US, China trade deficit narrows

Updated: 2013-08-07 10:50

By Zhang Yuwei in New York (China Daily)

|

||||||||

US exports to China, which have been growing in recent years, increased 4.5 percent in June, closing the deficit gap between the world's two largest economies, according to new trade figures released by the Commerce Department on Tuesday.

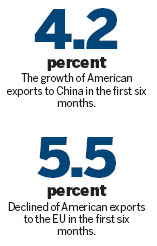

Exports to China - one of the fastest growing markets for US goods - were up 4.2 percent for the first six months of the year, the new data show.

US exports to the 27-nation European Union, however, only rose 1.5 percent in June, with exports to the EU in first half of the year down 5.5 percent compared to the same period in 2012.

Guo Feng, a senior economist at the Institute of International Finance, said US-China trade dynamics have been affected by China's currency rate and increases in certain categories of US goods in June.

"The appreciation of the RMB versus its basket was about 5 percent so far this year, making China's goods less competitive in the world market," said Guo.

"The Chinese interbank cash crunch in June may have had some negative impact on exporters, and China increased imports from the US," he added.

The Chinese yuan has appreciated by one percent against the greenback since the beginning of 2013. Due to the weakening of some major world's currencies - including the Japanese yen and British pound - the yuan's value has been pushed up in the past months, appreciating by nearly 20 percent against yen since July.

The new trade figures show that imports from China fell 2.2 percent, lowering the contentious U.S. trade deficit with China to $26.6 billion from $27.9 billion in May.

"China has been a fast-growing export destination for US companies and the underlying trend for US exports to China has been upward since mid-2009," said Sophii Weng, an economist with Standard Chartered Bank in New York.

China remained the US' third-largest export market after Canada and Mexico, purchasing nearly $110 billion in US goods in 2012, according the Washington-based US-China Business Council, which represents more than 200 US companies doing business in China.

The council's new report on US exports to China by congressional district - released last week - showed that between 2003 and 2012, total US exports to China rose 294 percent, an increase of nearly $81 billion.

Even smaller states have seen significant growth in their exports to China. Exports from Vermont, Connecticut, Hawaii, and Delaware posted at least 400 percent export growth since 2003.

"Integrated bilateral trade between the US and China, thanks to the globalization of supply chains, has made China a top export destination for US manufacturers, supporting a broad range of US producers regarding industrial supplies and capital goods," said Weng.

Stronger US economic growth will lead to solid US imports from China, said Weng, adding that the US has outperformed other major developed countries since 2009.

"We expect US economic growth to accelerate in the second half of this year, assuming fiscal headwinds dissipate gradually, in which case China's exporters would benefit," said Weng.

The Commerce Department's figures showed that the US trade deficit narrowed sharply in June to its lowest level in nearly four years, indicating a stronger outlook for second-quarter growth.

IIF's economist Guo said net exports look much more favorable for growth in the second quarter than the advance Gross Domestic Product (of 1.7 percent) estimated by the US Bureau of Economic Analysis last week, which implied a possible upward revision to second-quarter GDP.

The trade gap fell 22.4 percent to $34.2 billion, the smallest since October 2009. The percentage decline was the largest since February 2009.

The strong trade figures showed the US economy is getting back on track from the 2008 financial crisis. A stronger economic outlook in the US is also pushing forward the Federal Reserve's plan of tapering off the $85 billion-a-month-bond purchase program - or the Quantitative Easing round 3.

Weng said that tapering of the QE3 will mostly be based on unemployment figures rather than the GDP. "The job figure (162,000) in July wasn't too bad, but we still need to see what August looks like," she said.

yuweizhang@chinadailyusa.com

(China Daily USA 08/07/2013 page1)

- Furthering China-US trade

- Bumpy ride for Sino-US trade

- Keys to avoiding a China-US trade war

- Statistical discrepancy declines in Sino-US trade

- New measures may reshape Sino-US trade ties

- China-US trade talks conclude with positive results

- CEOs hold roundtable discussion at China-US dialogue

- Moments of the fifth China-US dialogue

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China vows to severely punish newborn traffickers

Sri Lanka suspends NZ milk powder imports

PV firms face risks despite EU deal

Small firms should also think global

China issues record fines to dairy firms

US, China trade deficit narrows

NBA courts Sina Corp

EC denies delay in telecoms probes

US Weekly

|

|