Texas tries to lasso China

Updated: 2014-12-05 23:27

By MAY ZHOU in Houston(China Daily USA)

|

||||||||

|

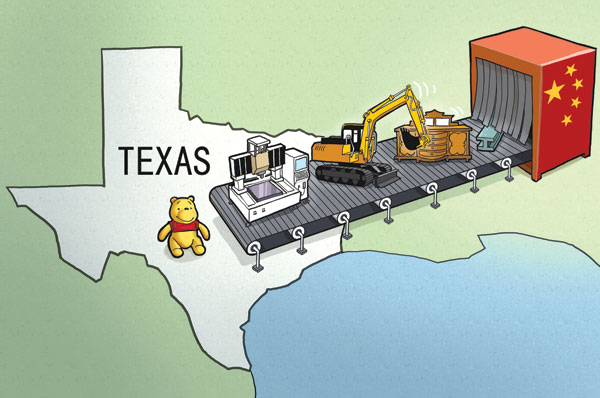

| Luo Jie / China Daily |

In 1979, Deng Xiaoping put an enormous cowboy hat on his head at a Texas rodeo and grinned for the cameras. Thirty-five years later, Texas officials are still giving the hats to visiting Chinese officials as they seek to increase trade, reports MAY ZHOU in Houston.

"The Chinese investors are coming. Are you ready?"

That was the question posed by Clarence Kwan, senior partner of Sino-Century China Overseas Investment Partners, at a recent business discussion hosted by Houston's Asian Chamber of Commerce. Chinese investors have come and more are coming to the Lone Star State. The latest available data tell the story:

With $10.8 billion in exports, China was the state's fourth-largest export destination in 2013. The major exports are industrial and electric machinery, chemicals, plastics and mineral fuel. Texas ranked third in exports to China after Washington and California, both of which exported more than $16 billion of goods to China in 2013.

In the same year, Texas imported $42.8 billion worth of Chinese goods, making China number two among the state's trading partners. The top imports include electric and industrial machinery, furniture, toys and iron or steel products.

Chinese companies have spent $22.2 billion to acquire Texas companies in M&As in the last decade, making it perhaps the largest investment category by Chinese investors so far.

From 2000 to the first three quarters of 2014, 79 Chinese foreign direct investment (FDI) projects with a total value of $5.3 billion have settled in Texas. The state has attracted more than 12 percent of the total of $43.1 billion in Chinese FDI projects in the United States. That makes Texas number two in the US behind California.

James Chen, Asia/Pacific director of the state's economic development and tourism division, has seen or helped a lot of the Chinese projects get into Texas. He said that FDI projects have picked up.

"I am seeing explosive growth in this area since last year. With Texas being an energy state, some of the projects are huge and the investment dollars often amount to billions. But we are also seeing more and more medium and small-sized companies as well as individual investors coming to Texas," he told China Daily.

In 2013, Sinopec USA, a subsidiary of one of the largest state-owned Chinese oil and gas companies, Sinopec Group, opened an R&D branch in Houston, where it already has a few operations.

Also in 2013, PetroChina International (America) Inc moved its headquarters to Houston from New Jersey. Its president, Li Shaolin, said the move has helped Petro China expand its oil products trade. The company has since increased the number of local employees to more than 80 from 50.

Business exchanges between Texas and China show no sign of slowing down.

On Monday, a delegation from Gansu province arrived in Austin, the state capital, at the invitation of Texas Agriculture Commissioner Todd Staples and commissioner-elect Sid Miller. The meeting was held to increase agriculture trade between Texas and Gansu, population 26 million.

Exporting Texas beef to Gansu is one of Miller's priorities. With 11 million head of cattle in the Lone Star State, Texas leads the nation in beef production. The beef industry generates more than $10 billion for the state.

On Nov 19, a Chinese trade delegation's visit to the state was organized by the China International Contractor Association (CICA) under the directive of China's Ministry of Commerce. That visit reciprocated Texas Governor Rick Perry's trip to China in September to promote the state, according to Chen. While visiting Beijing, Perry was received by Chinese Vice-Premier Zhang Gaoli, one of the seven standing committee members of the Politburo.

Chen, who helped plan and joined Perry's visit to China, said that in Beijing Perry signed a memorandum of understanding (MOU) between Texas and Tianjin, Fujian, Shandong, Jiangsu and Sichuan, recognizing the importance of developing and expanding ties of cooperation through business, trade, investment, tourism, education and research and development.

In addition, a joint task force of the governor's office and China's commerce ministry was formed to support Chinese investment in Texas.

In October, Fort Worth Mayor Betsy Price and Dallas Mayor Mike Rawlings joined a trade mission to China. Price discussed China's NGC Renewables's opening a new transmission plant later this year at the Alliance Texas Industrial Park. NGC Renewables also announced that Fort Worth will serve as its North America headquarters.

"The Chinese companies are encouraged to expand internationally and make overseas investment by their government, and the Texas government wants to attract more foreign investment. The need is well-matched on both sides and we are here to help," said Chen.

Big projects

Two big projects for Texas are being negotiated, said Chen. A private Chinese company is looking to build several chemical plants to produce ethylene glycol with an investment total of $2.6 billion. Another company may invest $1.2 billion in a methanol plant. Names of both companies have not been revealed.

A few Chinese firms are considering building a $4.5 billion methanol plant on the 900-acre Shoal Point peninsula near the Port of Texas City, according to a report by Galveston Daily News.

The growing connection between Texas and China also is demonstrated by the increase in airline service. Air China initiated Houston-Beijing direct flights in July. American Airlines began Dallas-Shanghai and Dallas-Hong Kong service in June, and the carrier recently announced that it has filed an application to operate Dallas-Beijing service beginning next summer.

The Chinese population in Houston also is growing. "I am seeing more and more Chinese coming to Houston looking for opportunities," said Austin Zhao, chairman-elect of Houston's Asian Chamber of Commerce and president of Pathway to China, which helps American companies do business with China and Chinese investors get a footing in the US.

"Thanks to former National Basketball Association star Yao Ming, Chinese are now more aware of Houston and Texas. Texas will surpass California and New York in Chinese population and investment growth," Zhao told China Daily.

The 2010 US Census put the state's Asian population at 964,596, including 166,837 Chinese.

Jensen Shen, director of Asia, Australia and Oceania at the Greater Houston Partnership, said that despite China's big three state-owned oil companies being in Texas, overall Chinese energy companies in the US still lag behind countries like Japan or South Korea in getting established to do business.

"Chinese companies came in and were poised to buy big companies or projects. Such a high profile often met with a lot of resistance from the government as well as other organizations. But now I see that they are changing strategy; more deals are being made by equity participation instead of M&A."

In November 2013, Sinopec agreed to pay $3.1 billion for a 33 percent stake in Houston-based Apache Corp's Egyptian oil and gas business. Sinopec was reported to also be in talks with Apache to buy a stake in the Kitimat LNG export project on Canada's Pacific coast, which is co-owned by Apache and Chevron Corp.

In June 2013, Sinochem spent $1.7 billion to purchase a 40 percent stake in West Texas's Wolfcamp Shale assets from Dallas-based Pioneer Natural Resources Co, the third-biggest single investment by a Chinese company in the US oil patch.

While large Chinese state-owned oil companies - such as CNPC, Sinopec and CNOOC - base most of their operations in energy trade, research and equity participation in Texas, a private Chinese petrochemical company - Shandong Yuhuang Chemical Inc - initiated in July a $1.85 billion FDI project to build a methanol manufacturing complex in Louisiana. It is possibly the largest Chinese invested methanol project in the US to date.

Charlie Yao, CEO of Yuanhuang Chemical Inc, the North American subsidiary of Shandong Yuhuang, said that factors such as better incentives from Louisiana led to his choosing Louisiana over Texas for the plant. However, Yao said the company based its headquarters in Houston because of a better talent pool. The office employs about 20 people and will eventually expand to about 50 as the methanol project progresses.

While PetroChina's Li Shaolin cites internal policy as the primary reason for not having invested in production projects, Yao said he sensed hesitation from the US business community when it comes to China's state-owned companies.

"When I was looking for business partners, I was always asked without exception if Yuhuang is state-owned. Upon a negative answer, the response was always, ‘Then we can do business with you.' I think the US is generally cautious of China's state-owned enterprises when energy as a primary resource is involved," said Yao.

Houston Chinese Consul General Li Qiangmin, while applauding the growing trade and investment between China and Texas, said he hopes that the US does not politicize trade and economic issues, and will relax its restriction on the export of high-tech products to China. He said the US should be more cooperative with China in energy and infrastructure, and eliminate some "unreasonable restrictions imposed on investment in the US by Chinese companies."

Successful model

Jensen Shen of the Greater Houston Partnership said that mergers and acquisitions are happening frequently among medium and small-sized companies because "they don't usually cause attention and meet resistance."

A successful example, he said, is Rigid Global Building, which specializes in constructing metal buildings.

Rigid is a restructured company from the former Rigid Building System (RBS), said Bowen Lo, COO of Rigid. The Houston-based RBS was adversely affected by the 2008 financial crisis and ran out of money after it invested in building a $10 million plant in Alabama. In January 2011, Jinhuan Steel Structures from China's Hebei province bought a 51 percent controlling share of RBS for an undisclosed amount after it went through bankruptcy and formed the current Rigid.

Lo, who worked in equipment trade for 30 years in the US, served as the match-maker between Rigid and Jinhuan, was later hired to help run the company and act as a bridge between Chinese and US shareholders.

"Rigid's employees have increased from 220 at the time of M&A to about 330 now. We are growing and doing very well in business. Our revenue in 2013 was $60 million, and the revenue for 2014 is estimated to be $70 million. Also, we are close to completing a $7 million new plant in north Houston with the size of 124,000 square feet," said Lo.

Prior to the merger, Rigid had no Chinese employees; now there are about 10 Chinese employees. "We only hire Chinese employees who have a US education to keep the management smooth. So far, no Chinese have been sent from China," he said.

He considers Rigid a good model for other Chinese companies to emulate when considering investing in the US:

"A new start-up has to spend considerable time to build the team and sales, and often doesn't see return until two years later. Jinhuan bypassed all that by utilizing the existing well-established management and employees," he said.

LNG exports

Texas could potentially increase its exports to China significantly if the tight US policy on the export of liquefied natural gas (LNG) is relaxed.

Under current US energy policy, American companies can export LNG without many obstacles to free trade agreement (FTA) countries, but a lengthy application and review process with the US Department of Energy (DOE) is involved when it comes to LNG exported to non-FTA countries. China, which has perhaps the biggest demand for energy in the world , is not an FTA country.

An effort by Texas business leaders and pro-business lawmakers led to passage of House Resolution 6 – the Domestic Prosperity and Global Freedom Act – in June, and it's pending action in the Senate.

The bill places a 30-day deadline on DOE to issue a final decision on applications to export LNG following the conclusion of a National Environmental Policy Act (NEPA) review, and requires expedited judicial review by the US Court of Appeals if DOE fails to meet the deadline.

Texas State Representative Gene Wu, who supports LNG exports to China, said: "If this get passed in the Senate and signed by the president, it will be huge for Texas and China. Texas has a lot of gas and refineries, and all those LNG traders are waiting to do trade with China."

Contact the writer at mayzhou@chinadailyusa.com

China, South Africa sign economic pacts

China, South Africa sign economic pacts

Texas tries to lasso China

Texas tries to lasso China

Film takes on Chinese stereotypes in US

Film takes on Chinese stereotypes in US

Obamas usher in Xmas with lighting of national tree

Obamas usher in Xmas with lighting of national tree

Family of nine struggles to survive

Family of nine struggles to survive

World news pictures of the year 2014

World news pictures of the year 2014

S. Africa marks first anniv. of Mandela's death

S. Africa marks first anniv. of Mandela's death

China's budget aviation sector has new comer

China's budget aviation sector has new comer

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Intel to invest $1.6b in Chengdu plant

China, South Africa sign economic pacts

China eyes Paris climate pact

Major general netted in anti-graft campaign

Xi vows military boost

Film takes on Chinese stereotypes in US

Best Buy getting out of China

Best Buy bids adieu to China after struggle with high costs

US Weekly

|

|