Chinese investors warm up to US

Updated: 2016-03-23 10:51

By Paul Welitzkin in New York(China Daily USA)

|

||||||||

As more Chinese companies set up shop in the US, Chinese investors are eager to follow those companies into American capitalism by investing in US stocks, observers said.

Noting that investment diversity is considered an admirable goal by many professionals, Chinese investors see US shares as a good hedge for their portfolios, and now thanks to the Internet, the process of opening an account to buy and sell US stocks is also relatively easy.

"People who want to diversify their investments seek US stocks," Jack Liu, senior vice-president of Chardan Capital Markets in New York, told China Daily. "I believe a lot of Chinese investors are between 30 and 40 years old and many have a Western education. They think they understand US markets and are familiar with it because they may have lived in the US at one time."

He said many Chinese investors who acquire US stocks are high net-worth investors. "They will use a US brokerage like Morgan Stanley to open an account," he said.

John Liu, no relation to Jack Liu, is the founder and CEO of Firstrade Securities Inc, in Flushing, New York. After working for US brokerage Merrill Lynch, he started Firstrade in 1985 and in 1997, he opened an online brokerage.

He describes the typical Chinese investor in US stocks at his firm as those who were born after 1980 or even after 1990.

"Many of them are employed by a technology company and they may have come to the US in the last 10 years or so. They are very tech savvy. The males slightly outnumber the females and most are upper-income individuals," he said in an interview.

Most Americans prefer to use a professionally managed mutual fund or exchange-traded fund (ETF) for their stock investments, John Liu said, but Chinese investors prefer to invest in individual companies.

"Investor participation in the institutional level with a mutual fund or ETF is very low for Chinese investors," he said. "They don't think about mutual funds or ETFs. They want to invest in Chinese companies that are listed in the US like Alibaba and Baidu. They are familiar with the company and the brand."

Noting that most Chinese investors in US stocks now are upper-income individuals, John Liu expects mutual funds and ETFs to gain popularity with Chinese clients in the future.

"As the middle class grows, the trend will be to use more mutual funds and ETFs," he said. "Americans now believe that it is best to have a professional manage their investments for the long term. I suspect the Chinese will eventually warm up to this as well."

Most Chinese investors view US stocks as a way to balance their portfolios with assets that are not connected to the value of the yuan, John Liu said.

"In addition to diversity, Chinese investors are looking for what they believe is a stable alternative. They see the US as a safe-haven currency. It's also why the Chinese seek to invest in US property as well," he added.

He said individual Chinese investors can send no more than $50,000 a year out of the country to buy stocks and other investments under current laws in the Chinese mainland.

He said opening an account with a brokerage is a simple process for most Chinese investors. He said they need an acceptable Chinese form of identification.

paulwelitzkin@chinadailyusa.com

(China Daily USA 03/23/2016 page2)

- Police issue wanted notice for suspect after Brussels attacks

- China eyes cooperation plan for Lancang-Mekong countries

- Toronto's colorful former mayor Rob Ford dies of cancer

- NASA's Kepler sees first 'shock breakout' in exploding star

- First case of Zika virus detected in S.Korea

- Syrian mothers: Survival and loss

Migrant couple returns to hometown to raise chickens

Migrant couple returns to hometown to raise chickens

Victims of Brussels attacks commemorated

Victims of Brussels attacks commemorated

In photos: Brussels rocked by multiple explosions

In photos: Brussels rocked by multiple explosions

Raul Castro and Obama hold talks in Havana

Raul Castro and Obama hold talks in Havana

Facebook's Mark Zuckerberg visits China's Great Wall

Facebook's Mark Zuckerberg visits China's Great Wall

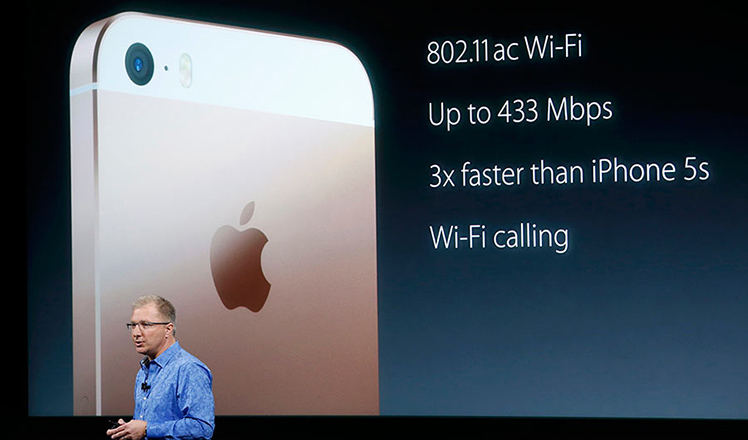

Apple releases smaller iPhones for new consumers

Apple releases smaller iPhones for new consumers

China's 'sleep testers' search hotels for a good night's rest

China's 'sleep testers' search hotels for a good night's rest

Practice makes perfect: Preparing for Boao forum

Practice makes perfect: Preparing for Boao forum

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Marriott unlikely to top Anbang offer for Starwood: Observers

Chinese biopharma debuts on Nasdaq

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

Accentuate the positive in Sino-US relations

Dangerous games on peninsula will have no winner

National Art Museum showing 400 puppets in new exhibition

US Weekly

|

|