Trade marriage to hit new heights

Updated: 2011-09-02 09:02

By Ariel Tung (China Daily)

|

|||||||||

|

|

Firms in Indiana, Zhejiang look to create jobs through biz deals

Their landmasses are very similar. Manufacturing dominates each region. Each is economically invested in what the other region produces.

The connections between the state of Indiana and Zhejiang province, which established ties as sister states in 1987, are already numerous, but in the next few years, leaders from both regions say they are planning to further cement economic ties.

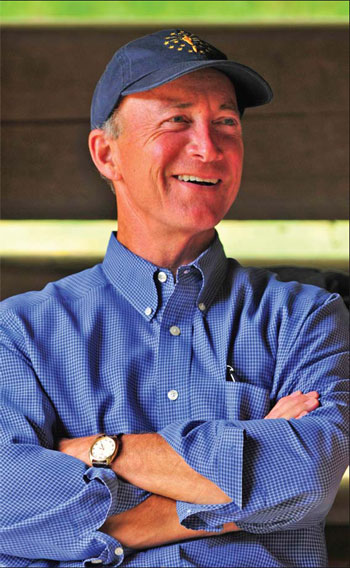

"Indiana is very excited and proud of the significant flow of the Chinese investments that have only begun in our state. We hope Chinese investments will continue to rise sharply in our state," says Indiana Governor Mitch Daniels.

China is Indiana's fastest-growing export market. According to a report from the US-China Business Council, the state's exports to China in the last 10 years have grown a hefty 554 percent, while the state's exports to all other countries have grown by 81 percent.

Daniels says China has contributed at least five significant job-creating investments to the state in the last few years in sectors ranging from manufacturing to automotive to agriculture and furniture.

China's investments across many sectors of Indiana reflect the nation's growing investments across the United States. A recent study by the Asia Society in New York estimates that China could potentially invest almost $2 trillion overseas in the next 10 years with a great portion of that heading to the US.

When Daniels first took office in 2005, he made job creation his top priority. He created the public-private Indiana Economic Development Corporation (IEDC) to replace a failing state bureaucracy in attracting new jobs. In 2008, CNBC named Indiana as the most improved state for business in the nation.

As a result of his efforts, Indiana's cemented relationship with Zhejiang province has brought Chinese businesses to the Hoosier state, such as Wanxiang Group Corp and Anji Yuankai Furniture Co.

Zhejiang, located on the east coast of China, is known for its thriving private sector. Daniels says he wants to concentrate on attracting the province's investments. He has visited Zhejiang twice in the last two years with other Indiana officials and business executives.

"Zhejiang is dynamic with many, many strong companies and we thought it would be wise to concentrate our efforts there. There is more than enough business in Zhejiang alone, if Indiana is good at competing for it," he says.

Both regions are strong in the automotive, manufacturing and pharmaceutical sectors. In the past, Indiana has landed high profile automotive investments from Toyota and Honda. Today, Indiana's growing profile in the electric vehicle supply chain is attracting China's investors.

In July, a Wanxiang Group division called Wanxiang Electric Vehicle Co announced a joint venture with lithium-ion battery maker Ener1 to co-manufacture lithium-ion cells and battery packs for the Chinese market.

The new company, named Zhejiang Wanxiang Ener1 Power System Co Ltd, will make use of Wanxiang's existing facility in Hangzhou to produce enough battery cells to power about 40,000 electric vehicles annually by 2014.

Daniels says Wanxiang is by far the largest Chinese investment in Indiana in terms of jobs creation. He says that within the next few years, Zheijiang Wanxiang Ener1 Power System will employ as many as 3,000 employees in Indiana.

That same month, Zhejiang and Indiana held the largest Indiana-Zhejiang trade symposium in Indianapolis. Zhejiang-based companies such as Alibaba, CHINT Group, Wanxiang, Zhejiang Westfield Outdoor and Hangzhou Wahaha Co were among the 170 Chinese and US businesses attending the event.

At the symposium, at least 12 deals worth a total of $364 million were signed. One of the biggest deals announced at the symposium was Nanshan America's near $100 million investment to establish an aluminum extrusions manufacturing facility in Lafayette, where it will make aluminum components for transportation and industrial machinery. The deal with Nanshan was reportedly a result of Daniels' trip to China last November.

"Word is getting out that Indiana is a low-cost, business-friendly state for investors looking to bring a piece of their business to the US," Daniels says. "I think we are at the front edge of a major trend of bringing dollars back from China and putting Hoosiers to work."

The IEDC offered Nanshan up to $1.3 million in tax credits based on the company's job creation plans. It is expected that hiring for assembly, supervisory and clerical associates will begin in the fall with additional hiring spread out over the next few years.

In a statement, Nanshan President Du Lijun says he chose Indiana because of the state's sound business environment, low costs of doing business in the state, strong workforce base, as well as technical support from Purdue University and Ivy Tech Community College.

Last year, Anji Yuankai Furniture announced its decision to invest $24.3 million to establish its first US subsidiary, King's Group USA LLC, in the Indiana city of Marion.

Techtop Motor LHP, based in Columbus, Indiana, is another significant joint venture formed last year between Indiana-based LHP Technologies and Shanghai Top Motor. The company's new facility in Columbus serves as a distribution center for its brake motors.

Daniels also says the state is very open to forging education ties with China. Indiana University, Purdue University and the Rose-Hulman Institute of Technology all have higher education partnerships with Zhejiang, according to the Office of the Governor.

In February, Indiana University was awarded the graduate flagship program for Chinese education by the National Security Education Program with a federal grant of $560,000. The university also won a $120,000 federal grant to help high school teachers teach Chinese in 2008.

In March, Purdue University announced the Global Business Engagement Initiative to help Indiana businesses and communities that want to explore ventures in China.

Daniels says he is proud of the success of some Indiana companies that have ventured into China, especially in the automotive sector. He says that their growth in China has made many more jobs possible in Indiana.

Through a joint venture with Chinese automaker Dongfeng Motor Corp, Columbus-based Cummins opened its first Chinese site in Wuhan, Hubei province, in 2008 to tailor and develop products for the Chinese market.

"Cummins made a few announcements last year about its business plans in China, which will bring more than 1,000 new jobs to Columbus, Indiana. American investment in China is leading to more jobs back in America," Daniels says.