Wall Street little changed as Fed set to meet

Updated: 2013-12-18 00:01

(Agencies)

|

||||||||

Although many in the market expect the Fed to begin to wind down its market-friendly $85 billion a month in asset purchases in March, some are betting on an earlier tapering of stimulus after a recent string of better-than-expected economic data.

US consumer prices were flat in November, but a bounce back in the annual inflation rate from a four-year low will probably give the Fed cover to start the taper. Separate data showed the US current account deficit was the smallest in four years in the third quarter as exports increased and more income was earned abroad.

The Fed has said its current policy is data-dependant, and some market participants believe the US central bank will upgrade its estimates for economic activity after a two-day meeting that is set to begin later on Tuesday.

"The Fed meeting begins today so I don't expect the market to do much after yesterday's strong performance," said Peter Cardillo, chief market economist at Rockwell Global Capital in New York.

"The news remains consistent with an economy that continues to gain traction and the market has discounted a Fed move."

The Dow Jones industrial average rose 8.28 points or 0.05 percent, to 15,892.85, the S&P 500 lost 3.49 points or 0.2 percent, to 1,783.05 and the Nasdaq Composite dropped 6.391 points or 0.16 percent, to 4,023.126.

KKR & Co said Monday it would acquire its specialty finance company KKR Financial Holdings in a $2.6 billion deal, paid for with KKR shares trading at an all-time high. KFN shares rose 27.5 percent to $12.05 while KKR slipped 2.9 percent to $24.36.

Facebook shares rose 1.8 percent to $54.81 after the Wall Street Journal reported the social network will begin selling video ads later this week.

Shares of 3M rose 2.6 percent to $131.02 after the industrial conglomerate affirmed its outlook and raised its dividend.

AT&T said it would sell its wireline operations in Connecticut to Frontier Communications for $2 billion in cash, partly to fund the expansion of its 4G network. Frontier shares jumped 8.5 percent to $4.77.

Boeing's board raised the company dividend about 50 percent on Monday and approved $10 billion in new share buyback authority that the company said it would use in the next two to three years. Shares rose 1.8 percent to $137.12.

Snow storm wallops NE USA

Snow storm wallops NE USA Russia to bail out Ukraine for $15 billion

Russia to bail out Ukraine for $15 billion

Fatal tiger attack 'points to flaws in zoo management'

Fatal tiger attack 'points to flaws in zoo management'

Merkel sworn in as chancellor for a third term

Merkel sworn in as chancellor for a third term

Life in poetry

Life in poetry

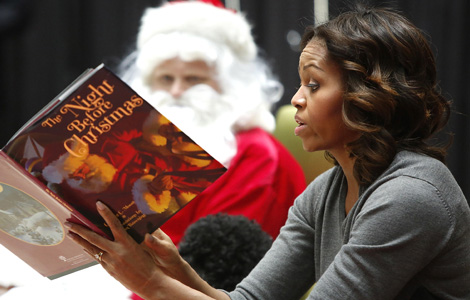

US first lady visits children in medical center

US first lady visits children in medical center

Harvard reopens after bomb scare

Harvard reopens after bomb scare

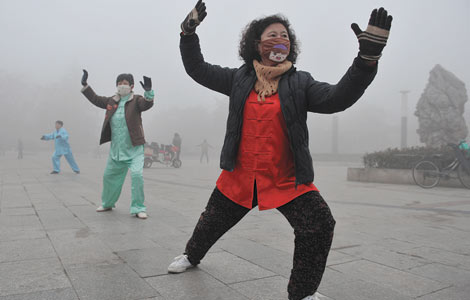

Snowstorms cause chaos for travelers in Yunnan

Snowstorms cause chaos for travelers in Yunnan

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Vast deposits of 'flammable ice' found

Russia to bail out Ukraine for $15 billion

System for organ donors test

Luxury market cooling down

Court to issue guide on private loan cases

China, US urged to lead climate change fight

US budget deal clears crucial vote in Senate

Japan seeks bigger role for military

US Weekly

|

|