Bringing back 'Made in USA'

Updated: 2015-01-30 12:04

By Paul Welitzkin(China Daily USA)

|

||||||||

Ties remain

But even Ferrise hasn't broken all his ties with China. "We get components from Mexico and China. We will make a blend to reach our primary threshold," he said.

Another factor limiting reshoring is that many suppliers in a manufacturing supply chain also have relocated to China.

"Once US companies decided to move production to China, about two to four years later their suppliers also moved to China. We find that companies are coming back to the US, but many of their suppliers are staying in China. They are being cautious," said Patrick Van den Bossche, a partner at Chicago-based A.T. Kearney and one of the authors of the reshoring report.

"Ten years ago, it was a slam-dunk case on whether it's cheaper and more productive to manufacture in China over the US. That is not the case anymore," said Moser.

According to Sirkin, if transportation costs are high, US companies are more likely to reshore.

If US labor costs are high, a company is less likely to bring manufacturing back. The ideal situation for reshoring is high transportation costs abroad and low US labor costs, he explained.

The US has regained its manufacturing competitiveness because companies have managed to address most of their major costs. "Manufacturers in the US have done a good job in maintaining costs and increasing productivity. This has helped large contract manufacturers to look at and in many cases choose a US location," said Sirkin.

"Shipping products from China is time consuming and costly. Chinese wages are rising and the Chinese currency is appreciating and energy prices such as electricity and natural gas are lower in the US. It's estimated that about 25 percent of what the US imports from China to be sold in the US, would actually be more profitable if it were made here," said Moser.

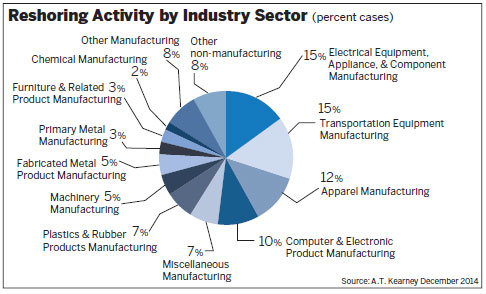

Nothing illustrates that better than the sharp increase in apparel manufacturing returning to the US last year. According to Kearney, of the top three reshoring industries in 2014 apparel manufacturing was third at 12 percent behind electrical equipment, appliance and component manufacturing and transportation equipment manufacturing at 15 percent each.

"Of all the industries, apparel would be one of the last you would expect to return to the US because apparel manufacturing supposedly required lots of cheap labor," Van den Bossche told China Daily.

While labor costs have stabilized in the US, they have risen sharply in China. Van den Bossche said the labor cost advantage still resides in China, but the gap continues to shrink as labor costs will continue to increase on the mainland. In the Yangtze River Delta region, he said labor costs averaged 82 cents an hour in 2001. In 2014, those same labor costs averaged $4.93 an hour.

One dynamic in apparel manufacturing that is turning out to be an advantage for the US is close proximity to a company's target market and supplier. "Being closer to a market source means an apparel company can operate with less inventory and working capital. It also means they can adjust quickly to fashion trends which tend to shift in a heartbeat," Van den Bossche said.

Inventory management is an even bigger reason than labor costs some manufacturers cite for shifting production back to the US.

Anthony Parisi is a vice-president of Plastimold Products in Delray Beach, Florida. The company has annual sales of about $2 million making molds used to manufacture combs and medical products.

Plastimold has eight employees and may have to add up to 10 more to make a mold for a medical product that was made in China.

"We are building a mold for a customer who has been in China. Even though it will cost more to do the mold here, he wants that because of the proximity. It's worth it to him because he can drive over to us and make changes in a day. Plus he doesn't have to speak Chinese," Parisi told China Daily.

He said more of Plastimold's business is coming from companies that used to outsource to China. "When you add in shipping costs and the quality we deliver, the price here isn't that much higher than what you get in China."

Reshoring to the US is being supplemented by Chinese companies moving manufacturing operations to the US for many of the same reasons US companies are returning.

CEO Xin Hu developed Taizhou Fuling Plastics Co Ltd in China, starting with a small factory with 10 employees and now employs more than 1,200. Taizhou Fuling makes plastic cutlery, cups, plates, straws and other tableware items for fast-food restaurants.

Later this year Fuling is scheduled to open a plant in Upper Macungie Township, Pennsylvania, in the Lehigh Valley north of Philadelphia. It is expected to employ 75 workers who will make and ship straws.

Bob Chapleski, vice-president of operations at Fuling Plastics USA, told China Daily that 40 percent of the company's sales are in the US. "He (Xin Hu) had been looking to move some of his production here. The biggest driver of this was freight costs. It just got too expensive to ship plastic straws from China to here."

Chapleski said Fuling looked at locations in Maryland and North and South Carolina before settling on Pennsylvania. "(Xin Hu) believes this is a good place to reach his customers."

Production of the cutlery and bowls will remain in China for now, but if the Lehigh Valley facility works out, Chapleski said Fuling may move more production to the US.

"Increasingly Chinese companies are establishing manufacturing operations in the US," added Moser of the Reshoring Initiative.

Across America Over the Week (Jan 23 - Jan 29)

Across America Over the Week (Jan 23 - Jan 29)

US futurist touts the rise of the "Global Southern Belt"

US futurist touts the rise of the "Global Southern Belt"

Ten surprising facts about Jack Ma

Ten surprising facts about Jack Ma

Outgoing US Defense Secretary Hagel lauded at farewell

Outgoing US Defense Secretary Hagel lauded at farewell

Across Canada Jan 30

Across Canada Jan 30

Gas blast at Mexico City children's hospital kills 7, injures 54

Gas blast at Mexico City children's hospital kills 7, injures 54

Don't have to be a queen to live in frozen wild of snow

Don't have to be a queen to live in frozen wild of snow

Ten characteristic streets in Beijing

Ten characteristic streets in Beijing

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

MH370 verdict reached

No change in Sino-US military ties

US law firms review Alibaba's fakes issue

US wants fair trade with China

New book looks to teach children folklore of Chinese Zodiac

US futurist touts the rise of the "Global Southern Belt"

Chinese brands derive rising revenue proportion overseas

Mongolian culture to highlight New Year's concert

US Weekly

|

|