Brazilian iron ore imports at record

Updated: 2014-01-27 06:10

By DU JUAN (China Daily Latin America)

|

||||||||

|

|

Quality inspection officials in Rizhao, Shandong province of China inspect iron ores imported from Brazil. China imported about 170 million metric tons of Brazilian iron ores last year and the demand from the world's second-largest economy is expected to remain high. provided to China Daily |

Brazil's iron ore exports to China reached a record high of more than 170 million metric tons in 2013 and will continue to increase as the demand for resources by the world's second-largest economy keeps rising alongside urbanization.

According to the Secretary of Foreign Trade of Brazil, the country exported 170.1 million tons of iron ore to China in 2013, up around 4 percent from the previous year.

"Brazil's iron ore exports to China have been increasing in the past five years and the trend will continue this way in the future," said Zhang Tieshan, a senior analyst with industrial information provider Mysteel.com.

Australia is the biggest iron ore exporter to China, followed by Brazil, India, South Africa and Ukraine. The top four provide about 90 percent of China's iron ore imports.

"Even though Australia is the biggest iron ore exporter to China, Brazil has a stable trading relation with China because they are both Bric countries," Zhang said. "Against the background of such huge iron ore demand in China, there is no marketing problem for Brazil, but the shipping fees are expensive from Brazil compared with other importers."

As a result, a recent fall in shipping fees is an advantage for Brazil's iron ore traders, Zhang said.

In the past 10 years, China's massive infrastructure construction and ongoing urbanization process have brought a rapid demand for iron ore.

As the world's second-largest iron ore producer, Brazil's exports to China have soared from 38 million tons in 2003 to 171 million tons in 2013, a 4.5 time increase within 10 years.

Brazil is also providing a bigger share of China's iron ore imports.

According to Wind Information Co Ltd, a financial information provider, Brazil accounted for 20.8 percent of China's iron ore imports in 2011 and that grew to 22.09 percent in 2012.

The increasing iron ore exports from Brazil are part of a strengthening trade relationship between the two countries.

According to data from the Brazil government, Brazil's foreign trade volume totaled $481.79 in 2013 with China its largest trading partner.

In the last year, Brazil exported mainly cathode copper, copper ore, soybeans, sugar and iron ore to China, with a total value of $46 billion, up 10.8 percent year-on-year.

Comparatively, Brazil's export volume with its traditional trading partner — the United States, declined from $26.84 billion in 2012 to $24.85 billion in 2013.

Vale SA, the Brazilian mining giant, is one of the top three contributors to the country's exports. The company's external sales reached $26.5 billion yuan in 2013, up 3.6 percent year-on-year and accounting for about 11 percent of Brazil's total export volume.

The Brazilian company said it has confidence in China's iron ore demand even though the country is slowing its economic growth rate, and has an overcapacity problem in the domestic steel industry.

Vale estimated that the company would export about 1.1 billion tons of iron ore to China over the next six years.

To realize that target, the company plans to invest $3.5 billion to raise its annual iron ore capacity by 50 percent to 450 million tons by 2018.

China will import 850 million tons of iron ore in 2014, according to Li Xinchuang, head of the China Metallurgical Industry Planning and Research Institute.

He estimated imports in 2013 will have totaled 800 million tons, up 7.5 percent.

China is transforming its economic restructuring from an investment-oriented mode to a consumption-oriented one, which has caused a slowing in the iron ore demand growth rate.

However, iron ore demand will still continue to increase on a large scale because of the huge benchmark amount.

Syria talks bring offer of exit from siege of Homs

Syria talks bring offer of exit from siege of Homs

Anti-World Cup protests wane in Sao Paulo

Anti-World Cup protests wane in Sao Paulo

Motorcyclists brave windchill for homecoming

Motorcyclists brave windchill for homecoming

8.8% salary hikes expected for 2014

8.8% salary hikes expected for 2014

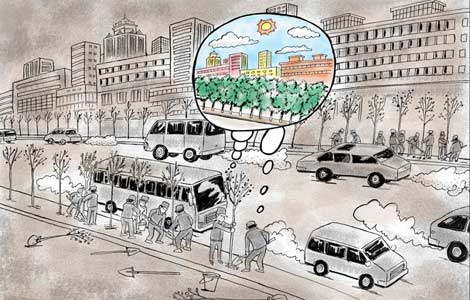

Holiday fireworks lose their sparkle amid smog

Holiday fireworks lose their sparkle amid smog

Three dead in US mall shooting

Three dead in US mall shooting

Thrill of victory

Thrill of victory

First amphibious aircraft lures tourists

First amphibious aircraft lures tourists

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Talent returns to China, but progress slow

Gunman in mall shooting identified

China's banks must evolve or perish

China takes measures against H7N9

Holiday fireworks lose sparkle

US tariff investigation clouds commerce

Uygur teacher involved in separatism

Three dead in US mall shooting

US Weekly

|

|