Center of attention

Updated: 2016-01-27 08:22

By Hu Yongqi(China Daily)

|

||||||||

Many of Beijing's upwardly mobile suburban residents are taking advantage of cuts in interest rates and down payment requirements to move closer to the city's downtown area. Hu Yongqi reports.

When he received the ownership certificate for his new home, Wang Lin took a long, deep breath of relief; the six-month struggle to sell his old apartment and buy a new one had finally come to an end.

The 34-year-old IT engineer bought his first apartment five years ago in the northeastern Beijing suburb of Shunyi, which lies outside the Fifth Ring Road. Wang hoped that the nearby subway line, opened ahead of the 2008 Olympic Games, would shorten his daily commute to work.

To his dismay, the journey to his downtown office still took two hours, so he decided to exploit a series of cuts in interest rates and down payment requirements, and take on more debt, to buy a new home closer to the center. His new apartment is just a 15-minute walk from his office.

Wang's case is a mirror of the city's second-hand housing market. Last year, transactions featuring second-hand apartments hit 198,018, a six-year high and a year-on-year rise of 91 percent, according to the Beijing Municipal Commission of Housing and Urban-Rural Development.

Real estate agencies estimated that about 50 percent of those apartments were bought by people whose homes no longer met their requirements. The owners were upgrading to places closer to better resources, such as transportation, education and medical services.

Better locations

In Beijing, there is a huge disparity in public resources between the suburbs and downtown, which is home to a greater number of prestigious schools and hospitals. None of the city's top 10 hospitals are located outside the Fifth Ring Road, and just one of the 10 most-distinguished high schools is in Shunyi. Some remote suburbs don't even have a bus service.

On Jan 21, Xia Qinfang, deputy director of the Beijing Bureau of Statistics, said 11.27 million square meters of new apartments were sold last year, a rare year-on-year decline of 1.2 percent.

"Many second-hand apartments have the advantage of being in better locations than the new residential complexes. That's why the trade volume has soared by more than 90 percent," she said, adding that there is little free land within the Fifth Ring Road, which is partly responsible for the rise in sales of second-hand apartments.

Wang's company is located in the downtown's Chaoyang district, 25 km from his old home. The subway, which he thought would be fast and convenient, was extremely crowded during rush hours, especially after the line was extended further west. "The city is too big and I don't want to spend so much time being squashed on the train anymore. Five years of traveling like that is enough," he said.

Wang bought an apartment in Shunyi because he hadn't saved enough to afford a down payment in a downtown area. "At the time, I expected property prices to rise and I hoped the apartment would bring me a profit," he said.

His investment was successful; he received 1.5 million yuan ($230,000) in cash when the sale of the apartment was completed for 2.3 million yuan.

"I earned more than 600,000 yuan, and 1.5 million yuan was sufficient to pay the down payment for an apartment of the same size in the downtown as mortgages became easier to obtain," he said.

Financial stimulus

In 2014, property transactions and prices declined sharply and many of China's top 100 cities experienced a downturn in the housing market. In March last year, Premier Li Keqiang pledged that the central government would not only support people buying their first homes, but would also encourage them to buy larger properties to improve their standard of living. Many mortgage brokers and property dealers interpreted Li's remarks as an incentive for suburban residents to move closer to the center of Beijing.

The market was further boosted at the end of March, when the People's Bank of China, the central bank, cut down payment requirements, which, coupled with the rising value of the buyers' existing homes, made larger mortgages more accessible. Beijing also raised the ceiling for housing fund mortgages - preferred by buyers because of the lower interest rate - for first-time purchasers from 800,000 yuan to 1.2 million yuan, while the annual rate for loans of five years and longer was cut to 3.25 percent, a seven-year low.

Now, the annual interest rate for commercial loans is 4.9 percent, 20 percent lower than in February last year, which has sharply reduced the burden on mortgage payers.

"All the financial data showed that it was a good time to buy property," said Zhang Yang, an English tutor at a school in the downtown district of Dongcheng.

Unlike Wang, Zhang bought his first apartment in May 2013 in the suburban Daxing district. Although he paid top dollar, 2 million yuan, for the three-bedroom property, Zhang suffered a loss when he bought another property in July last year because the value of his apartment had fallen to 1.8 million yuan.

"I noticed the trade volume kept rising and the housing price also rose because cheap properties were being sold," he said.

Zhang had planned to buy a car to make the 30-minute drive from home to office, but after two years he has not been lucky enough to win in Beijing's license plate lottery system, under which applicants register and then wait for their number to be called.

"It seems unpredictable to buy a car, because the city has restricted the use of private cars. A better way is to move to an apartment closer to my school," he said. "Fortunately, interest rates have been adjusted to a record low and I can afford the monthly mortgage of 7,000 yuan."

In 2013, local authorities ruled that single people such as Zhang were only allowed to own one apartment, meaning he had to sell his old apartment before he could buy a new one, even though he would lose money on the transaction.

Zhang lost 200,000 yuan on the sale of his old apartment, so he borrowed 400,000 yuan from friends and bought a two-bedroom place in Dongcheng, just 10 minutes from his place of work.

His new community is home to one of Beijing's best primary schools, so Zhang won't have to worry about his children's education, when he eventually has them.

Post-retirement plans

The downtown/suburban divide isn't just one-way traffic, according to Hou Liping, who has worked as a real estate agent in Chaoyang for nine years. Many retirees are looking to purchase large apartments in the suburbs, using the money they made from selling their downtown homes.

The average price of residential properties in six downtown districts, including Chaoyang and Dongcheng, is almost double that in 10 suburban districts, meaning a 108-sq-m apartment in the suburbs costs the same as a 60-square-meter downtown apartment, Hou said.

Li Fangjun, retired from the Hongxing Brewery in Chaoyang two years ago. He has moved to the suburb of Pinggu, where he paid 1.4 million yuan for a 100-sq-m apartment. The sum accounted for 60 percent of the 2.3 million yuan he gained from selling his 65-sq-m downtown apartment, and the remaining 900,000 yuan has been deposited at banks as savings for emergencies, he said.

"People have different demands in each phase of life. Now, I don't have to worry about the traffic because I don't have to go to work," he said.

Wang and Zhang both echoed Li's sentiments. They said their new apartments, boasting easy access to transportation services and good schools, are perfect for their lives right now.

"I follow the market trends and make full use of any favorable policies made by the central government, to make changes for a better life," Wang said.

Contact the writer at huyongqi@chinadaily.com.cn

Arduous endeavor and anxious times

For Wang Liping, a 35-year-old pharmaceutical saleswoman, changing apartments was a long, arduous struggle.

In August, Wang started looking for a new apartment in an area with good schools with the aim of providing her 7-year-old son with a decent education. However, the process was stressful and time-consuming.

First, she put her property online and waited to be contacted by potential buyers. In the meantime, she set a minimum price for her apartment and reduced her budget for the new one as much as possible.

Beijing is the only city in China to levy a 20-percent tax on the margin between the original and current values of properties, the only exceptions being people who have lived in the only property listed under their name for at least five years. Although the tax is imposed on the seller, in reality it is almost entirely shouldered by the buyer.

Wang said it took her "a long time to find apartments with a lower tax".

One cold December day, Wang visited several apartments that met her requirement of at least one south-facing bedroom that would admit generous amounts of sunlight.

"There were no perfect apartments, but it took three months for me to learn that," she said. Eventually, she sold her old apartment and signed a deal to buy another the foll-owing week, having noticed that prices for apartments of the same size had risen by 100,000 yuan ($15,000) in just two months.

Under the current rules, Wang had to make an appointment with the bank to pay off her existing mortgage. However, because she didn't have enough money to buy her new property straightaway, she had to wait for the down payment from the buyer, which took at least a month.

"It would have been risky if the buyer had been unable to transfer the money punctually. That would have caused a default and threatened my chances of obtaining another mortgage," Wang said. "With that in mind, I called the buyer every week to confirm that the money would arrive on time."

Fortunately for Wang, the money was delivered on schedule, and she proceeded as planned. Next month, she will receive the property certificate for her new apartment.

Agents profiting from rising trade volume

The boom in the second-hand housing market has provided real estate agents with the opportunity to earn far more than usual. However, the work is hard and often time-consuming.

Sun Xiaofen, who has worked for the real estate brokerage Lianjia.com for three years, said the sharp contrast between the cold winter and the booming market made every day a struggle when she took customers to visit apartments.

Many agents in Beijing ride electric bikes because they are affordable and convenient for accessing residential complexes. Although it only took the 28-year-old a week to master the bike, she fell off at least 10 times and injured her leg.

"It's a prerequisite to know how to ride e-bicycles and have a clear picture of the apartments I am going to sell," she said.

Unlike some of her peers, Sun couldn't stand the cold and her knee joints ached after just one week of riding the bike, so she took the advice of a veteran colleague and laid a thick blanket across the front of the bike to block the wind.

Patience is a key quality for agents. "Clients always have emergencies, and I have to wait and be caring to build trust between them and me," Sun said.

Last month, she made an appointment to meet a customer at 7 pm outside a subway station. Although she confirmed with the customer before leaving her office 15 minutes ahead of schedule, the customer failed to show up.

"The client didn't notify me of the delay until 15 minutes after the appointment because his mother had been in an accident," she said.

"Take your time and we can meet tomorrow," she told the client. One week later, she sold him an apartment for 6 million yuan, netting 140,000 yuan ($21,000) in brokerage fees, and earning Sun 48,600 yuan.

"It's hard to gain trust from strangers right now. But if you can do that, you will win," Sun said.

Six steps to buying a second-hand home

Usually, the home-buying process involves at least six steps:

1. Owners are only allowed to sell property once they have paid off their existing mortgage.

2. Sellers have to wait for at least two months for the property to be transferred to the buyer. At least two weeks later, the seller will receive their money.

3. The seller becomes a buyer and can sign a contract for a new apartment.

4. Restrictions on transactions of residential apartments mean the contract has to be registered online within 10 working days of checking the buyer's status .

5. The buyer must attend an interview with a bank or housing fund center to apply for a mortgage.

6. When a deal is struck, the new property will be transferred to the buyer after about one month. The buyer then begins paying monthly mortgage repayments.

(China Daily 01/27/2016 page6)

- A glimpse of Spring Rush: little migrant birds on the way home

- Policy puts focus on genuine artistic students

- Police unravel market where babies are bought, sold as commodities

- More older pregnant women expected

- Netizen backlash 'ugly' Spring Festival Gala mascot

- China builds Mongolian language corpus

- Special envoy to visit Laos and Vietnam

- El Nino expected to wreak havoc in S. America well into 2016

- Police officer rescues frightened sloth at corner of busy highway

- US Secretary of State visits Laos, aiming to boost ties

- 2 Chinese nationals killed, 1 injured in suspected bomb attack in Laos

- New York, Washington clean up after fatal blizzard

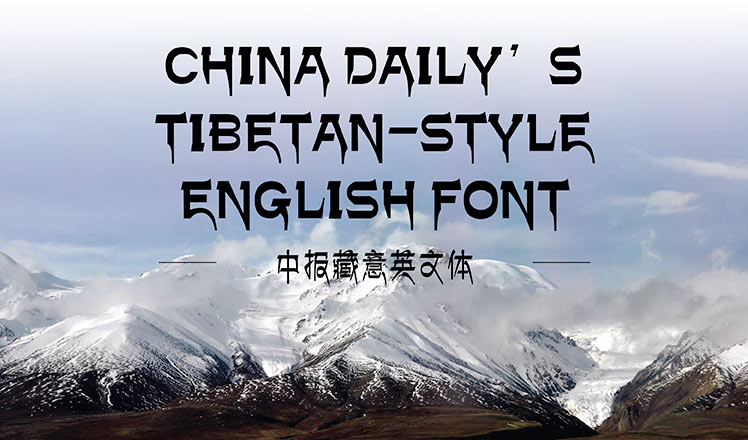

Creation of China Daily's Tibetan-style font

Creation of China Daily's Tibetan-style font

Drone makers see soaring growth but dark clouds circle industry

Drone makers see soaring growth but dark clouds circle industry China's Zhang reaches Australian Open quarterfinals

China's Zhang reaches Australian Open quarterfinals

Spring Festival in the eyes of Chinese painters

Spring Festival in the eyes of Chinese painters

Cold snap brings joy and beauty to south China

Cold snap brings joy and beauty to south China

First trains of Spring Festival travel depart around China

First trains of Spring Festival travel depart around China

Dough figurines of Monkey King welcome the New Year

Dough figurines of Monkey King welcome the New Year

Ning Zetao, Liu Hong named China's athletes of the year

Ning Zetao, Liu Hong named China's athletes of the year

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

National Art Museum showing 400 puppets in new exhibition

Finest Chinese porcelains expected to fetch over $28 million

Monkey portraits by Chinese ink painting masters

Beijing's movie fans in for new experience

Obama to deliver final State of the Union speech

Shooting rampage at US social services agency leaves 14 dead

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

US Weekly

|

|