China's central bank makes massive liquidity injection

Updated: 2016-01-30 10:18

(Xinhua)

|

|||||||||

|

|

A clerk counts yuan bills at a bank in Huaibei, East China's Anhui province. [Photo/IC] |

BEIJING - China's central bank is pumping huge flows of cash into the financial system via open market operations to stave off a pre-holiday liquidity squeeze.

The People's Bank of China (PBOC) on Friday offered 100 billion yuan ($15.3 billion) of funds to the market, using reverse repurchase agreements (repo), a process in which central banks purchase securities from banks with agreements to resell them in the future.

The move, following Tuesday's 440-billion-yuan reverse repo operations, the largest single-day liquidity injection in three years, and Thursday's injection of 340 billion yuan, has resulted in a net 690 billion yuan being pumped into the market this week.

The central bank said on Thursday that it would temporarily increase the frequency of its open market operations to every working day around the Lunar New Year holiday, compared with previously twice a week -- on Tuesday and Thursday.

The massive liquidity injection is intended to satisfy surging cash demand ahead of the week-long Lunar New Year holiday, which starts on Feb. 7.

Following the cash injection, the Shanghai Interbank Offered Rate (Shibor), which measures the cost at which Chinese banks lend to one other, fell slightly to 1.989 percent on Friday.

- China's consumer finance expected to be a market without ceiling

- No basis for renminbi to devaluate over long term

- Spillover effects of Chinese market fluctuation 'exaggerated': IMF deputy chief

- Chinese economy outlook upbeat amid favorable policy: experts

- China to issue digital currency 'as soon as possible'

- Students must learn safety education, experts say

- 73 bodies recovered from rubble of Shenzhen landslide

- Chinese travelers lead 2015 global outbound tourism

- S Korea to issue 10-year visa to highly-educated Chinese tourists

- A glimpse of Spring Rush: little migrant birds on the way home

- Policy puts focus on genuine artistic students

- Negotiating political transition in Syria 'possible': Hollande

- At least three killed in light plane crashes in Australia

- BOJ further eases monetary policy, delays inflation target

- DPRK may have tested components of hydrogen bomb

- Goodwill sets tone at Wang, Kerry's briefing

- Obama picks new Afghan commander

Djokovic puts down Federer fightback to reach final

Djokovic puts down Federer fightback to reach final

Treasures from Romania shine in Beijing museum

Treasures from Romania shine in Beijing museum

First container train links China to Middle East

First container train links China to Middle East

'Monkey King' performs dragon dance in underwater tunnel in Tianjin

'Monkey King' performs dragon dance in underwater tunnel in Tianjin

The odd but interesting life of a panda breeder

The odd but interesting life of a panda breeder

Top 10 best selling cars on Chinese mainland 2015

Top 10 best selling cars on Chinese mainland 2015

Warm memories in the cold winter

Warm memories in the cold winter

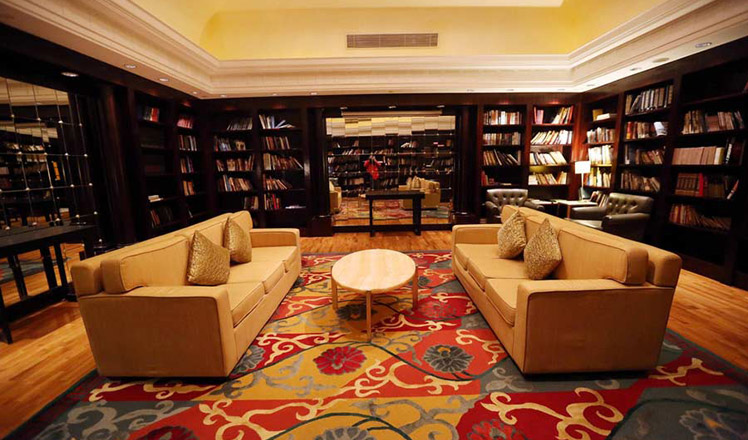

The world's highest library

The world's highest library

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

National Art Museum showing 400 puppets in new exhibition

Finest Chinese porcelains expected to fetch over $28 million

Monkey portraits by Chinese ink painting masters

Beijing's movie fans in for new experience

Obama to deliver final State of the Union speech

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

US Weekly

|

|