All the world's a Chinese investment stage

Updated: 2016-02-01 08:49

By Chen Yingqun(China Daily USA)

|

||||||||

Big, medium or small, domestic companies accelerate their global play across industries

China's most important holiday, the Lunar New Year, is drawing near, but entrepreneur Shu Wenbin has no intention of relaxing and taking time out to party. Instead, it's his busiest time of the year.

Apart from meetings with potential partners across China, the general manager of Continental Interior Design and Construction Ltd also plans overseas trips to the United States and other markets to seek out business opportunities he may able to seize after the holiday.

"China's real estate and construction industries have slowed down in the past two years, new residential and commercial projects are seeing sluggish growth, and investment prospects are uncertain," he said.

"Overseas markets, especially in Southeast Asia and South America will be new growth points. Prospects in European and US markets are also good."

Shu's company, which offers interior design and construction services, started its overseas business in 2012 through its partners, big state-owned enterprises operating overseas. The company has about 150 employees and annual revenue of about 300 million yuan ($45.5 million; 41.8 million euros), of which about 20 percent is from overseas.

It used to enjoy about 30 percent annual growth on average, but in the past two years, with slower growth in the construction sector and rising labor and material costs, searching for new opportunities globally has become an attractive option.

"We are planning to set up a company and operate directly overseas, and I want half of the company's revenue to come from overseas by 2017," Shu said.

His company is typical of Chinese small and medium-sized enterprises that are increasingly going global at a time when the government is accelerating economic restructuring and easing restrictions on overseas investment.

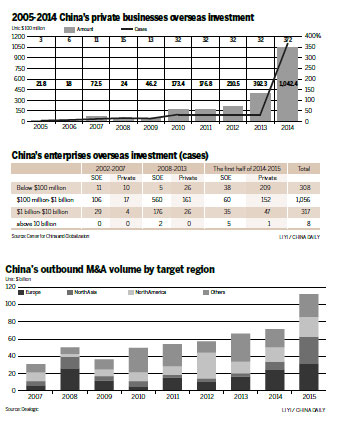

Headline-grabbing mergers and acquisitions by Chinese enterprises of totemic companies in the West suggest an invasion, but it was only in 2014 that China's outbound investment reached $140 billion, for the first time overtaking inbound investment of $120 billion, according to the Ministry of Commerce. President Xi Jinping predicted in 2014 that China's outbound investment will reach $1.25 trillion over the next decade.

This trend is set to accelerate. The 2015 Report on Chinese Enterprise Globalization, published by the Beijing-based Center for China and Globalization, said that in 2014 and the first six months of 2015, the annual number of newly increased outbound investments (686) was about six times the average number (121) from 2008 to 2013.

"We are on the verge of a big wave of Chinese companies going global," said Wu Jianmin, China's former ambassador to France. "In the past, it was mainly big companies that were interested in going global, but now so are smaller and medium-sized companies. Many companies have realized that if they don't look for opportunities globally, they will probably die in China finally."

In 2015, Chinese companies made nonfinancial direct investments of $118 billion in 5,085 companies in 153 countries and regions, a year-on-year increase of 14.7 percent, according to the Ministry of Commerce.

Wang Huiyao, director of the Center for China and Globalization, said in about 63 percent of the cases, Chinese companies' overseas investments are between $100 million and $1 billion.

"The number of smaller outbound investments (below $100 million) is growing fastest, as private companies and SMEs are playing a bigger role," he says, adding that, in 2014, private companies' outbound investments saw a year-on-year growth of 295 percent, and they made up of 69 percent of the total number of cases.

Xiao Qiang, director of the China Small and Medium-Sized Enterprise Institute, said most SMEs that the institute has helped go global have annual revenue of between 50 million yuan and 400 million yuan and an employee headcount below 2,000.

He said of the total, SMEs' outbound investments account for 30 percent of the value and 80 percent by number of cases.

Long Yongtu, former vice-minister of commerce, says the trend of Chinese companies going global is irreversible. China's corporate and private bank deposits amount to more than 138 trillion yuan, and the abundance of capital makes it easier for Chinese companies to invest overseas.

"Globalization is to allocate resources globally. If Chinese restructuring is conducted with a global scope, its economic transformation would be less painful and is more likely to succeed," he said.

Wang Chaoyong, founder and CEO of ChinaEquity Group, a Chinese venture capital institution, said there are three ways for Chinese companies to go global: products, industrial capacity and capital.

"I have observed huge changes in all these three," he said. "In the products, I have seen quality, added value, and brands have improved greatly. In capacity going global, a big feature is that, be it a State-owned company or SME, they cooperate and form clusters to explore overseas markets."

For capital going global, Chinese investors in the past would typically buy US treasuries, European government bonds or some blue chips, but now private equity and venture capital have become the main avenues for capital going global.

"The number of overseas mergers and acquisitions is also increasing rapidly, through which many companies are able to get overseas products, technology, sales channels, design, and so on," he said.

A recent example is Shenzhen Ellassay Fashion Co Ltd, a high-end female clothing company, which bought a Hong Kong company that owned the German fashion brand Laurel for 11.18 million euros ($12.1 million) as part of its global expansion. The takeover would see Ellassay own Laurel's design, pricing and production rights at all its stores on the Chinese mainland.

A recent report from Dealogic, an international information provider on investment deals, says Chinese outbound M&A volume increased for the sixth consecutive year to a record $111.9 billion in 2015, breaching the $100 billion mark for the first time.

A recent report from Boston Consulting Group shows the changing trends in Chinese overseas M&As. From 1990 to 2014, about 40 percent of M&As were in energy and resources. But in recent years, only about 20 percent have involved energy and resources, while about 75 percent were in technology, brands and market share.

Manufacturing is an important sector that has drawn the attention of Chinese entrepreneurs, who are encouraged by Made in China 2025, China's national strategy to upgrade its manufacturing sector.

Figures from the Ministry of Commerce show that, from January to November 2015, outbound investment in the manufacturing sector was about $11.8 billion, a year-on-year increase of 95.4 percent, with $5.89 billion going to equipment manufacturing, a year-on-year rise of 117.3 percent.

chenyingqun@chinadaily.com.cn

|

Long Yongtu, former viceminister of commerce, said that the trend of Chinese companies going overseas is irreversible. Chen Yingqun / China Daily |

|

Wang Huiyao, director of the Center for China and Globalization Provided To China Daily |

|

Wu Jianmin, China's former ambassador to France Provided To China Daily |

(China Daily USA 02/01/2016 page15)

- Students must learn safety education, experts say

- 73 bodies recovered from rubble of Shenzhen landslide

- Chinese travelers lead 2015 global outbound tourism

- S Korea to issue 10-year visa to highly-educated Chinese tourists

- A glimpse of Spring Rush: little migrant birds on the way home

- Policy puts focus on genuine artistic students

- Negotiating political transition in Syria 'possible': Hollande

- At least three killed in light plane crashes in Australia

- BOJ further eases monetary policy, delays inflation target

- DPRK may have tested components of hydrogen bomb

- Goodwill sets tone at Wang, Kerry's briefing

- Obama picks new Afghan commander

Year of the Monkey arriving in Washington

Year of the Monkey arriving in Washington

Djokovic puts down Federer fightback to reach final

Djokovic puts down Federer fightback to reach final

Treasures from Romania shine in Beijing museum

Treasures from Romania shine in Beijing museum

First container train links China to Middle East

First container train links China to Middle East

'Monkey King' performs dragon dance in underwater tunnel in Tianjin

'Monkey King' performs dragon dance in underwater tunnel in Tianjin

The odd but interesting life of a panda breeder

The odd but interesting life of a panda breeder

Top 10 best selling cars on Chinese mainland 2015

Top 10 best selling cars on Chinese mainland 2015

Warm memories in the cold winter

Warm memories in the cold winter

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

National Art Museum showing 400 puppets in new exhibition

Finest Chinese porcelains expected to fetch over $28 million

Monkey portraits by Chinese ink painting masters

Beijing's movie fans in for new experience

Obama to deliver final State of the Union speech

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

US Weekly

|

|