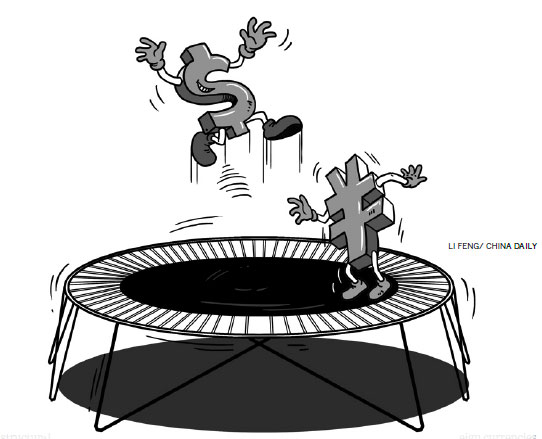

Renminbi is convenient scapegoat, not culprit

Updated: 2016-06-07 08:18

By Dan Steinbock(China Daily USA)

|

||||||||

Even before the start of the eighth Strategic and Economic Dialogue the issue of the renminbi's exchange rate was back on the agenda.

When China's growth model still relied on exports and investment, US allegations of currency manipulation by China topped the list of bilateral concerns in Washington. Before the S&ED meetings, US Treasury officials would threaten to label China a "currency manipulator" in exchange for "greater reforms" (economic initiatives deemed in the US' interests).

China has intensified financial reforms. But in its exchange-rate reforms, it is likely to emulate other Asian economies, such as South Korea - not the US.

At a time when China is moving away from net exports, it is not in China's interest to "manipulate" its currency to boost exports.

After years of trade surpluses and large-scale foreign direct investment inflows, China's foreign exchange reserves stand at $3.2 trillion. However, the US has had a trade deficit with Asia for decades; first with Japan, then with small Asian tiger economies, more recently with China. The US trade deficit has been regional and multilateral, not bilateral.

Some critics claim that the renminbi is depreciating because China faces the challenge of capital outflows, but they tend to mistaken cyclical fluctuations with structural trends. In reality, China's foreign-exchange reserves actually rose in April; for the second straight month. The US Treasury's effort to "press China" to move toward a "market-determined exchange rate" reflects election politics in the US.

So what's the real story of the Chinese renminbi today?

The exchange rate was about 6.05 Chinese Yuan (CNY) to the dollar in January 2014. As the US Federal Reserve ended its quantitative easing and began to prepare for rate hikes, the dollar began to rise. In August 2015, it was around 6.21 CNY to the dollar and, after the subsequent renminbi devaluation, 6.36.

But after late March, the renminbi began appreciating. Moreover, after the Chinese New Year, the exchange rate has largely correlated with the US Dollar Index, which measures the value of the dollar relative to a basket of foreign currencies.

The correlation is not a surprise. The basket of the US Dollar Index currencies accounts for some 70 percent of the weights in the Renminbi Index launched in December 2015. As the renminbi is now managed via a basket of currencies, China is not unilaterally driving the renminbi weaker - despite US election rhetoric.

Today, the exchange rate is about 6.57 CNY to the dollar. After hosting the G20 Summit, the renminbi will officially join the International Monetary Fund's international currency basket in early October. It is thus very much in Chinese interests to keep the renminbi stable.

From fall 2014 to spring 2015, the US dollar strengthened significantly, as evidenced by the US Dollar Index. In spring 2016, it declined somewhat.

In January, the Fed tempered rate hike expectations citing "global risks." In late February, the G20 countries agreed to move away from relying too heavily on zero-bound interest rate policies to support growth. After these two measures, the markets began to improve significantly.

However, rate hike speculation has returned in the past few weeks. As a result, economic uncertainty is increasing and market volatility climbing. However, that is not driven by the renminbi, but uneasy labor markets in the US, rising global uncertainty and the Fed's accompanying ambivalence.

If the Fed increases interest rates prematurely, the collateral damage will not be just domestic but global. In this scenario, the renminbi is not the appropriate culprit but a convenient scapegoat.

The author is the founder of Difference Group and has served as research director at the India, China and America Institute (USA) and visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Centre (Singapore).

(China Daily USA 06/07/2016 page12)

- Suspected IS terrorists arrested in Germany

- Japanese boy abandoned by parents in Hokkaido forest found alive

- China to build Africa's biggest university library

- 'Kill list' found in UCLA campus shooter's residence: Police

- Swiss declare Alps tamed as Gotthard rail tunnel opens

- China urges Japan to properly settle Chinese forced laborers issue

Popular foods to break fast during holy month of Ramadan

Popular foods to break fast during holy month of Ramadan

Top 10 biggest brands in Asia listed in media report

Top 10 biggest brands in Asia listed in media report

Things you need to know about China's gaokao

Things you need to know about China's gaokao

The world's most striking images: May 30 - June 5

The world's most striking images: May 30 - June 5

Djokovic conquers Roland Garros to join tennis pantheon

Djokovic conquers Roland Garros to join tennis pantheon

Students receive gaokao cheers in east China

Students receive gaokao cheers in east China

Students use creative ways to relieve gaokao stress

Students use creative ways to relieve gaokao stress

Frederik the Great: Is it a horse or a stunning statue?

Frederik the Great: Is it a horse or a stunning statue?

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

Chinese State Councilor Yang Jiechi to meet Kerry

Chinese stocks surge on back of MSCI rumors

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

US Weekly

|

|