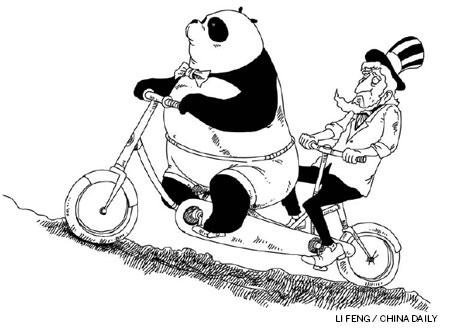

Change drives China-US talks

Updated: 2013-07-17 07:49

By Dan Steinbock (China Daily)

|

||||||||

The fifth US-China Strategic & Economic Dialogue, held in Washington last week, provided an opportunity for new senior policy teams on both sides to take measure of each other and work on key bilateral, regional and global issues.

Although many jaded US political observers say the S&ED has become unwieldy and excessively process-oriented, the reality is that things are changing. The operating environment of the US-China talks is shifting toward multipolarity - as proven by a slate of proposed regional trade deals and the cybersecurity debate.

US-China dialogue rests on strategic and economic tracks. The former covers vital security issues, such as Chinese military modernization, maritime disputes in Asia, US strategic pivot to Asia, bilateral military-to-military relationship, Iran's nuclear program and the denuclearization of the Korean Peninsula. It also includes cross-Straits relations and US arms sales to Taiwan.

In cybersecurity, former National Security Agency contractor Edward Snowden's expos of the US surveillance program created a storm in both countries, as well as the rest of the world, and severely harmed US credibility. In China, many political analysts say that, after the popularity of the Barack Obama administration began to fall, it became more vocal in alleging that China had violated cybersecurity.

Now China, along with other BRICS member states and Germany, accuses the US and US-based interests of violating cybersecurity. It also accuses the NSA of having cozy relationships with the largest US-based Internet giants, from Google to Microsoft, saying they should be commercial companies rather than extensions of the government's intelligence wing.

Not surprisingly, the inaugural session of the highly anticipated US-China bilateral working group on cybersecurity preceded the S&ED meeting, enabling both sides to insulate the Strategic and Economic Dialogue from the cybersecurity flames.

In the ultimate analysis, though, cybersecurity is a global challenge and requires multipolar cooperation.

The S&ED focused on economic issues, including China's reforms, bilateral trade deficit, innovation policies and intellectual property rights, the US' quantitative easing (QE) and China's currency policy, US Treasuries held by China and global trade issues.

The Bilateral Investment Treaty talks represent a potentially promising area in China-US dialogue. A successful BIT could re-anchor the bilateral economic relationship in the 21st century, support economic reforms in China and energize US companies in the world's largest emerging market. In practice, the BIT talks appear to be secondary to broader, regional trade negotiations, whose outcomes could be inclusionary as well as exclusionary - as seen in recent trade friction between the European Union and China, for instance.

Washington has started paving the way for broad free trade talks with the EU, while preparing for the next stage of negotiations with select Asia-Pacific nations. From the standpoint of the White House, these initiatives are efforts to find new catalysts for economic growth. However, the absence of China from both negotiating tables has prompted Chinese observers to see the talks as efforts to contain China's trade.

Realistically, the US-EU trade talks may raise heat on China, but they could also work for China. As advocates of the US-EU trade pact acknowledge, the proposed deal is likely to take years to negotiate and implement and, hence, will not support recovery policies anytime soon.

Moreover, a deal that would fuel growth and thus imports in the US and Europe could also support Chinese imports, which totaled $808 billion in the two regions last year. Also, the US-EU talks are likely to provide an added incentive for China to negotiate a parallel trade and investment deal with the US.

Whatever the outcome, the net effect of these economic forces is that they will energize multipolar trends from the US to the EU, and from China and Japan to Southeast Asia.

The Obama administration is also preparing for the next round of the Trans-Pacific Partnership talks, which includes Japan and several Asian and Latin American countries, but not China. Indeed, the TPP could have a more direct, proximate and immediate impact on China than the US-EU trade pact.

Over the past decade, some Asian countries and regions have shifted their productive capacity to China. Consequently, an exclusive trade deal would complicate efforts to ship parts to and from Asian countries outside the TPP group and thus jeopardize China's role as the final assembly point.

However, as Europe copes with a "lost decade" and the US must soon begin the exit from liquidity-driven growth, it is China's massive market that will offer growth prospects in Asia and worldwide. An exclusionary approach would increase the TPP countries' pricing pressures and complicate efforts to increase their presence on the Chinese mainland.

An inclusionary approach could offer a way out of the current TPP quagmire. If China were to join the TPP talks, the long-term outcome could be more favorable to the US, Japan, and other Asian and Latin American countries.

As the talks on cybersecurity, US-EU and TPP trade deals indicate, the old unipolar world of military might is giving way to an emerging world of economic multipolarity. It is this transition that now drives US-China talks as well.

The author is research director of international business at India, China and America Institute, a US-based independent think tank, and a visiting fellow at Shanghai Institutes for International Studies and Singapore's EU Centre.

(China Daily 07/17/2013 page9)

Panama finds 'missile equipment' aboard DPRK ship

Panama finds 'missile equipment' aboard DPRK ship

Free on his feet

Free on his feet

Extreme heat causing vehicle fires

Extreme heat causing vehicle fires

Men, you look good in slim elegant cut

Men, you look good in slim elegant cut

Luxury dresses in plastic

Luxury dresses in plastic

Obama urges restraint amid protests

Obama urges restraint amid protests

Putin wants Snowden to go, but asylum not ruled out

Putin wants Snowden to go, but asylum not ruled out

Apple to probe death of Chinese using charging iPhone

Apple to probe death of Chinese using charging iPhone

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Asiana crash passengers sue Boeing

Li highlights economic restructuring

Merkel's rivals go on attack over US spying

'Missile equipment' found aboard DPRK ship

Egypt's interim govt takes oath

Gay marriage to be legal in UK

China signs cooperation agreements with Belarus

Philippines' accusation refuted

US Weekly

|

|