Experts weigh in on China's economic slowdown

Updated: 2016-01-22 23:31

By YU RAN in Shanghai(China Daily USA)

|

||||||||

One of the ways to stabilize China's current economic situation would be to implement a more proactive fiscal policy to help the market revive confidence, according to HSBC economists.

"China is facing a more severe economic situation in 2016 compared with the previous year, and it may suffer from deflation and downward spirals as a result," said Qu Hongbin, co-head of Asian economic research at HSBC, who also suggested that the government should lower corporate taxes and fees, as well as expand the deficit to arrest the economic slowdown.

"It is still possible to ease the trend of deflection and stabilize the current economic situation by reducing the interest rate and deposit reserve ratio, supporting migrant workers with low-rent housing, and carrying out certain infrastructure projects. However, depreciation shouldn't be part of the policy as it is not an efficient method to resist deflation on the global scale," added Qu.

The renminbi weakened by 1.5 percent against the US dollar in early January, the largest weekly decline since August last year, while China's foreign exchange reserves fell to $3.33 trillion at the end of December, the lowest level in more than three years and down by $108 billion from November.

Speaking about the depreciation of the renminbi, HSBC chief economist Stephen King pointed out that it was partly caused by the other countries.

"Many countries depreciate their currencies to transfer economic problems to other markets. This is the case with the continuous slowdown of China's economy, which was a result of the depreciation of other currencies against the renminbi," said King.

"Now, due to China's slowing down, we are losing an investor or consumer on the global scale, and this will lead to a fall in the prices of bulk commodities and in turn affect certain newly emerging markets that major in these commodities."

According to David Bloom, global head of foreign exchange strategy of HSBC, the weakening of the Chinese currency is a natural consequence of a slowing economy, unlike in the West where the currency is weakened due the deliberate implementation of policies.

Bloom also emphasized that what the markets are largely worried about is not the weakness of the renminbi, but the speed at which it is weakening.

"We're looking for a slightly weaker renminbi of about 6.7 against the US dollar by the end of this year," said Bloom.

Economists have also made their forecasts on the global equity markets in developed countries, with King saying that the valuation of the US market will be a bit expensive and that it may be difficult for US corporations to maintain rapid growth as in recent years.

HSBC's asset evaluation and equity strategy teams believe that European equities are valued better than their US counterparts, and predict that the Euro will ascend to 1.20 against the dollar by the end of the year

- Netizen backlash 'ugly' Spring Festival Gala mascot

- China builds Mongolian language corpus

- China's urban unemployment rate steady at 4.05 pct

- German ecologist helps relieve poverty in Sichuan

- 'Unhurried' Guizhou village makes NY Times list of places to visit

- Railway police nab 40,315 fugitives in 2015

- 7 policemen, 3 civilians killed in Egypt's Giza blast

- Former US Marine held in Iran arrives home after swap

- Powerful snowstorm threatens US East Coast; flights canceled

- 2015 Earth's hottest year on record: US agencies

- 8 killed in car bomb near Russian Embassy in Kabul

- Researchers find possible ninth planet beyond Neptune

Art exhibitions in 2016 worth seeing

Art exhibitions in 2016 worth seeing

Winter flexes its muscles as cold snap makes its way

Winter flexes its muscles as cold snap makes its way

Bright Temple of Heaven shines in winter

Bright Temple of Heaven shines in winter

Netizen backlash 'ugly' Spring Festival Gala mascot

Netizen backlash 'ugly' Spring Festival Gala mascot

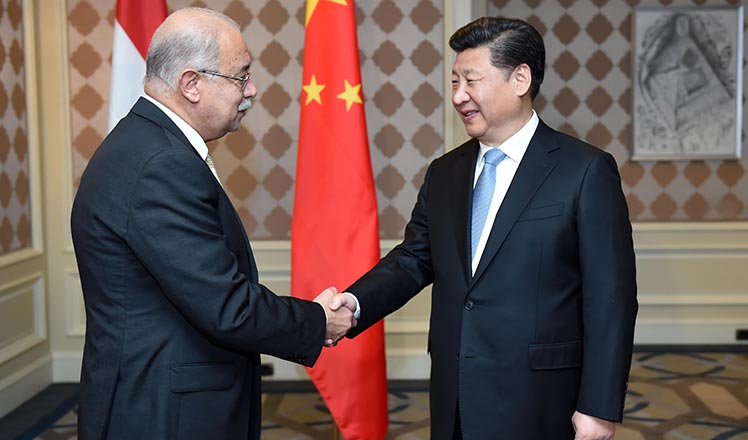

Egyptian welcome for Chinese President Xi Jinping

Egyptian welcome for Chinese President Xi Jinping

Robots reads China Daily to stay up to date with news in Davos

Robots reads China Daily to stay up to date with news in Davos

China's Yao honored with Crystal Award in Davos

China's Yao honored with Crystal Award in Davos

Happy memories warm the winter

Happy memories warm the winter

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

National Art Museum showing 400 puppets in new exhibition

Finest Chinese porcelains expected to fetch over $28 million

Monkey portraits by Chinese ink painting masters

Beijing's movie fans in for new experience

Obama to deliver final State of the Union speech

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

US Weekly

|

|