VC firms feel the chill of sluggish market, but warm about future

Updated: 2016-10-10 15:22

(chinadaily.com.cn)

|

||||||||

Potential fields - Consumption upgrade, frontier technologies

The other two forces Deng mentioned were consumption upgrade and technology innovation.

The focus on comsumption was echoed by Sheng Xitai, co-founder of Angel Plus. "Consumption upgrade is the biggest wave over the past seven or eight years," Sheng said.

On frontier technologies, Deng said, "For the past few years, the opportunities for business success have become scarce in the innovation of business modes. But the chances in technology innovation are bigger."

Read more: Frontier technologies, the next big leap forward

Deng mentioned two aspects in technology: the IT revolution such as machine learning, artificial intelligence; the development of life science that will produce new potentials in precision medicine (personalized medicine) and biopharmaceutics.

"I believe that the biomedicine will be a big opportunity in the healthcare field for venture capital in the future."

Yan is also a keen supporter of technology innovation. He said it will bring some new opportunities, such as battery tech that could increase stand-by time, healthcare and gene tech, AR/VR, and internet of things.

Richard Liu, partner of Morningside Venture Capital, one of China's earliest early-stage venture investors, eyed technology innovation that combines artificial intelligence with internet of things.

Liu said opportunities for the future also lie in services that could enhance corporate efficiency.

The enthusiams for corporate service is especially obvious for Wang Donghui, the co-founder of Ameba Capital, who said they would allocate 40 percent of the second fund under their management totaling 700 million yuan ($105 million) to invest in the Software as a Service (SaaS) industry, which could help enterprises improve their efficiency.

Read more: From finding unicorns to supporting pig-raising software

- World's longest sightseeing escalator awaits you in Central China

- More than 20 buried under collapsed buildings in Wenzhou

- Li arrives in Macao to boost ties with Portuguese-speaking countries

- Scenic spots ranked for their holiday services

- Illness raises risk of vanishing

- Jack Ma and Spielberg work together to tell Chinese stories

- Panel tackles controversial Fox News skit on Chinatown

- Chinese tourists forced to sleep at airport for 5 days

- Saudi-led coalition denies striking funeral in Yemen's capital

- From bars to shops, seniors working in Tokyo

- Boat with some kids aboard capzised in San Francisco

- China urges G20 to implement Hangzhou consensus

The world in photos: Sept 26 - Oct 9

The world in photos: Sept 26 - Oct 9

Classic cars glitter at Berlin motor show

Classic cars glitter at Berlin motor show

Autumn colors in China

Autumn colors in China

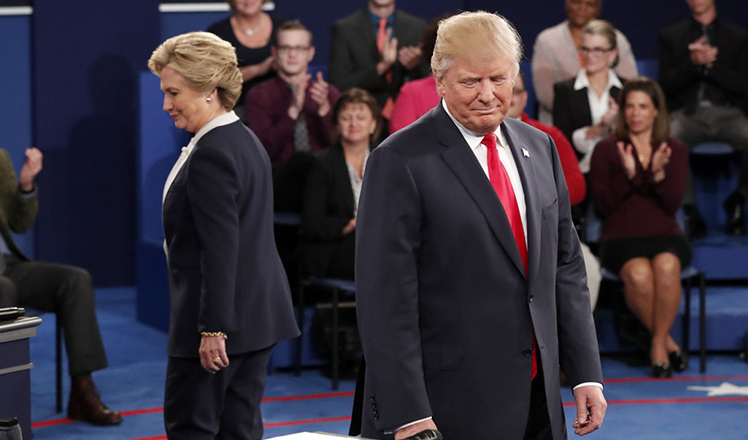

US second presidential debate begins

US second presidential debate begins

Egrets Seen in East China's Jiangsu

Egrets Seen in East China's Jiangsu

Highlights of Barcelona Games World Fair

Highlights of Barcelona Games World Fair

Coats, jackets are out as cold wave sweeps in

Coats, jackets are out as cold wave sweeps in

6 things you may not know about Double Ninth Festival

6 things you may not know about Double Ninth Festival

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|