Zotye Auto set to sell and build in SA

Updated: 2014-02-04 06:18

By MICHAEL BARRIS in New York (China Daily Latin America)

|

||||||||

China's surging car sales are about to cool. Europe's auto market is recovering, but slowly. In search of new sales, China's Zotye Auto is turning to South America's largest consumer market: Brazil.

Starting this fall, the Zhejiang-based automaker will begin selling two models — its budget-priced Z100 hatchback and its T600 luxury SUV — in the world's fifth largest country. The Zotye Holding Group subsidiary also will set up a manufacturing facility in South-East Brazil's Espirito Santo state by fall 2016, according to published reports.

|

|

A car distributor in Jilin province held an event to showcase Zotye's Z300 model last April. Provided by CFP |

"Increasingly, the majority of new sales are found in emerging markets, where improved incomes enable entry into new vehicle ownership," Colorado-based industry-forecasting company IHS Inc said in a report last week on the outlook for the global automotive industry.

By 2020, IHS forecasts that emerging markets such as China, Brazil, Eastern Europe, the Middle East and South America will represent more than 50 percent of global vehicle capacity share. To satisfy demand, foreign automakers are choosing to build vehicle and powertrain production facilities in Brazil and other emerging markets rather than pay 35 percent import tariffs, the report said. That trend reflects a decline in vehicle sourcing between regions, from a high of 19 percent of overall sales in 2008 to 15 percent today.

Currency swings between key trading partners as well as escalating logistics costs, ballooning in-transit inventory and the elusiveness of political leverage have influenced automakers' decision to shift vehicle and powertrain production closer to sales destination, IHS said.

"In years past, manufacturers would merely export from a home market, hoping to maintain strong facility utilization," the report said. "This was the easiest path. Japanese, German and Korean vehicle manufacturers used this model to varying degrees until economic, consumer and political forces dictated otherwise."

Despite Brazil's infrastructure issues, carmakers see Brazil as "a still-bustling economy" with "a lot of potential customers", Forbes.com reported in an October 2012 article entitled Why the World's Auto Makers Love Brazil.

"Forget that only 14 percent of the roads are paved. Incomes are rising, lifting almost 40 million more Brazilians into the middle class since 2003 — and putting a vehicle purchase within their reach for the first time," the article said.

With Brazil at a critical point, Zotye is trying to reach a broad piece of the market with its plan to start selling two models in October. The Z100, a five-door hatchback city car unveiled at the 2013 Shanghai Auto Show, is a relatively inexpensive car whose design was inspired by the seventh generation Suzuki Alto, according to US News Best Cars. The T600 is a midsize SUV launched in December 2013, powered by either a 1.5-litre turbo or a 2.0-litre turbo petrol engine. Published reports compare the T600's appearance to such upscale vehicles as the Audi Q5 and the Volkswagen Touareg.

Research by J.D. Power & Associates has shown that Brazilian buyers place the cost of owning a car above quality, design or service, since price represents a larger share of household income than in developed countries.

The manufacturing plant in Brazil is scheduled to open in September 2016, according to the Carpress report.

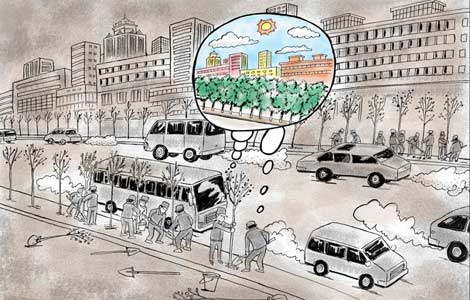

Zotye's pivot to Brazil comes amid an expected slowdown in Chinese automotive sales as government restrictions curbing new vehicle sales are enforced across the nation because of record pollution levels, IHS Automotive senior analyst Namrita Chow said. Last month, the northern city of Tianjin became the latest to limit cars by capping the number of license plates it issues.

IHS forecasts passenger vehicle sales in China will rise around 10.4 percent this year, down from 13.9 percent growth last year as sales reached 21.98 million, smashing through the 20 million mark for the first time.

In teen star transition, Bieber may want to emulate Miley

In teen star transition, Bieber may want to emulate Miley

Thai caretaker PM urges protesters not to block voting

Thai caretaker PM urges protesters not to block voting

Holy waters in Nepal

Holy waters in Nepal

Kongfu stars wax shine in London ChinaTown

Kongfu stars wax shine in London ChinaTown

Obama pushes minimum wage hike

Obama pushes minimum wage hike

Getting ready for some football

Getting ready for some football

The Year of Horse gallops in

The Year of Horse gallops in

Musical celebration of Fab Four anniversary

Musical celebration of Fab Four anniversary

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Non-manufacturing PMI drops in January

Navy starts West Pacific drill

Shooting spree fugitive caught

WeChat cash gifts popular

Li signs regulation on state secrecy law

Obama speech on NSA welcome

Tape of King speech found

Norovirus blamed for cruise sickness

US Weekly

|

|