will supply 85 percent of the semiconductors consumed in China by 2020, which is only a slight improvement over the 91 percent share of consumption in 2014.

A target should be established for Chinese companies to manufacture 40 percent of China's semiconductor consumption by 2020. This should be a national initiative that needs a top-level commitment with funding support provided to meet the goal. A 40 percent target would equate to nearly $105 billion in 2020.

Chinese semiconductor companies should also plan to sell their products into global markets as well as local markets to ensure competitiveness with foreign companies in quality and product functionality.

Having a strong semiconductor industry would help China gain high value from key devices such as smartphones and tablet computers.

China will provide more than 50 percent of the unit volume of smartphones and tablet computers in 2015, and the percentage of global supply will increase through 2020. High profits, however, will be taken by foreign companies because they provide key components such as modems, application processors, image sensors, power amplifiers, transceivers, displays, batteries and other components.

A similar situation should apply to Internet of Things (IoT) devices, which will have a unit volume of nearly 43 billion in 2020. China should have a large portfolio of IoT devices as well as supply the required semiconductor products.

Furthermore, China manufactures more than 20 million automobiles a year, but key semiconductor products are provided by foreign companies. With their control over IP, foreign semiconductor companies also generate high profits from supplying automotive electronics to Chinese automobile companies.

Establishing a strong semiconductor industry would expand opportunities in many product areas. It would be important for Chinese semiconductor companies to focus on high-revenue and high-volume products.

Some proposed steps include building strong fabless semiconductors that are competitive in global markets and building a strong wafer-manufacturing base in China since wafers represent a high percentage of the cost of semiconductor products. Tens of billions of dollars would need to be provided to build a globally competitive wafer supply ecosystem, but the payback can be excellent.

Building packaging-testing facilitates in China that employ a large number of workers and vertically integrated companies that can manufacture memory, analog, discrete, and MEMS products are also essential.

It is critical to build a strong manufacturing infrastructure in China due to the combination of the large employment base that is generated and the benefits that are obtained from having control over the full supply chain.

It will be necessary to gain access to technologies from foreign companies for product design, IP, and manufacturing, which can be done through acquisitions and joint ventures. The acquisition of OmniVision Technologies by Hua Capital Management is a good step because it provides access to competitive image sensor technology.

It is also essential to make a number of other strategic acquisitions in order to build a $100 billion semiconductor industry by 2020. Substantial funding would be required to make these acquisitions.

There are more than 400 fabless companies in China, but without the establishment of appropriate strategies and operating structures, they will compete with each other rather than focusing on building a strong supply chain in China. It would be the classic "fighting at home" conundrum.

A number of high profile and successful projects have been established in China, and a high-level project approach will be needed to build a $100 billion semiconductor industry by 2020. The role of government will be critical in setting the goals and in providing the guidelines for achieving the mark because market forces alone will not be adequate.

In addition, the role of entrepreneurs will be important in implementing top-level strategies. The structure of corporations and the financial metrics that are established need to drive the development of corporations that gain high market share, generate good financial returns and provide a large and diverse employment base within the high technology industry.

Chinese semiconductor companies will need to focus on end markets such as smartphones, tablet computers, cloud computing, IoT, automotive electronics, medical electronics, energy distribution and other strategic market segments. High market share will need to be generated based on technology leadership.

There are longer-term benefits for China in building a $100 billion semiconductor industry, which is one of the most important industries that can be addressed by China to become a global power in the high-value and high-technology segments of the electronics industry.

The author is founder, chairman and CEO of International Business Strategies, Inc (IBS), which is based in Los Gatos (California) and has been in business for more than 25 years.

(China Daily USA 10/07/2014 page12)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

HK occupiers urged to reflect on campaign

Chinese actress Li Bingbing calls for action on climate change

Big believer in real estate now a skeptic due to sluggish sales

WB cuts China growth forecast

World Bank weighs protest's economic impact

162,629 'phantom' staffers taken off govt payrolls

Holiday tourism fever continues

Smog, fog to shroud China

US Weekly

|

|