Swiss turn eagerly to renminbi

Updated: 2015-01-22 07:33

By Zhao Yinan in Davos, Switzerland and Zhao Shengnan in Beijing(China Daily USA)

|

||||||||

|

|

Premier Li Keqiang attends the International Business Council of the World Economic Forum in Davos, Switzerland, on Wednesday. Rao Aimin / Xinhua |

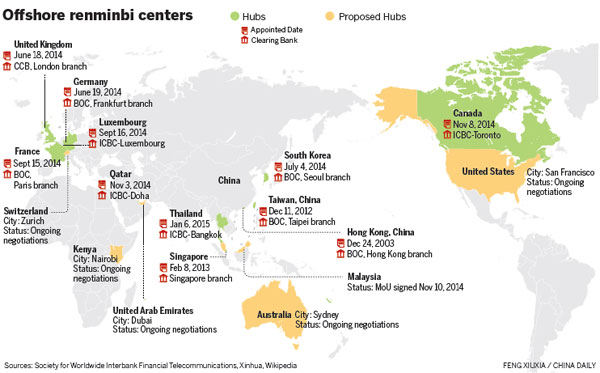

Chinese bank awaits approval to establish operations in Zurich, a world finance center

After ditching its euro cap, Switzerland courted the yuan with renewed vigor as it signed key financial deals with China on Wednesday.

Zurich received 50 billion yuan ($8 billion) as its Renminbi Qualified Foreign Institutional Investors quota, which will allow investors in Switzerland's financial capital to invest renminbi directly into Chinese financial markets.

The countries also signed a document that will see the first branch office of a Chinese bank in a country known for its banking prowess.

The establishment of a Chinese bank, still waiting for approval from the Swiss authorities, is a prerequisite for a bilateral currency swap deal and a major step in building Zurich into an important offshore center for the renminbi.

Premier Li Keqiang and the president of the Swiss Confederation, Simonetta Sommaruga, witnessed the signing of the deals on Wednesday after the two met in Davos, where the annual meeting of the World Economic Forum is underway.

Experts said Switzerland's decision to scrap the Swiss franc-euro cap indicates that the country is seeking alternative partners as the outlook for the euro remains bearish in light of looming quantitative easing and an expected drop in value.

Zurich's status as an international financial center will also help to speed up the internationalization of the renminbi, the experts said.

Zurich is the latest city in Europe to compete for the RQFII program - launched by the Chinese government in 2011 - following Luxembourg, London, Frankfurt and Paris.

Last year, China's foreign currency watchdog said at least 71 international financial institutions have taken part in the program, with a total allowance of 250.3 billion yuan.

Ding Yifan, a researcher at the State Council's Development Research Center, said European cities are eager to become more engaged in the renminbi business because of it's huge potential benefits.

In addition to speeding up the internationalization of the renminbi, the program will help reduce risk for Chinese businessmen if they can settle exports and imports in renminbi, instead of dollars or euros, Ding said.

The yuan appears headed for the major leagues of currency after a surge in interest. Offshore trading in yuan soared some 350 percent on Thomson Reuters trading platforms in 2014.

Dong Jinyi, former Chinese ambassador to Switzerland, said closer financial cooperation with China shows that Switzerland is optimistic about the renminbi because it is backed by the Chinese economy's size and growth rate.

Data released on Tuesday by the government showed that China's economy grew by 7.4 percent in 2014, its slowest pace in 24 years. But GDP exceeded $10 trillion for the first time last year and the growth rate is in line with market expectations.

Cooperation will also boost trade and investment between China and Europe, Dong said.

Switzerland is China's fifth-largest trading partner in Europe. Both countries' trade volume reached $59.5 billion in 2013, up by 126 percent, according to Chinese customs reports.

Contact the writer at zhaoyinan@chinadaily.com.cn

Li predicts bright future for real estate

Li predicts bright future for real estate

Wanda boosts its branding in Europe

Wanda boosts its branding in Europe

Ontario highlighted in overseas investment forum

Ontario highlighted in overseas investment forum

Texas executes man convicted of killing 3

Texas executes man convicted of killing 3

US, Cuba end migration talks

US, Cuba end migration talks

HK trade office refresh ties in Toronto

HK trade office refresh ties in Toronto

US Justice Department ready to clear Ferguson

US Justice Department ready to clear Ferguson

Across Canada Jan 21

Across Canada Jan 21

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US rejects DPRK's call for six-party talks

Swiss turn eagerly to renminbi

Business leaders are optimistic

Li predicts bright future for real estate

Chinese developer buys Canadian ghost town

Bank takes renminbi-clearing seriously

Stampede victims' families compensated

Oil-price drop spurs Chinese to invest in Texas

US Weekly

|

|