HSBC's journey to participate in China's green finance market

Updated: 2015-05-14 23:09

By Cecily Liu(chinadaily.com.cn)

|

||||||||

|

|

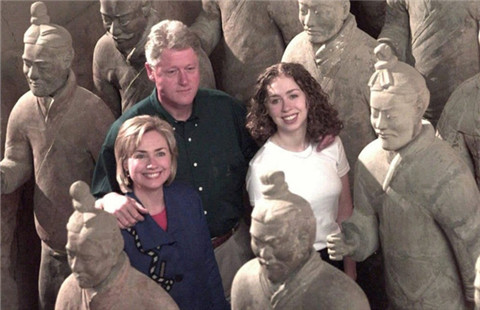

HSBC's sustainable financing forum in Beijing in April 2015. [Provided to China Daily] |

As China embarks on the important journey of developing a green finance market, HSBC is embracing the opportunity to help China by sharing international best practice and latest examples' with Chinese policy makers and clients across corporate and financial institutions to help identify this opportunity both domestically and internationally'.

HSBC has already demonstrated its commitment and experience in this task by acting as the sole lead manager for the first ever yuan-denominated offshore green bond, which was issued by the International Finance Corporation in London in June 2014.

The bank's leadership in this space is also evidenced by actively setting up the internationally recognized "green bond principles" with other ICMA members.

"As China continues to focus on how to mitigate the effects of rapid development and urbanization the potential demand for investment in green projects here is enormous," says Spencer Lake, Group General Manager, Global Head of Capital Financing, at HSBC.

"China has an insatiable demand for infrastructure investment, which will require innovative as well as traditional financing to succeed," Lake says.

In April 2015, HSBC again took the lead by hosting a one day forum in Beijing on sustainable financing, which was attended by Chinese policy makers, banks, insurance, corporates and public sector clients.

The forum covered topics including the importance, vision and next steps of China's green finance market, how it can take lessons from international best practices, what it means for the opening up of access to China's capital market, and the potential impact this market could have globally.

Lake says that sustainable finance is not just about addressing environmental challenges, but also finding solutions for financing long term investment and economic growth and supporting the necessary infrastructure and technology to make it happen.

"Green Financing aligns the international interests at both the political and business level. We need to understand where this trend goes and where the money flows," he says.

Green bonds are a relatively new asset class, started in 2008 when the World Bank's environment department issued the first. Proceeds were small, in the tens of millions of dollars, and there were few investors.

But over the past few years the global green bond market has grown rapidly, with issuance tripling in 2014 alone. The great potential of this market is still to be realized, with figures predicting new issuance of green bonds to triple again in 2015, reaching a staggering $100 billion.

Ulrik Ross, Global Head of Public Sector and Sustainable Financing at HSBC, says that China has the potential to become a global leader in developing the green bond market, due to the scale of projects available in the country and the great commitment the Chinese government has shown to grow this market.

He says that his team has witnessed a very high level of engagement from both Chinese public and private sector players at the recent HSBC conference in China, which has convinced him that progress on developing this market will be made very rapidly.

"With the right incentives structures, China can mobilize a lot of scale in green financing and that will have a transformational effect on the industry. If China becomes the first country to do so, others will follow," Ross says.

To achieve scale, he says it is important for China to establish transparent standards on green bonds, and to establish a system of certifying that the proceeds raised from the green bonds are directed towards environmentally friendly projects, he says.

Currently the Chinese government has established a 'special green finance task force'. The task force will help build an effective domestic green market, which includes defining 'green' by leveraging international standards and proposing an acceptable second opinion provider in China for verification purposes. Events such as the HSBC Beijing green bond conference have been key to facilitating such discussions.

Internationally, green bonds principals and regulations are established through the leadership of the International Capital Market Association, which then facilitates cooperation and discussions between representatives of issuers, investors and intermediaries in this market.

Ross says that he expects China's green bond market to soon establish new regulations and frameworks that borrow from successful lessons from the international market, but at the same time are also suitable for the Chinese context.

Ross says although green bond markets in mature Western countries have primarily grown through a non regulated and non incentivized model, he expects China's green bond market to grow through a more policy driven model, which will create scale for this asset class in the process. "A non incentivized model in China would work, but not to the same scale that China wants," he says.

Cannes Film Festival unrolls star-studded red carpet

Cannes Film Festival unrolls star-studded red carpet

Amazing artworks in supermarkets

Amazing artworks in supermarkets

Top 10 venture investors in the world

Top 10 venture investors in the world

Ten photos you don't wanna miss - May 14

Ten photos you don't wanna miss - May 14

Classical private school in Qinling Mountain

Classical private school in Qinling Mountain

Heads of state show you around Xi'an

Heads of state show you around Xi'an

Cross dressing for Peking Opera

Cross dressing for Peking Opera

Ten photos you don't wanna miss - May 13

Ten photos you don't wanna miss - May 13

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Xi to give Modi a hometown welcome

Cui rebuffs US stance on

S. China Sea

China set to delay maiden flight of C919 commercial jet

Police warn 'strange outfits' on subway may cause stampedes

At least six die in Philadelphia train derailment, scores hurt

Cui: How to get a win-win in Asia

Animated Deng Xiaoping set to hit silver screen this week

Foreign reserves show a record decline in Q1

US Weekly

|

|